How To Calculate Capital Allowance Malaysia

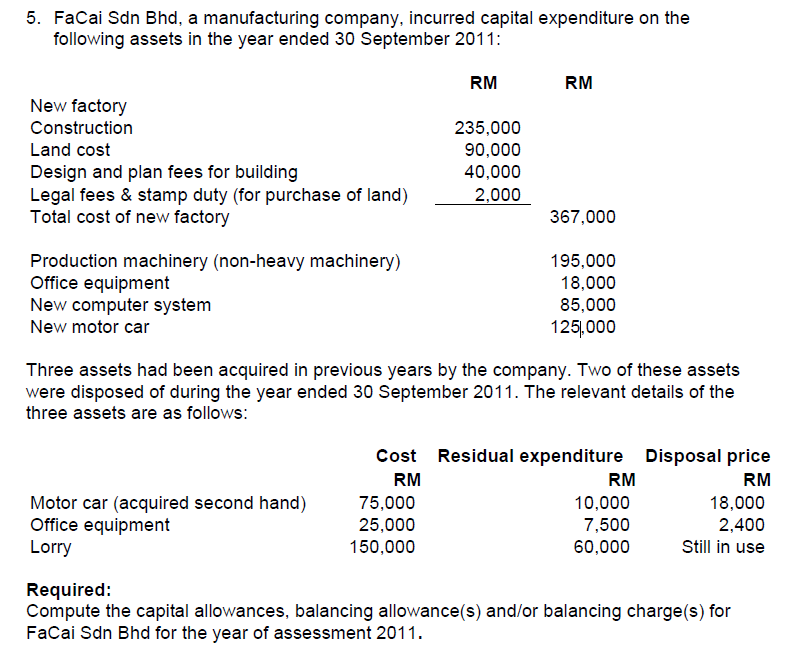

Computation of capital allowances and balancing charge.

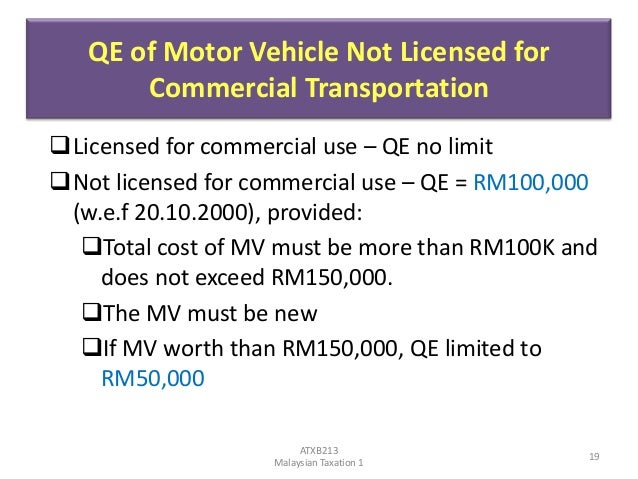

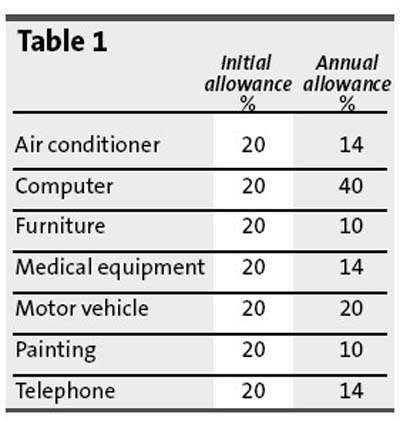

How to calculate capital allowance malaysia. Rm rm year of assessment 2014 qe 200 000 ia 20 x rm200 000 40 000 aa 14 x rm200 000 28 000 68 000. Balancing charge allowance if the disposal value of a fixed asset exceeds the tax written down value the excess is known as a balancing charge the amount is restricted to the actual capital allowances claimed previously. The average on property improvements is 50. Capital adequacy framework capital components 4 of 44 issued on.

