Stamp Duty Malaysia 2017

One of the most popular wishes in the run up to budget 2017 among industry players was to have easier financing and packages to assist first time homebuyers.

Stamp duty malaysia 2017. However stamp duty relief is available for the following circumstances subject to meeting the pre requisite. On the other hand the rate of stamp duty on property transfers worth more than rm1 million will be increased from 3 to 4 but effective only from jan 1 2018. Malaysia imposes stamp duty on chargeable instruments executed on certain transactions. The transfer of shares will attract stamp duty at the rate of 0 3 on the consideration paid or market value of the shares whichever is the higher.

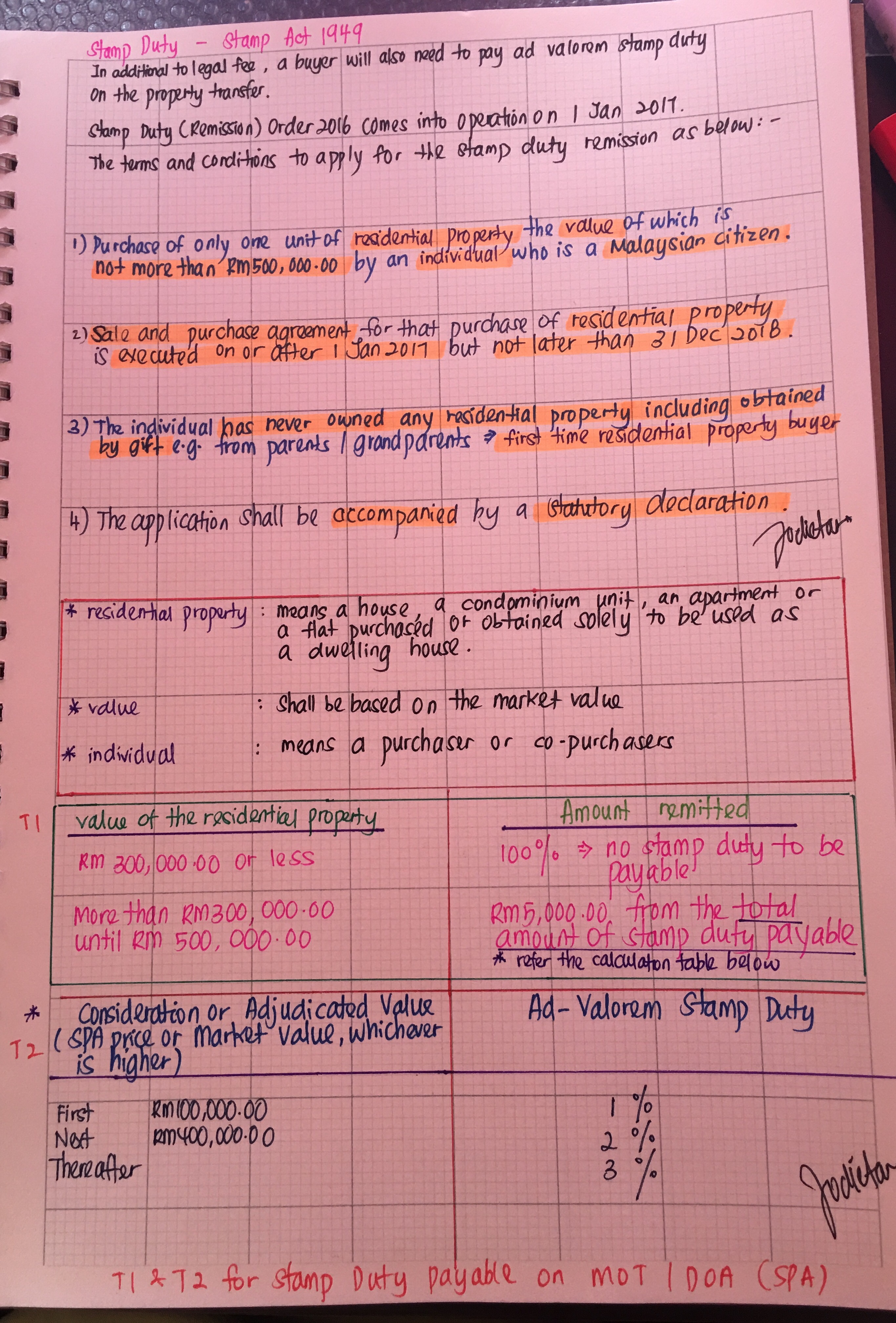

Malaysia tenancy agreement stamp duty fee calculation april 7 2017 eddie 0 comments after getting your property paperwork sorted out and the daunting task of completing your renovation investment buyers will quickly seek to collect rental from the property. There are two types of stamp duty namely ad valorem duty and fixed duty. For the purchase of first home priced exceeding rm300 000 up to rm500 000 stamp duty exemption is limited to rm300 000 of the value of home and the remaining balance of the value of the home is subject to the prevailing rate of stamp duty. The stamp duty for sale and purchase agreements and loan agreements are determined by the stamp act 1949 and finance act 2018 the latest stamp duty scale will apply to loan agreements dated 1 january 2019 or later and to sale and purchase agreements and.

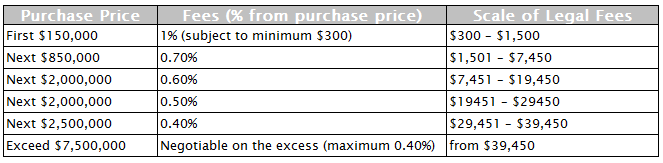

Home malaysia law firm malaysia law statutes legal fee stamp duty for sale purchase agreement loan. In malaysia for example the below is the current percentage applicable. Instruments liable to stamp duty are those listed in the first schedule of the stamp act 1949 exemptions relief from stamp duty general exemptions under section 35 in first schedule stamp act 1949 and specific exemptions under item 2 4 and 32 in first schedule stamp act 1949. In malaysia stamp duty is a tax levied on a variety of written instruments specifies in the first schedule of stamp duty act 1949.

In general term stamp duty will be imposed to legal commercial and financial instruments. The calculation formula for legal fee stamp duty is fixed as they are governed by law. Stamp duty up to rm300 000 100 between rm300 001 and rm500 000 100 on the first rm300 000 and excess is subject to the prevailing rate of stamp duty. Computation of stamp duty for transfer of real estate sample calculation for a rm500 000 property as per image on left first rm100.

It applies to the usual property markets of the world including our friendly neighbour singapore too. For sale and purchase agreement executed from 1 january 2017 to 31 december 2018. Nope this is not just in malaysia.