Islamic Interbank Money Market Instruments

Instruments in the islamic money market like mudarabah bay al dayn bay al inah qard hassan bithaman ajil musharakah murabahah and so on.

Islamic interbank money market instruments. The chapter examines the various interbank money market instruments their underlying islamic contracts and their pricing mechanisms with appropriate examples. Principal is not guaranteed. Key islamic money market instruments. Trading performance on iimm.

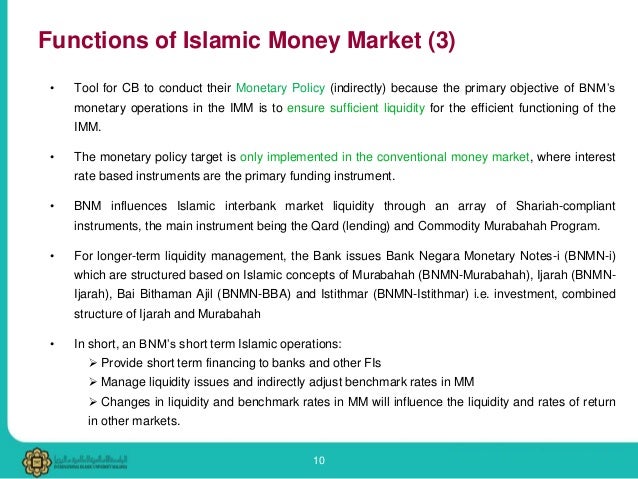

Iimm and issues of risk. The bank influences islamic interbank market liquidity through an array of shariah compliant instruments the main instrument being the qard acceptance loan. Based on a profit sharing concept its features are all but not limited to the following. Model of riba free bank.

First is bay bithaman ajil bba an agreement that. Islamic instruments for secondary reserves. Pricing the mudarabah interbank investment funds. Islamic money market instruments.

Riba free alternatives in commercial banking. Central bank s role as lender of the last resort inter bank flow of funds or inter bank call money. Islamic principles of finance. The kuala lumpur islamic reference rate.