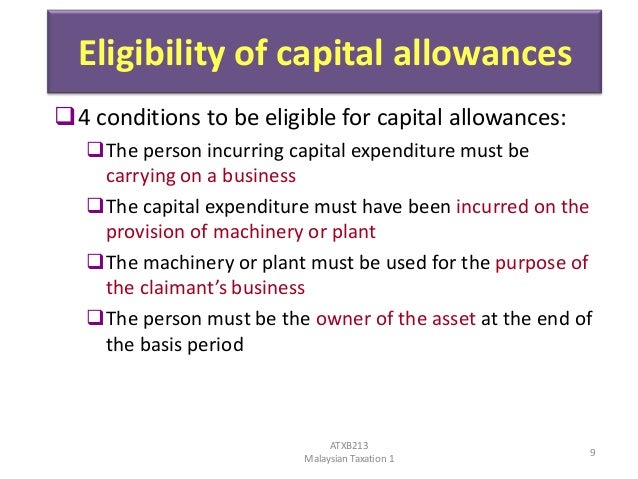

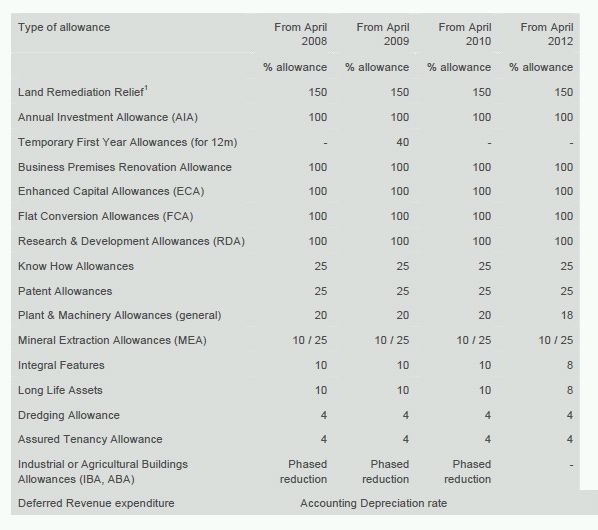

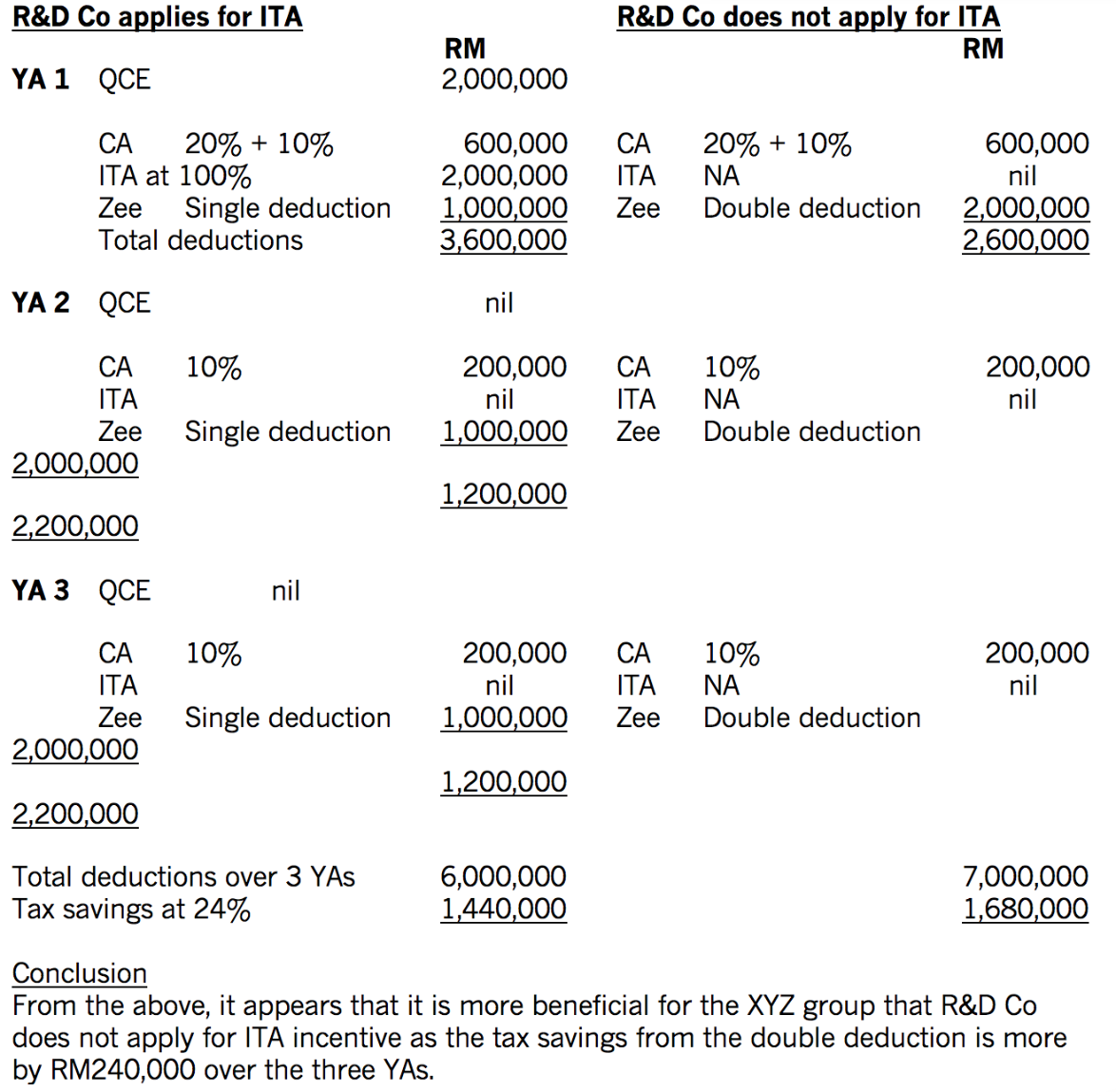

Capital allowances are allowed to a person who incurred qualifying expenditure qe on assets used for the purpose of his business and made a claim in writing in his income tax return form. Small value assets not exceeding rm2 000 each are eligible for 100 capital allowances. Conditions for claiming capital allowance are. Computation of initial annual allowances in respect of plant machinery 1 0 tax law this ruling applies in respect of the computation of annual allowances for plant and machinery under paragraph 15 schedule 3 income tax act 1967 and the income tax qualifying plant annual allowances rules 2000 p u a 52 2000.

