Type Of Allowance For Employees In Malaysia

Only applicable for ya 2009 to 2010 travelling allowance petrol cards petrol allowance or toll.

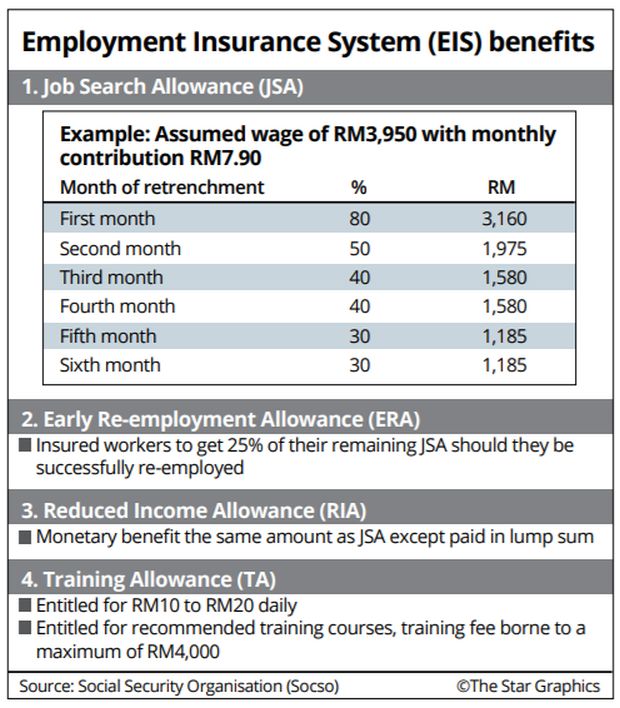

Type of allowance for employees in malaysia. 2020 malaysia benefits summary. Fixed allowance are taxable income except for the following exempted allowance from ya 2009 a travel allowance of rm2 400 per year would be exempted for travelling between home and work. A sunway business school economics professor has forecasted a 5 6 unemployment rate ahead of the 3 3 rate currently with the number of unemployed individuals projected to rise to more than 800 000. Employees shall be granted 12 vacation days on a prorated basis for less than 2 years of service.

In malaysia employees are allowed to claim tax exemptions for the benefits perquisites below unless the employee has shareholding or voting power in the company. Employees of regional operations. Petrol allowance petrol card travelling allowance or toll payment or any combination. According to economists the risk of more job losses and salary cuts have increased with the prolonged movement control order mco in malaysia and recovery could take up to 12 months.

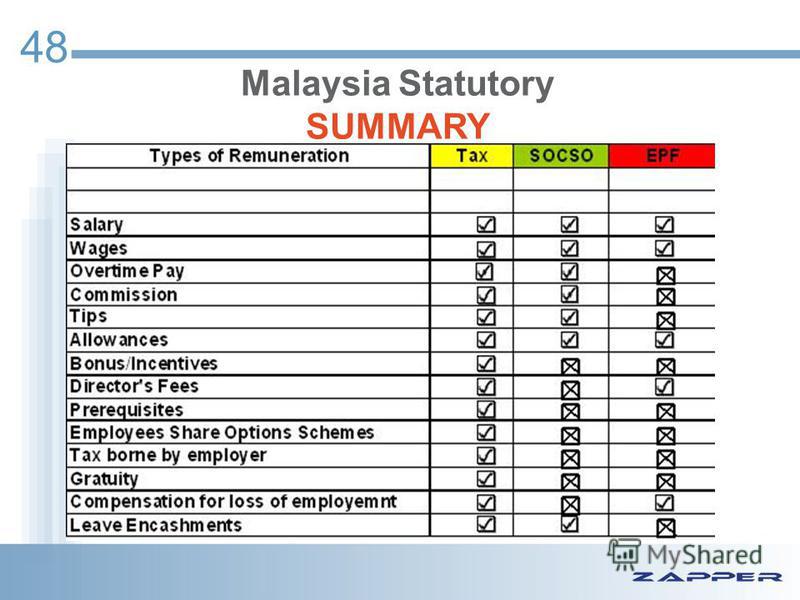

The scope is very wide and includes virtually all forms of remuneration. Non malaysian citizens who are based in malaysia working in operational headquarter ohq or regional office ro or international procurement centre ipc or regional distribution centre rdc or treasury management centre tmc status companies would be taxable on employment income attributable to the number of days they exercise employment in malaysia. Salary guide for year 2020. Other employee benefits called fringe benefits include various types of non wage compensation provided to employees in addition to their normal wages or salaries.

Here are the 14 tax exempt allowances gifts benefits perquisites. Employment of women no employer shall require any female employee to work in any industrial or agricultural undertaking between 10 pm to 5 am nor commence work for the day without having had a period of eleven consecutive hours free. Malaysia salary guide year 2020. Any employee as long as his month wages is less than rm2000 00 and.

The income of an employee from an employment includes wages salary remuneration leave pay fee commission bonus gratuity perquisite or allowance whether such items are paid in money or otherwise in respect of having or exercising the employment. He is under your employment and will be having contract of service offer letter epf. Any employee employed in manual work including artisan apprentice transport operator supervisors or overseers of manual workers persons employed on vessels and even domestic servants are classified as employees even if their wages is more than rm2000 00 per month.