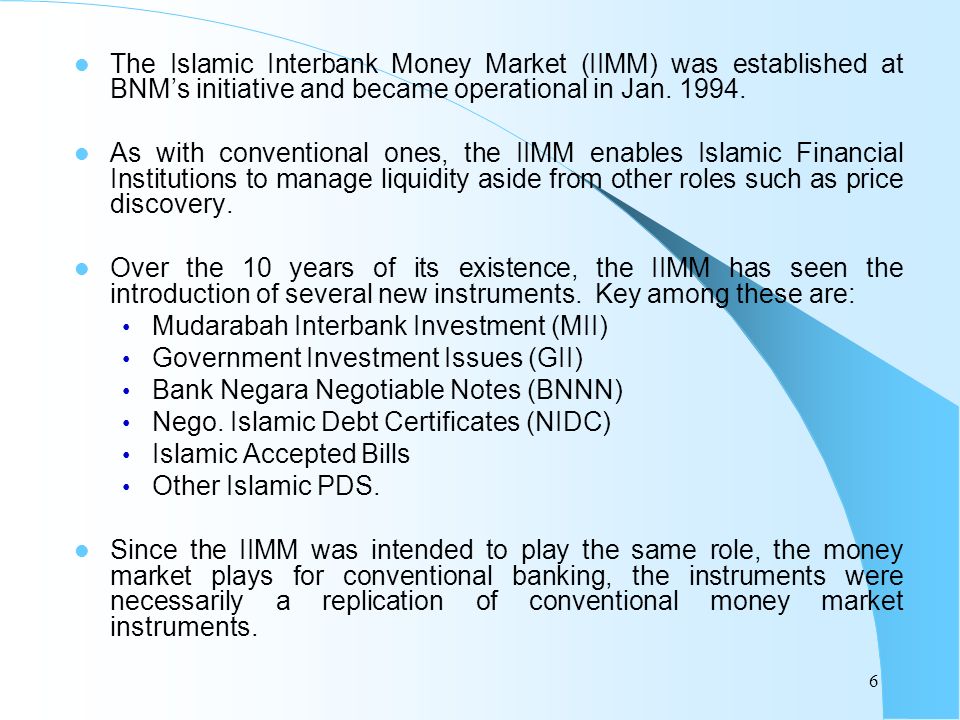

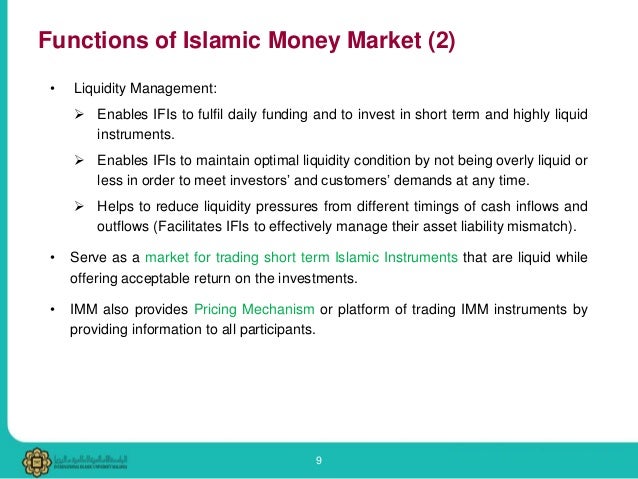

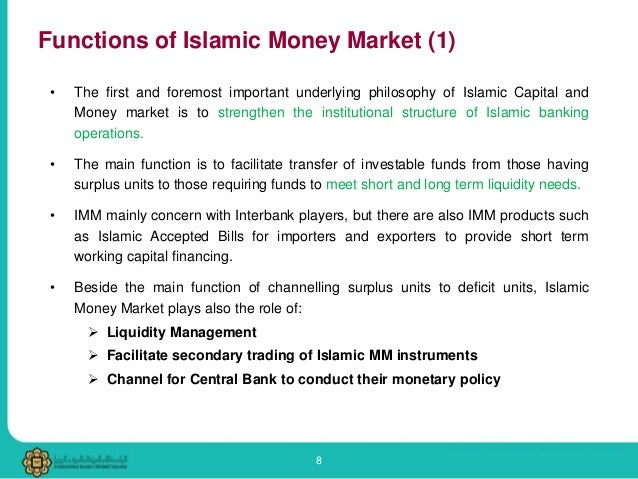

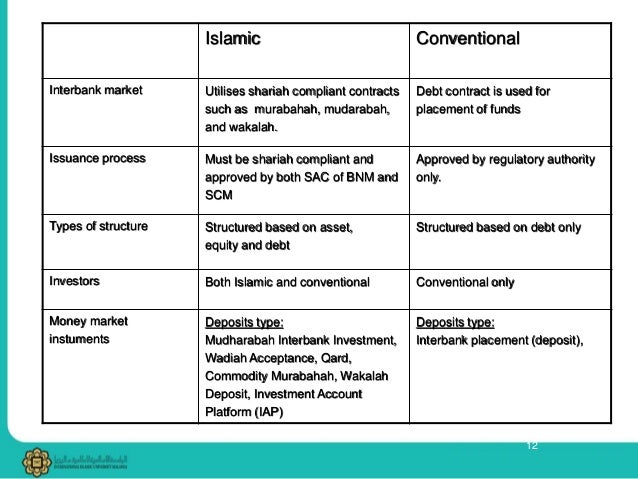

Interbank mudarabah is a wholesale money market transaction designed as liquidity management instruments in the islamic money market. Return is only determined on maturity date. This chapter discusses the islamic interbank money market its instruments and operations. Through the qard acceptance the bank manages liquidity in the context of a surplus liquidity environment by inviting islamic banking institutions to place their surplus funds with the bank.

The availability of various islamic interbank money market instruments allows islamic banks to cover their exposure in case of deficit and make placement on short term basis in case of surplus. Pricing of islamic money market instruments. Provident fund balances of the employees. The islamic interbank market.

The chapter examines the various interbank money market instruments their underlying islamic contracts and their pricing mechanisms with. The discussion demonstrates that the existence of a viable islamic interbank money market is crucial for the successful implementation of an islamic financial system. The availability of various islamic interbank money market instruments allows islamic banks to cover their exposure in case of deficit and make placement on short term basis in case of surplus. Types of instruments in islamic interbank money market a mudarabah interbank investment mii b wadiah acceptance c government investment issue gii d bank negara monetary notes i bnmn i e sell and buy back agreement sbba f cagamas mudharabah bonds smc g when issue wi h islamic accepted bills iab i islamic negotiable instruments ini.