Non Allowable Expenses For Corporation Tax

You may incur petrol costs in the day to day operations while driving your brand new porsche but the act prohibits the deduction of all expenses related to s plate vehicles.

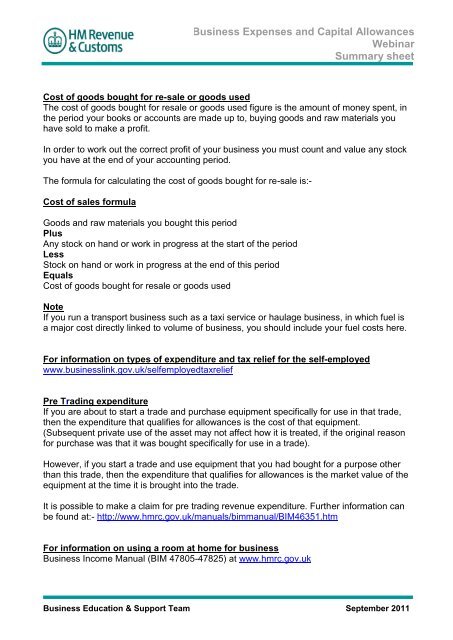

Non allowable expenses for corporation tax. Contingent liability is not allowable as a tax deduction. Accountancy fee is fully tax deductible unless it is for company set up or relates to your personal tax return. Most of the costs you incur from running your business are allowable such as office equipment salaries and business insurance. What is a non tax deductible expense.

