What Is Capital Allowance Assets

A capital allowance is an expenditure a u k.

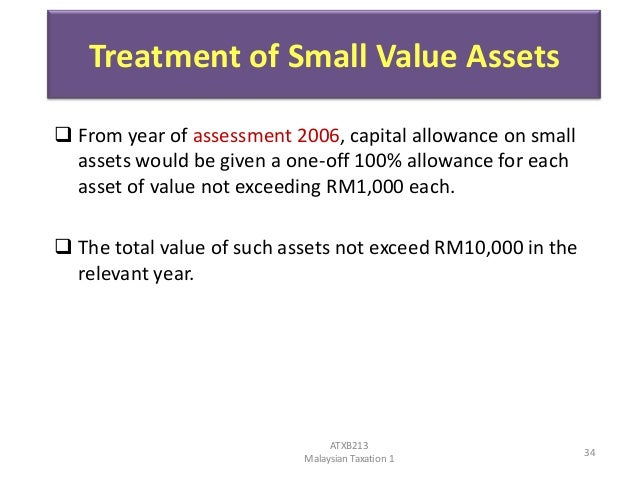

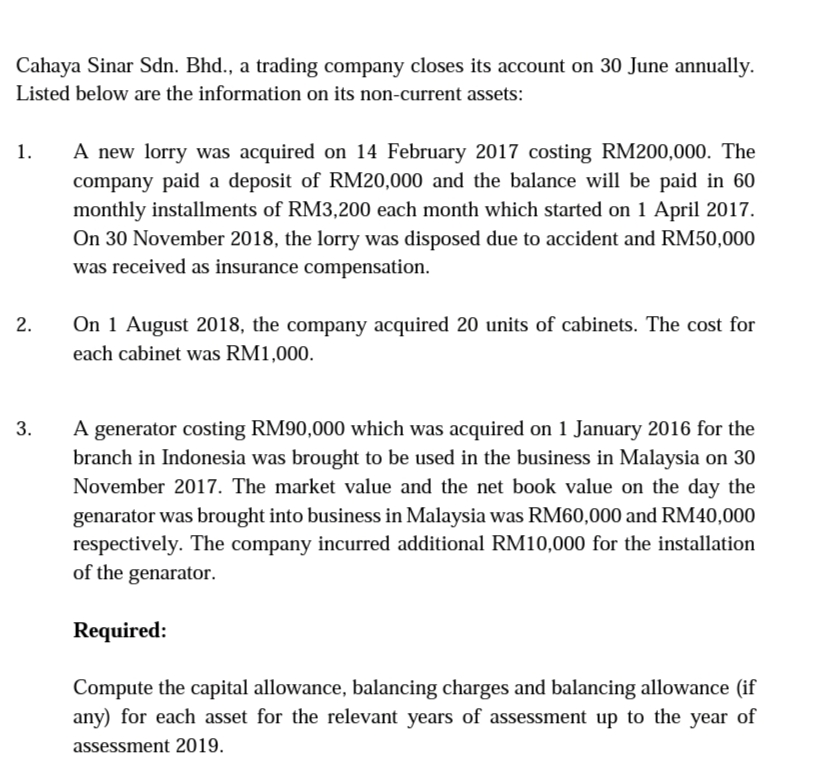

What is capital allowance assets. Capital allowances are deductions claimable for the wear and tear of qualifying fixed assets such as industrial machinery office equipment and sign boards. Small value assets not exceeding rm2 000 each are eligible for 100 capital allowances. Capital allowance is a tax deduction claimable for the decline in value depreciation of capital assets such as your investment property. What is a capital allowance.

