What Is Capital Allowance In Taxation

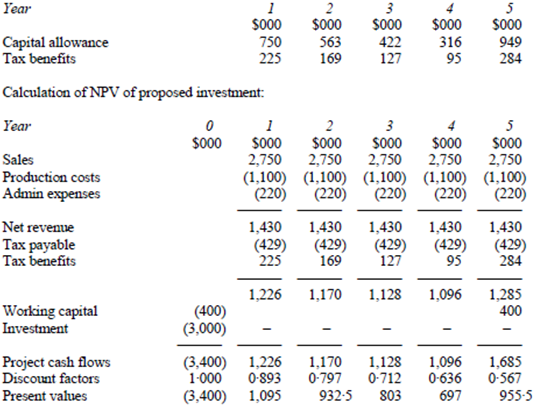

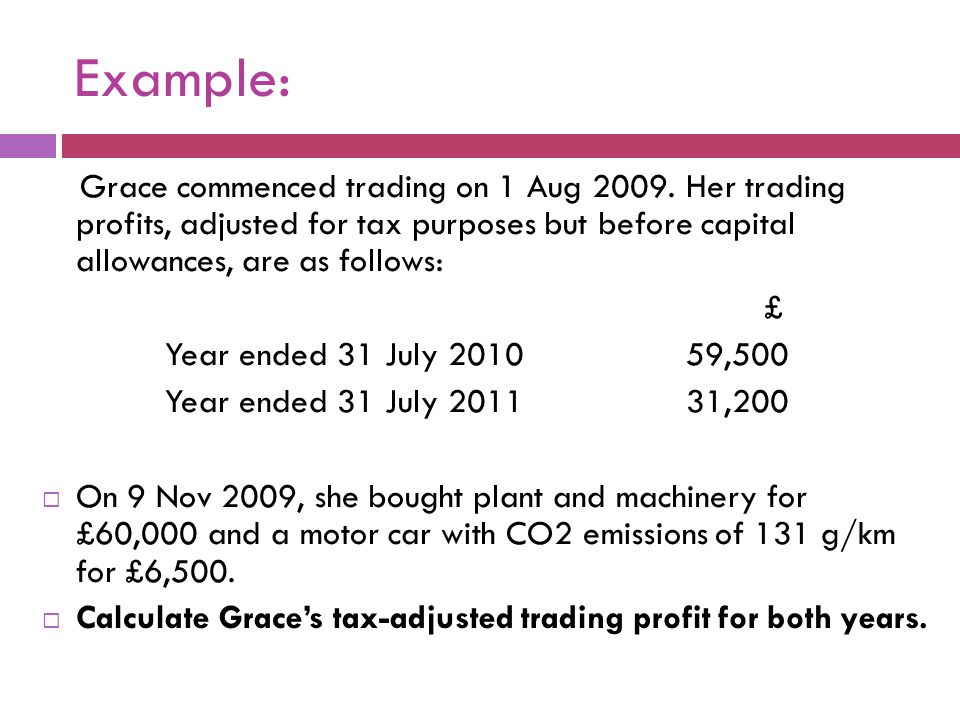

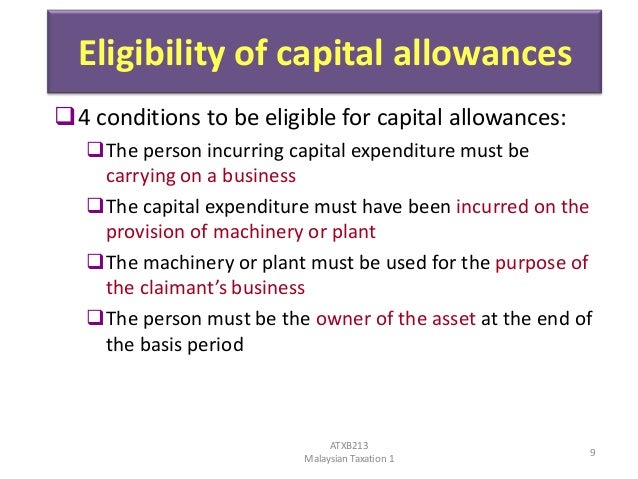

Capital allowances is the practice of allowing a company to get tax relief on tangible capital expenditure by allowing it to be expensed against its annual pre tax income.

