Sst On Credit Card Malaysia

Provision of credit card or charge card services by any person who is regulated by bank negara malaysia through the issuance of a credit card or a charge card.

Sst on credit card malaysia. Under sst 2 0 the rm25 charge will be applied to each credit or charge card regardless if it is a principal or supplementary card. Guides to doing business. How to register for sst. What are the changes.

Written by gowri krishnan. A upgraded for example classic card to gold card b downgraded for example gold card to classic card c converted for example visa credit card to mastercard credit card or co branded card to generic card or vice versa. If your business is liable to register for sst you may complete the sales tax registration or service tax registration respectively online on the mysst website. Full details are available on the rmcd s website.

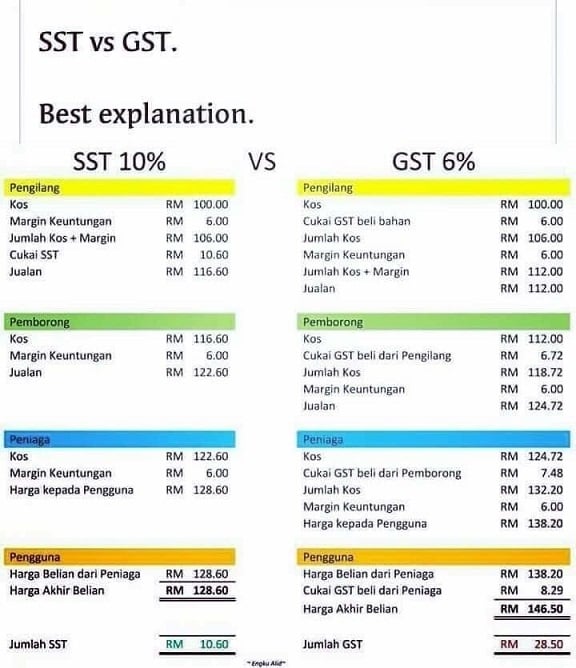

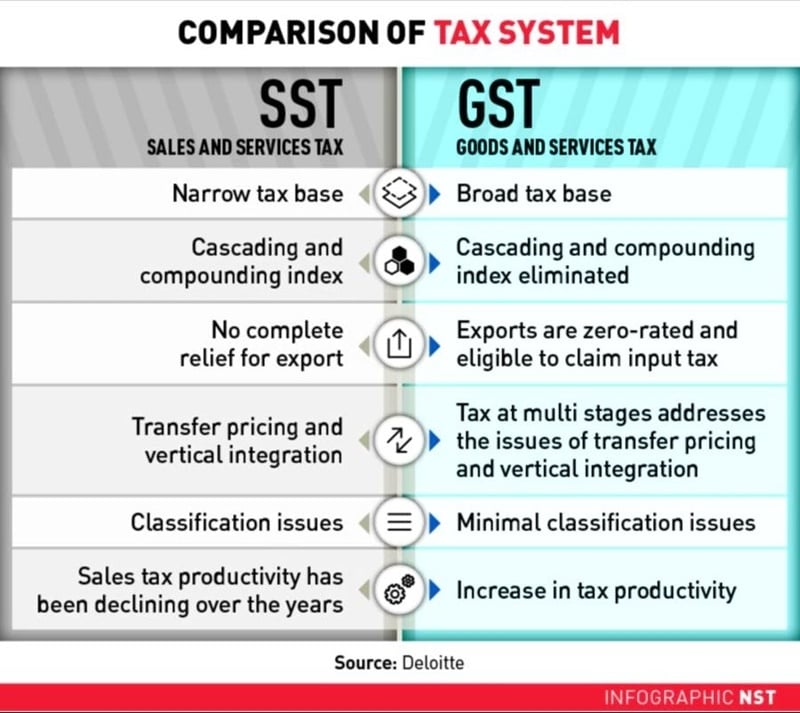

From 1 september 2018 the sales and services tax sst. The sales and services tax sst which is set to roll out on the 1st of september will have an impact on credit card holders. Kuala lumpur aug 30 a service tax of rm25 will be imposed on either new credit card users or those who renew their credit cards from september 1 onwards the finance minister has ordered. It should be noted that sst rate is fixed at 6 for a list of services.

Get more guidance and information from our business guides. This website is developed to enable the public to access information related to the royal malaysian customs department includes corporate information organization and customs related matters such as sales and service tax sst. 6 for all taxable services except for the provision of charge or credit card services which is rm25 per year on each principal or supplementary card. Under sst 2 0 the rm25 charge will be applied to each credit or charge card regardless if it is a principal or supplementary card.

Under the old service tax model a service tax of rm50 a year on each principal credit card and charge card and a service tax of rm25 a year on each supplementary card was implemented. Credit card holders will be charged with an annual rm25 service tax which is expected to contribute an additional rm225 million to the national revenue. Credit cards also include co branded credit cards and corporate cards. Yes service tax will be imposed in the event a credit card is.

In an order that was made just days before the revived sales and services tax sst regime kicked in on. Each tax payments are recorded every year in this particular card. In order to be registered for the sales and service tax in malaysia a service need to issue a tax submission supplementary card which will cost about rm25.