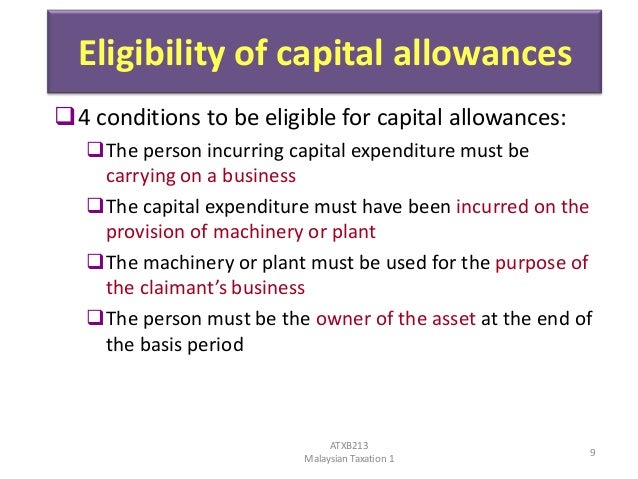

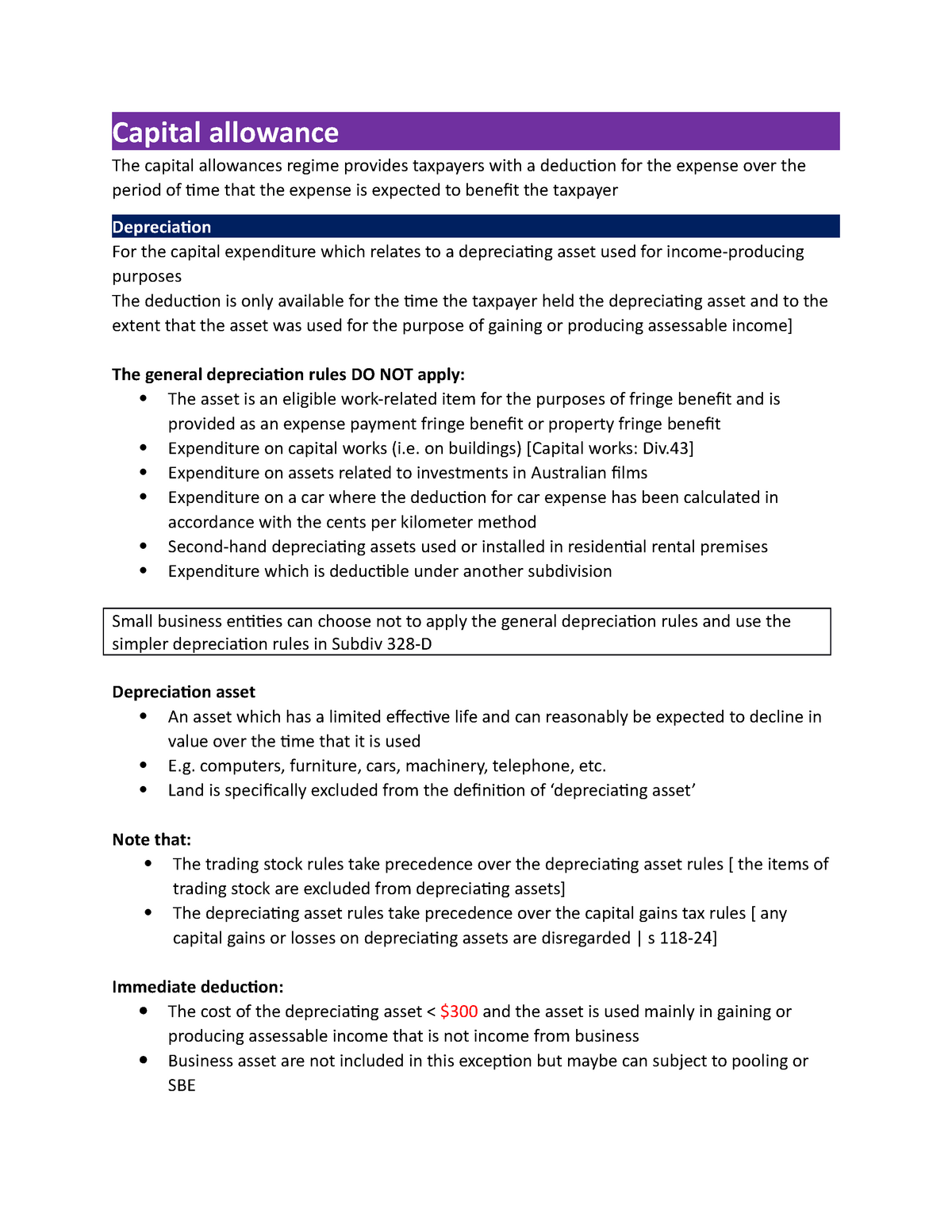

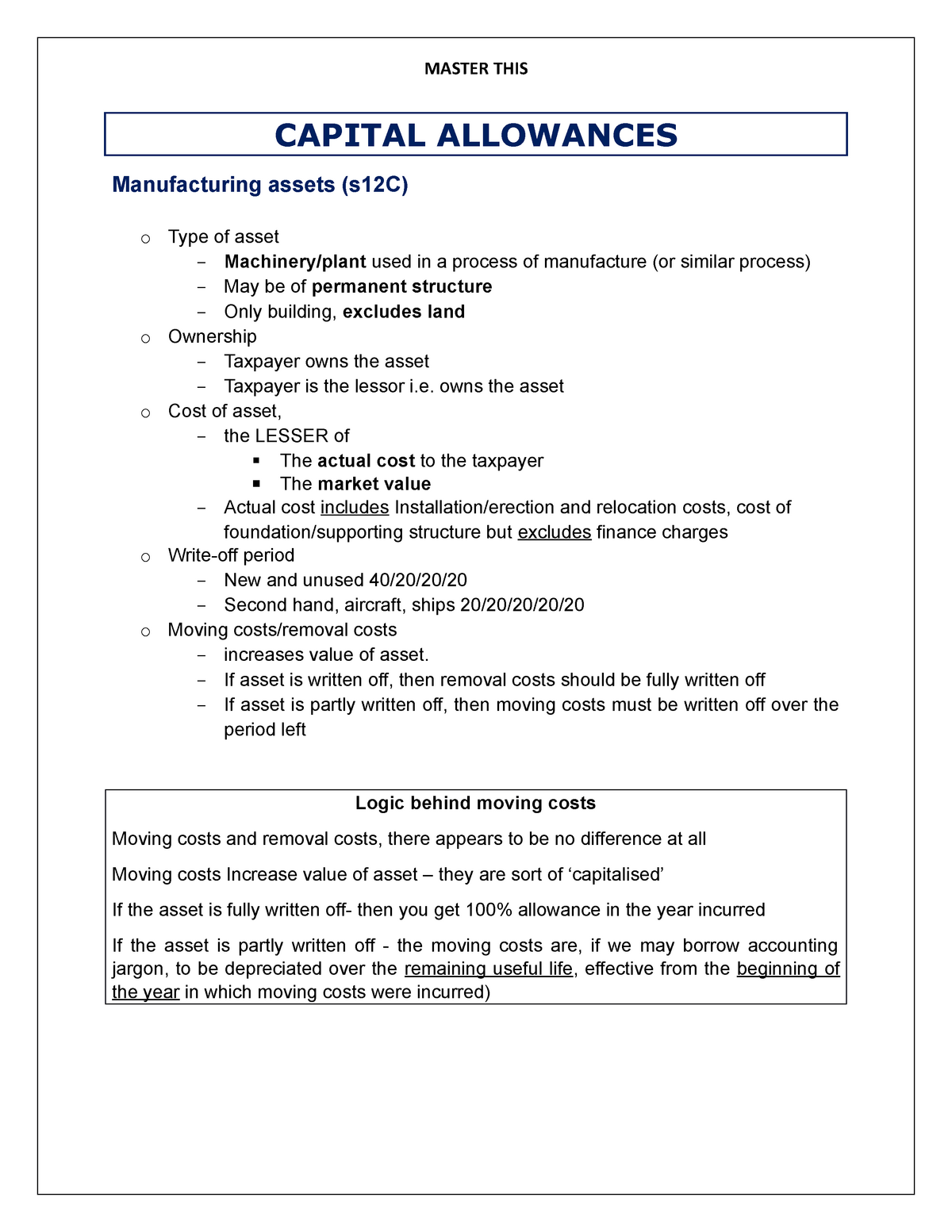

Capital allowances are akin to a tax deductible expense and are available in respect of qualifying capital expenditure incurred on the provision of certain assets in use for the purposes of a trade or rental business. Capital allowances are deductions claimable for the wear and tear of qualifying fixed assets such as industrial machinery office equipment and sign boards. Under the general depreciation rules an immediate write off applies to. Capital allowances are generally granted in place of depreciation which is not deductible.