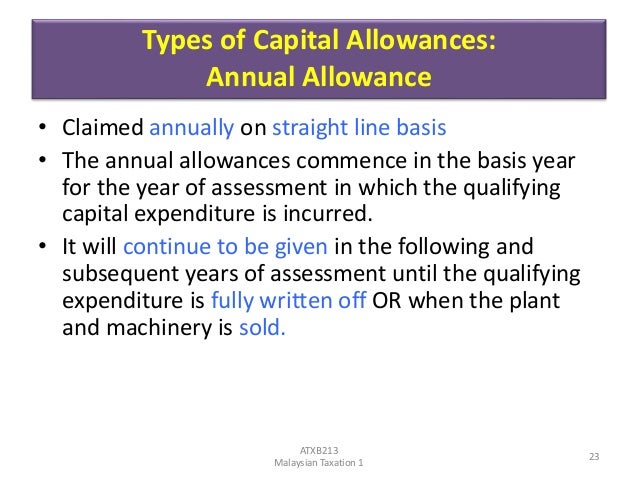

What is capital allowance in taxation. Unusually the irish corporate tax system has a capital allowances for intangible assets scheme which. Some expenses will fall under a different tax relief system such as business expenses while others cannot be claimed at all. They effectively allow a taxpayer to write off the cost of an asset over a period of time. Try it free for 7 days.

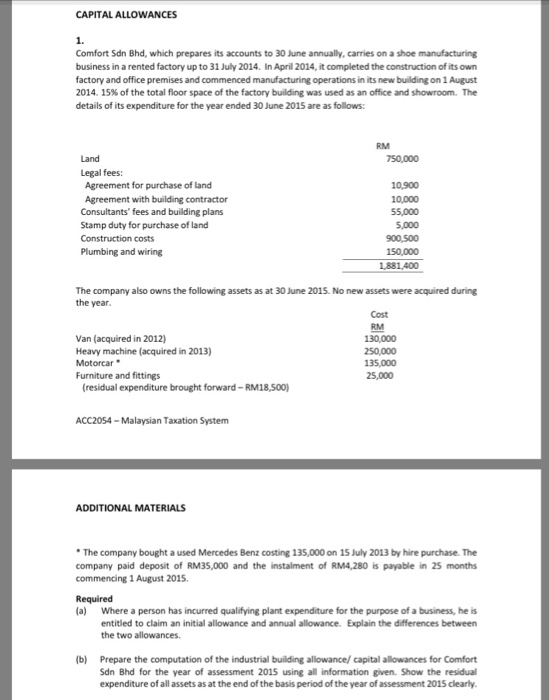

Capital allowances may be claimed on most assets purchased for use in the business ranging from. Review of assets used in medical and surgical equipment manufacturing industry. Aa 100 of the cost of the asset. The term is used in the uk and in ireland.

A capital allowance is an expenditure a u k. Or irish business may claim against its taxable profit. For assets purchased by cash. Review of assets used in other non metallic mineral mining industry.

Under the 100 write off capital allowance is allowed in the form of annual allowance aa where. Small value assets not exceeding rm2 000 each are eligible for 100 capital allowances. Capital allowances and who can claim. Capital allowance is an amount of money spent on business assets that can be subtracted from what a business owes in tax track the depreciation of your assets easily with invoicing accounting software like debitoor.

The total capital allowances of such assets are capped at rm20 000 except for smes as defined. Capital allowances are akin to a tax deductible expense and are available in respect of qualifying capital expenditure incurred on the provision of certain assets in use for the purposes of a trade or rental business. A capital allowance is tax relief based on the amount of money invested in business assets within the tax year. Generally the capital allowances will exist for only specified items of tangible capital expenditure and the expensing is usually spread over a fixed period of years.

Review of assets used in casino operations industry. For assets purchased under hire purchase. Capital allowances are deductions claimable for the wear and tear of qualifying fixed assets such as industrial machinery office equipment and sign boards. Capital allowances are generally granted in place of depreciation which is not deductible.

Not every investment is a capital allowance however.