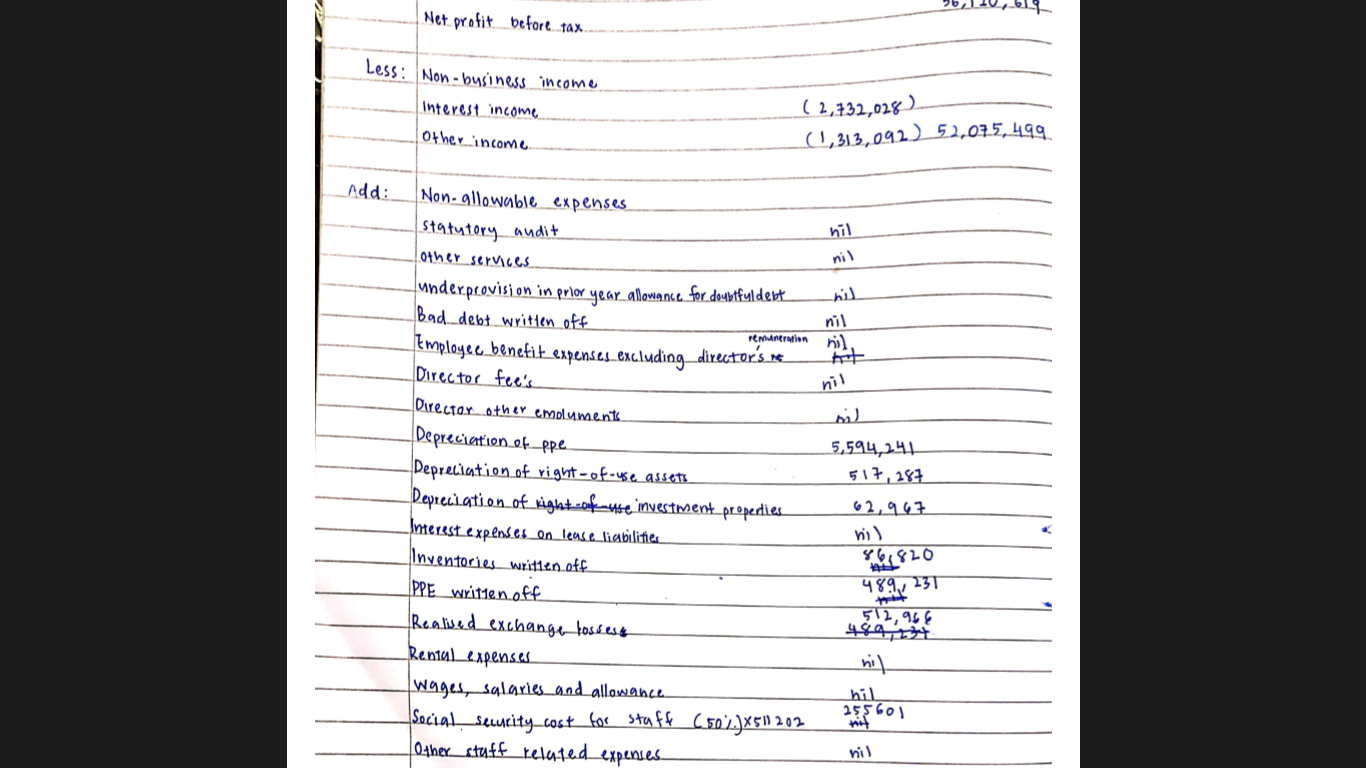

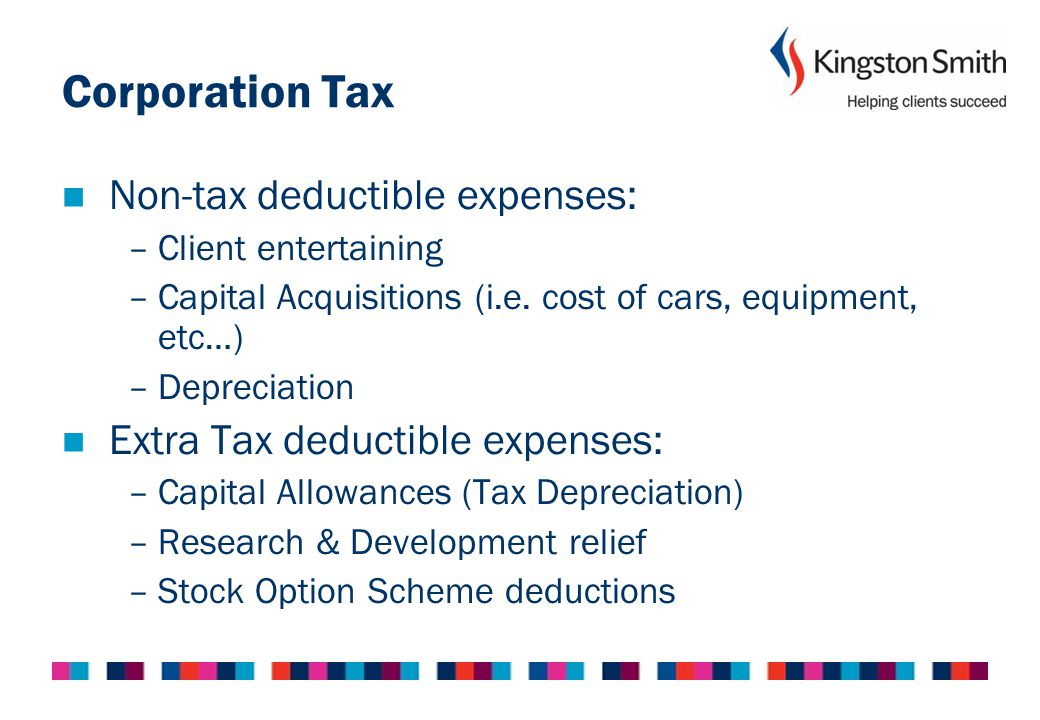

The rules on limited company expenses as long as an expense is allowable you can deduct it from your revenue to calculate your taxable profit. These can be claimed to reduce your tax bill. This includes personal expenses such as travel or entertainment not related to the running of the business and capital expenses such as expenses incurred to incorporate a company and purchase of fixed assets. Some expenses are not allowed for corporation tax for example entertaining clients add these back to your.

Disallowable deductions expenditure which is not wholly and exclusively intended for trade purposes is not allowable. Your own salary allowances bonus and contributions to medisave cpf. An easier way to remember what is allowable is to use the tax return itself. This is a list of expenses as part of the 2017 tax cuts and jobs act effective for the april 2018 filing that is not deductible on your business tax return or your personal return for that matter.

This expenditure is usually referred to as wholly exclusively. Travelling expenses for your personal trips. Your personal income tax. Knowing what qualifies as an allowable business expense will help you to pay the right amount of tax required by iras.

On the tax. Expenses that are capital in nature e g. A deductible tax expense is a purchase deemed necessary and ordinary for business operation. Expenses incurred solely for business purposes are generally allowable.

Expenses that are personal and private in nature are not allowable as they do not relate to your business. Non deductible business expenses are activities you or your employees pay for that do not fulfil the conditions above. The expenses must be incurred. Examples of disallowable business expenses include.

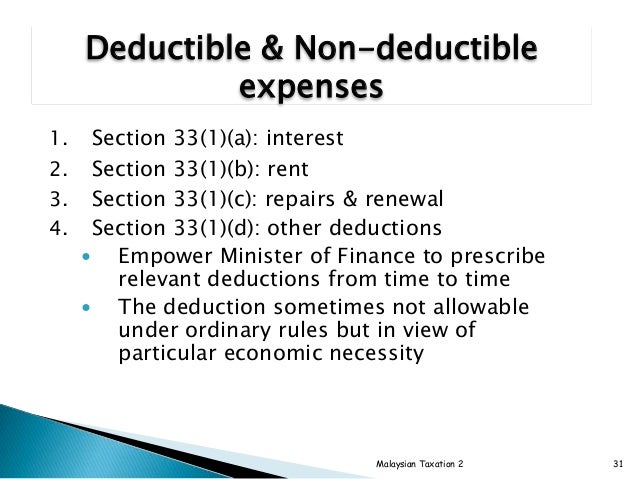

However depreciation of fixed assets may be claimed as capital allowances. Purchase of fixed assets such as plant and machinery are not allowable business expenses. Purchase of fixed assets. The deduction must not be prohibited under the income tax act example.

As you complete your business taxes you may be gathering information and wondering what is deductible and what is not. Your personal medical fees insurance donations and income tax.