Fixed Deposit Interest Tax Exemption Malaysia

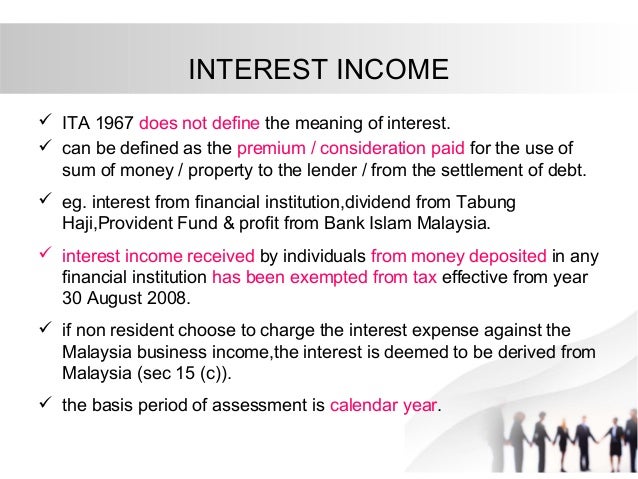

Yes interest accumulated on fixed deposits are seen to be financial income and is therefore taxed.

Fixed deposit interest tax exemption malaysia. Thus the date of interest accrued for the purpose of income tax is the last day of the period set out in each case. Non application of subsection 33 2 interest restriction 7 8 8. Individual income tax exemption of up to rm5 000 to employees who receive a handphone notebook or tablet from their employer effective july 1 2020. Additionally where interest is paid to a non resident the interest derived or deemed derived from malaysia is subject to withholding provisions.

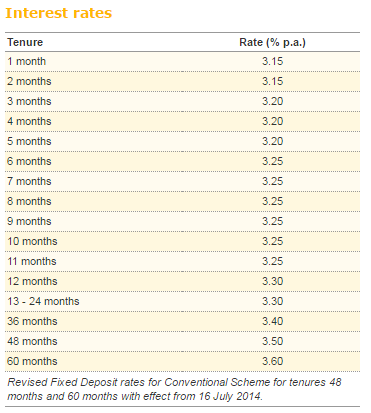

Interest expense incurred on investments 8 17 9. Interest restriction under subsection 33 2 of the ita 3 7 7. The rate of interest offered by a fixed deposit is. But you might not have known that there are also tax exemptions in the law which are basically types of income that you pay 0 tax on.

Foreign sourced interest income is specifically tax exempt. Deferred payment credit 19 11. For your information the interest earned from local bank is tax exempt with effect from august 30 2008. Although there are a few exemptions tax is deducted on the interest earned on a term deposit.

Tax treatment of interest expense 1 3 6. An effective way of saving income tax is to invest in fixed deposits that are eligible for tax deduction under section 80c of the income tax act. Depending on the terms and conditions of the fixed deposit contract. Total annual income tax exemptions tax reliefs.

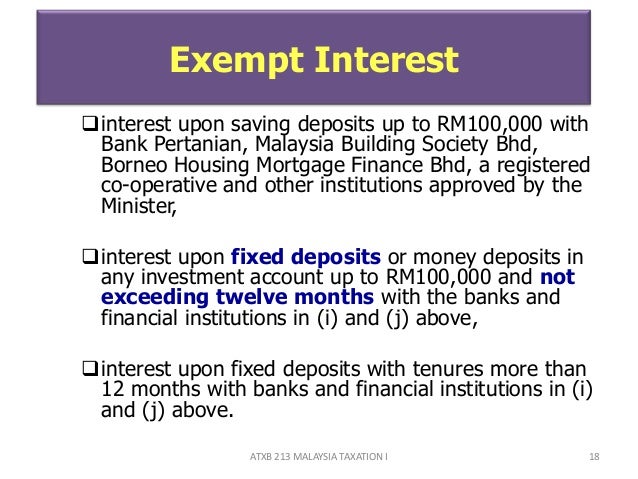

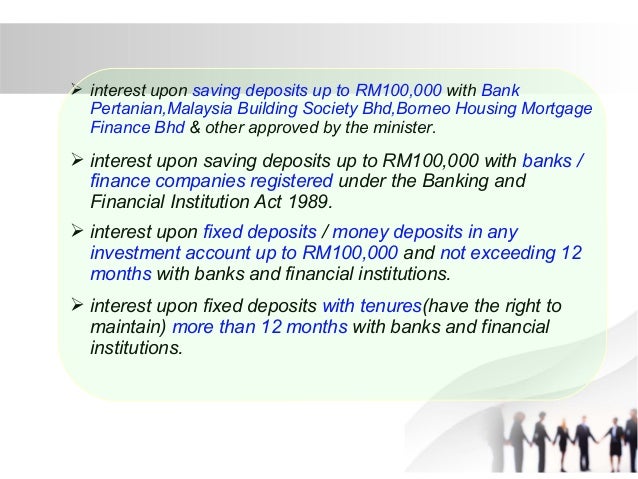

Exemptions and concessional tax treatment for expatriates exemptions or concessions are given in certain situations such as. Interest which accrues in respect of any fixed deposits account including negotiable certificates of deposits of up to rm100 000 for a period not exceeding twelve months withbank pertanian malaysia bank kerjasama rakyat malaysia bhg bank simpanan nasional borneo housing mortgage finance bhd malaysia building society bhd or a bank of finance company licensed under bafia 1989. By applying these exemptions and reliefs ben s chargeable income will actually be like below. If interest is paid for a deposit which has not reached its maturity date the accrued interest is for the period for which the interest is paid.

The determination of the source of interest income is significant as only interest derived from malaysia is taxable in malaysia. Income from employment exercised in malaysia for short term visiting non resident employees other than public entertainers if the period of employment does not exceed 60 days in a calendar year. Most malaysians are familiar with tax reliefs which you can file as income that won t get taxed because you spent them on certain types of expenses. Real property gains tax rpgt exemption for malaysians for disposal of up to three properties from june 1 2020 to december 31 2021.