What Is Capital Allowance Tax

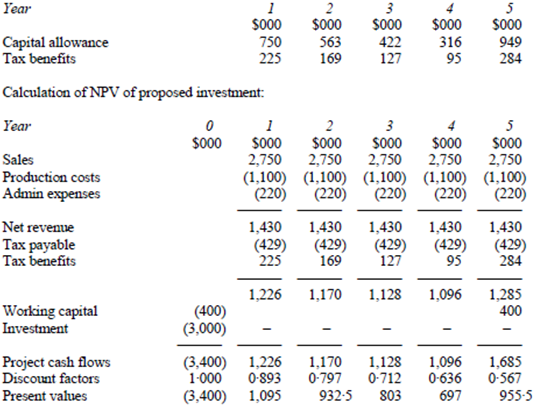

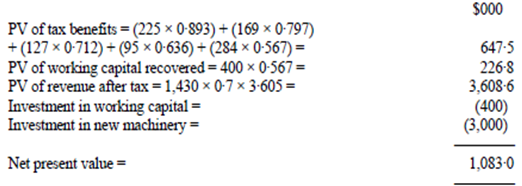

They effectively allow a taxpayer to write off the cost of an asset over a period of time.

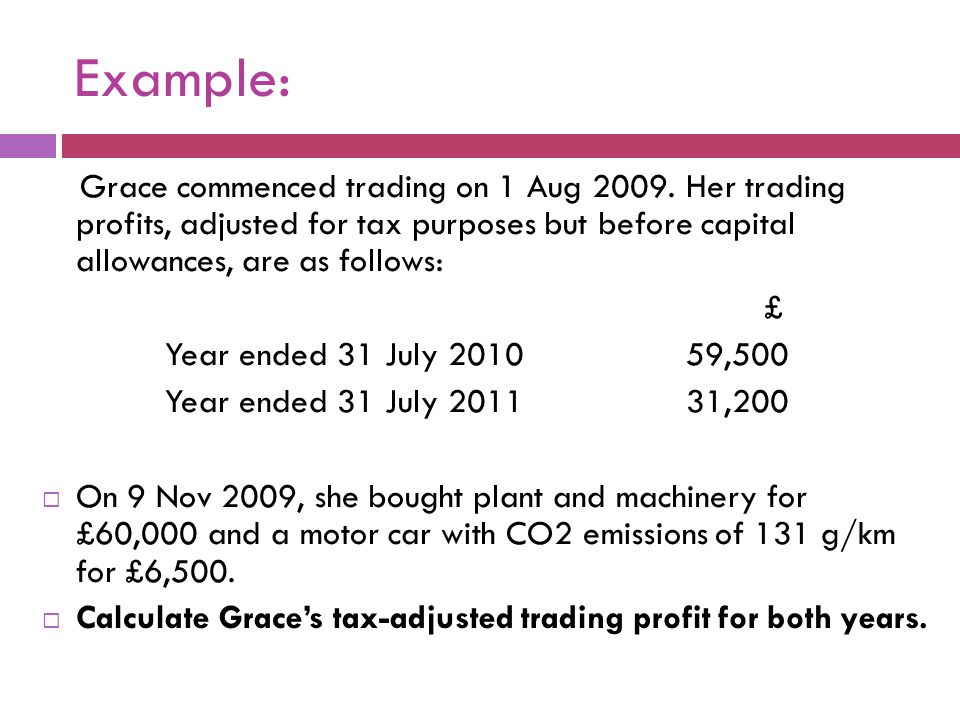

What is capital allowance tax. While annual allowance is a flat rate given every year based on the original cost of the asset. Capital allowances are deductions for fixed assets. Initial allowance is fixed at the rate of 20 based on the original cost of the asset at the time when the capital expenditure is incurred. Capital allowances may be claimed on most assets purchased for use in the business ranging from.

Qualifying fixed assets include carpets machinery and office equipment. Capital allowances consist of an initial allowance and annual allowance. Capital allowances are deductions claimable for the wear and tear of qualifying fixed assets such as industrial machinery office equipment and sign boards. Some expenses will fall under a different tax relief system such as business expenses while others cannot be claimed at all.

It is only calculated when a company is computing its tax liabilities. Try it free for 7 days. Capital allowances are generally granted in place of depreciation which is not deductible. Capital allowances are deductions you can claim for wear and tear of qualifying fixed assets bought and used in your trade or business.

A capital allowance is an expenditure a u k. Enhanced capital allowances eca plant and machinery that is deemed energy efficient and environmentally friendly attracts 100 tax relief through a first year allowance called enhanced capital allowances ecas. Capital allowance is an amount of money spent on business assets that can be subtracted from what a business owes in tax track the depreciation of your assets easily with invoicing accounting software like debitoor. Capital allowances are akin to a tax deductible expense and are available in respect of qualifying capital expenditure incurred on the provision of certain assets in use for the purposes of a trade or rental business.

Capital allowances is the practice of allowing a company to get tax relief on tangible capital expenditure by allowing it to be expensed against its annual pre tax income. Or irish business may claim against its taxable profit. Not every investment is a capital allowance however. Usually when companies prepare income statement they always charge depreciation as an expense before arriving at their profit before tax.

A capital allowance is tax relief based on the amount of money invested in business assets within the tax year. Generally the capital allowances will exist for only specified items of tangible capital expenditure and the expensing is usually spread over a fixed period of years.