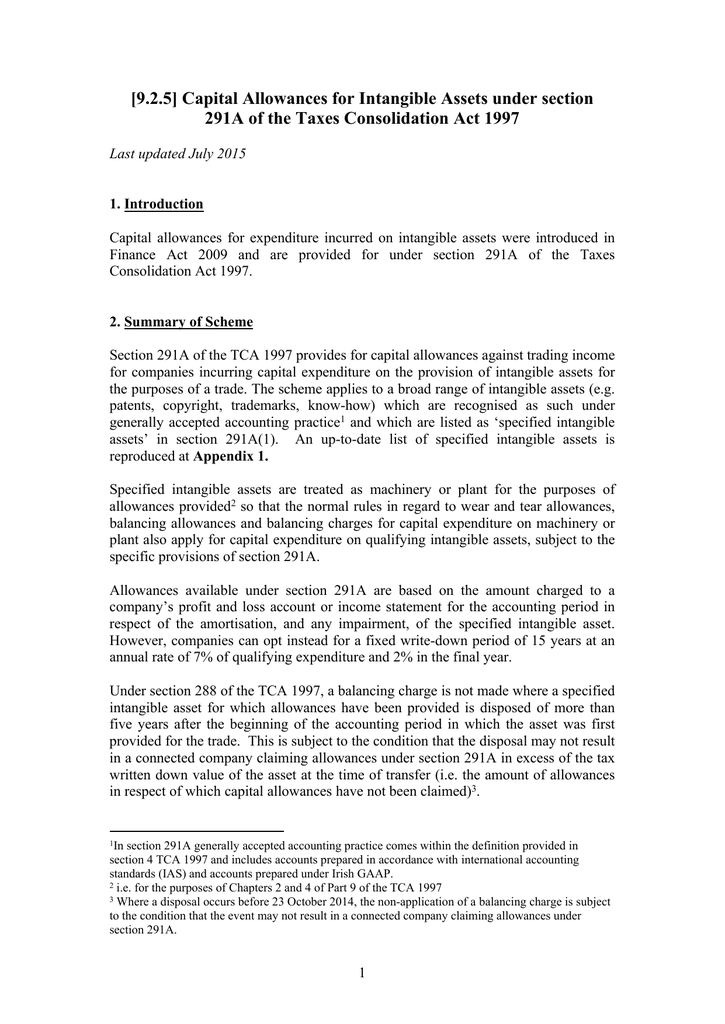

Or irish business may claim against its taxable profit. Capital allowances is the practice of allowing a company to get tax relief on tangible capital expenditure by allowing it to be expensed against its annual pre tax income. For property investors it means the deductions you can claim as an expense for the ageing wear and tear of your investment property and the included assets. Capital allowances may be claimed on most assets purchased for use.

These rules set out the amounts capital allowances that can be claimed based on the asset s effective life. Claiming capital allowance means a reduction in tax something that is nearly always a positive for a business and. Generally the capital allowances will exist for only specified items of tangible capital expenditure and the expensing is usually spread over a fixed period of years. There are specific categories that the assets must fall under in order to qualify and be claimed under capital allowance with hmrc.

Capital allowances are generally granted in place of depreciation which is not deductible. Why claim capital allowance. However capital allowance does not apply to all types of assets.