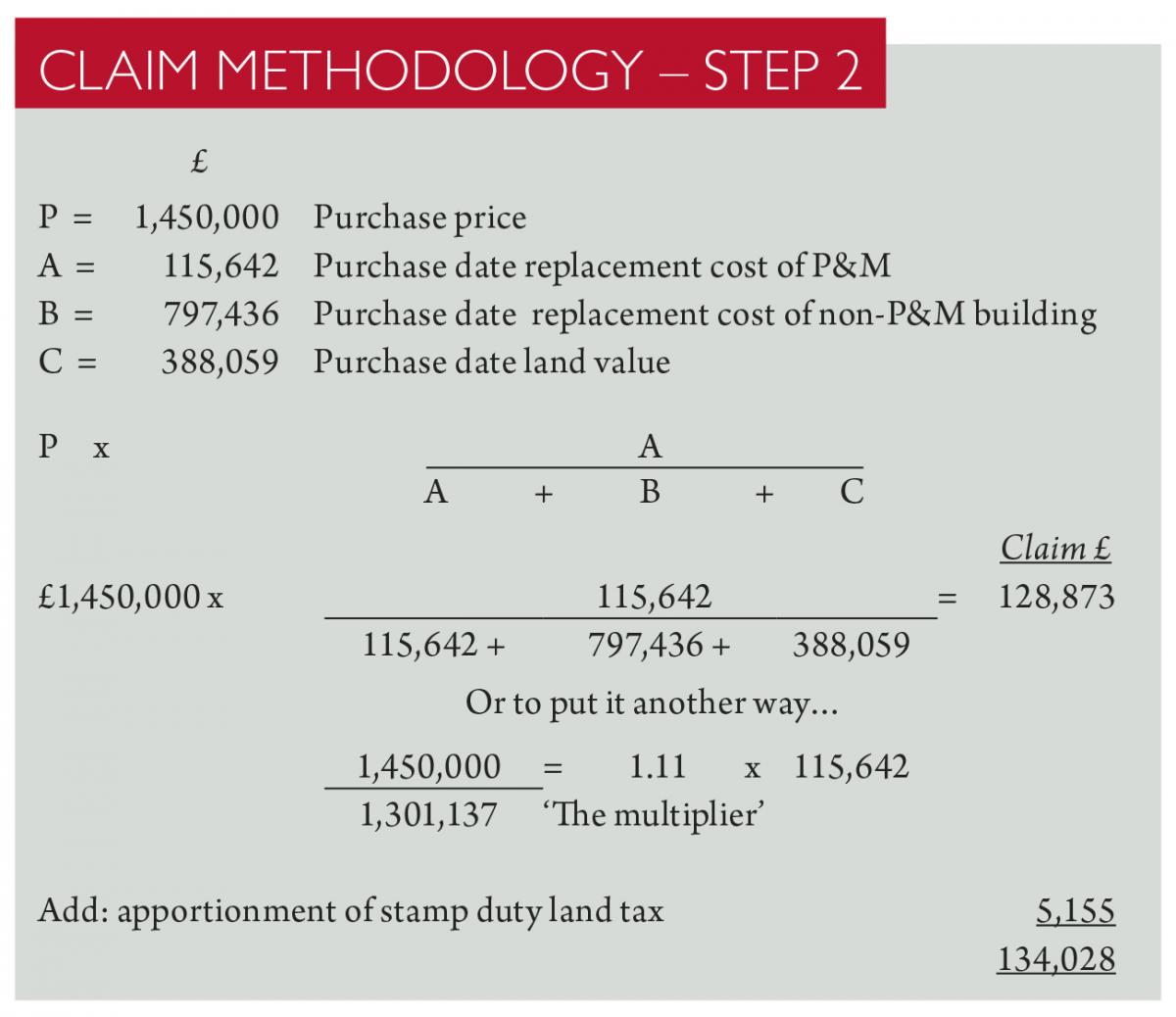

The total capital allowances of such assets are capped at rm20 000 except for smes as defined. A b total rwa c s 8 2 for the purpose of paragraph 8 1. Capital allowance review service has acted for properties of all types from a chain of karaoke bars for which capital allowance savings of 412 791 were made to a property which a landlord rented out for which unclaimed capital allowances were identified to the tune of 22 of the property cost. Instead capital allowances calculated at the prescribed rates on a straight line basis are given in lieu of depreciation.

More than 160 000 was identified for one client in. The amount of qe incurred will be used in the computation of initial allowance ia and annual allowance aa under schedule 3 of the ita. At deloitte we work hard to help make sure our clients don t miss out on the opportunity to enhance the claim from identifying the entitlement through to delivering the tax benefits. Initial allowance is fixed at the rate of 20 based on the original cost of the asset at the time when the capital expenditure is incurred.

Capital allowances consist of an initial allowance and annual allowance. Undertaking a thorough capital allowances study on property construction related activities can be a complex task. Examples of assets used in a business are motor vehicles machines office equipment furniture and computers. Business loss for the year of assessment 2016 capital allowances b f and current year capital allowances on other assets were rm160 000 rm30 000 and rm55 000 respectively.

This ruling is effective. 5 february 2020 8 capital adequacy ratios s 8 1 a financial institution shall calculate its common equity tier 1 cet1 capital tier 1 capital and total capital ratios in the following manner.