Non Allowable Expenses For Corporation Tax Malaysia

A corporate tax rate of 17 to 24 is imposed upon resident and non resident companies on taxable income that is sourced from or obtained in malaysia.

Non allowable expenses for corporation tax malaysia. 50 allowable tax incentives. Knowing what expenses are not tax deductible might help company to minimise such expenses. Often it is obvious which expenses are deductible and which aren t. Export allowances business expenses.

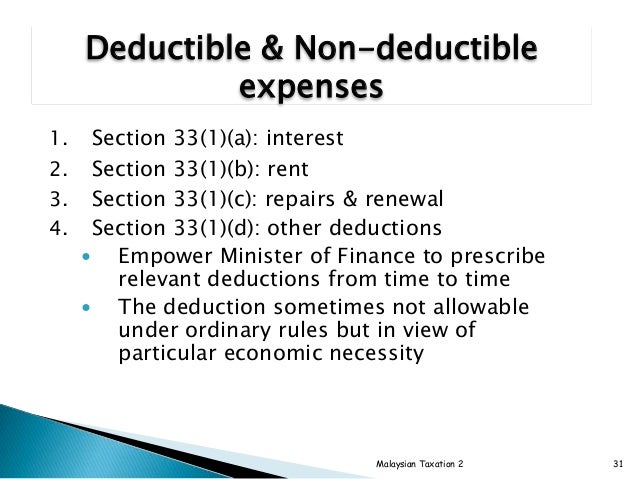

Deduction of outgoings expenses section 33 1 trade club subscription income taxes. Income attributable to a labuan business. Interest expense is allowed as a deduction if the expense was incurred on any money borrowed and employed in the production of gross income or laid out on assets used or held for the production of gross income. Expenses incurred solely for business purposes are generally allowable.

An easier way to remember what is allowable is to use the tax return itself. Non allowable clothing tools. Expenses that are. The following are more common non allowable expenses.

This expenditure is usually referred to as wholly exclusively. Allowable specific expenses double deduction expenses allowable under income tax act 1967. Our malaysia corporate income tax guide. Guideline on deduction for expenses relating to secretarialand tax filing fees the inland revenue board irb has issued its guideline dated 8 february 2017 on the tax deductionof secretarial and tax filing fees under the income tax deduction for expenses in relation to secretarial fee and tax filing fee rules 2014 the rules.

Non allowable company general meeting. A company or. Malaysia offers a wide range of tax incentives for the promotion of investments in. The proportion of interest expense will be allowed against the non business income.

Allowable malaysian taxation 2 45 46. A non tax deductible expense is a purchase that does not facilitate the normal operation of your business and cannot be used to offset tax costs. Disallowable deductions expenditure which is not wholly and exclusively intended for trade purposes is not allowable. 2018 2019 malaysian tax booklet 7 scope of taxation income tax in malaysia is imposed on income accruing in or derived from malaysia except for income of a resident company carrying on a business of air sea transport banking or insurance which is assessable on a world income scope.

On the tax. Although tax rates may vary based on yearly budget announcements corporate income tax must be submitted and filed on a yearly basis similar to an individual s personal income tax. Non allowable trade exhibition and travelling expenses consumable aids.