Exempt Private Company Malaysia Companies Act 2016

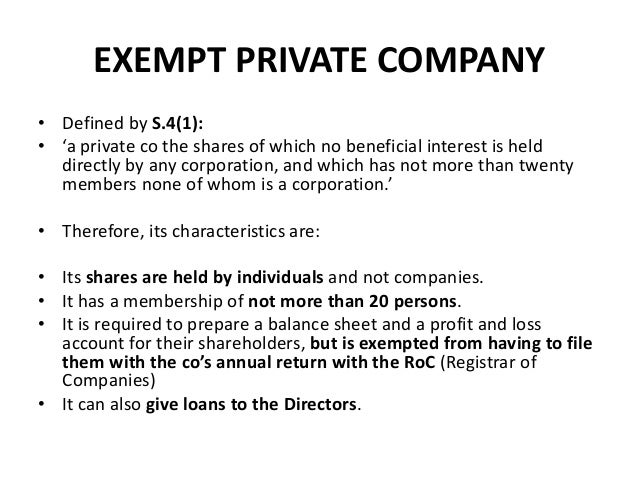

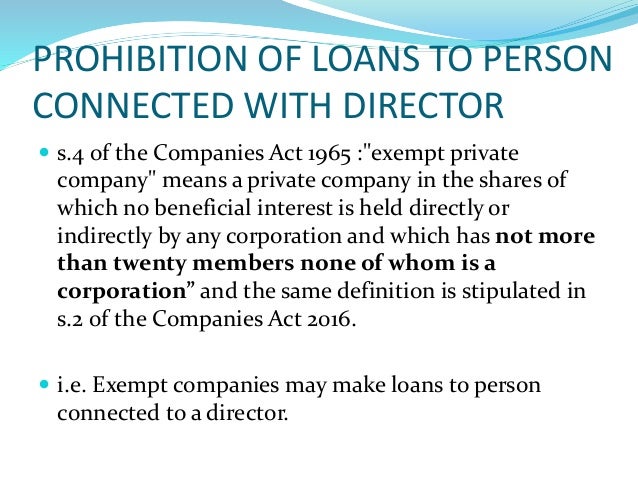

Where beneficial interest of shares in the company are not held directly or indirectly by any corporation ie.

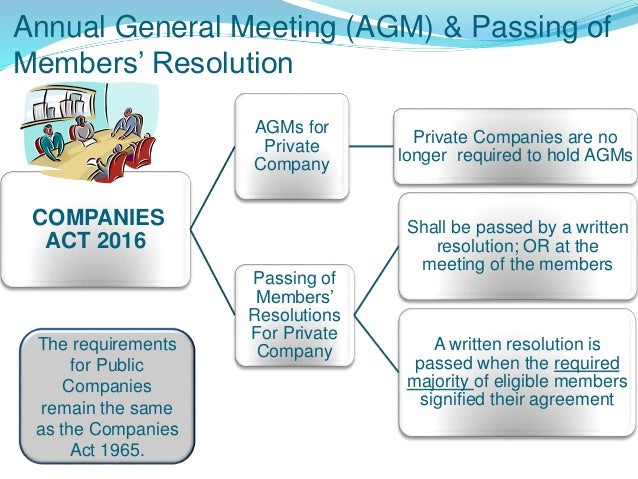

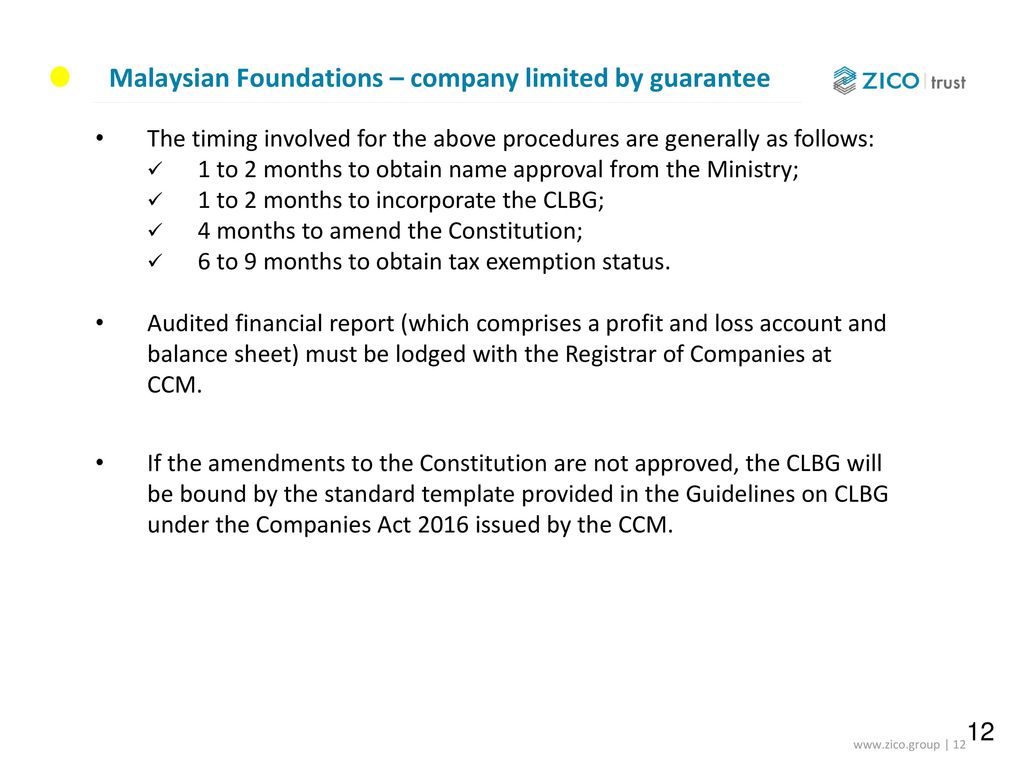

Exempt private company malaysia companies act 2016. An act to provide for the registration administration and dissolution of companies and corporations and to provide for related matters. 1 this act may be cited as the companies act 2016. Terms of office of a private company. In malaysia section 267 1 of the companies act 2016 mandates every private company to appoint an auditor for each financial year of the company for purposes of auditing its financial statements.

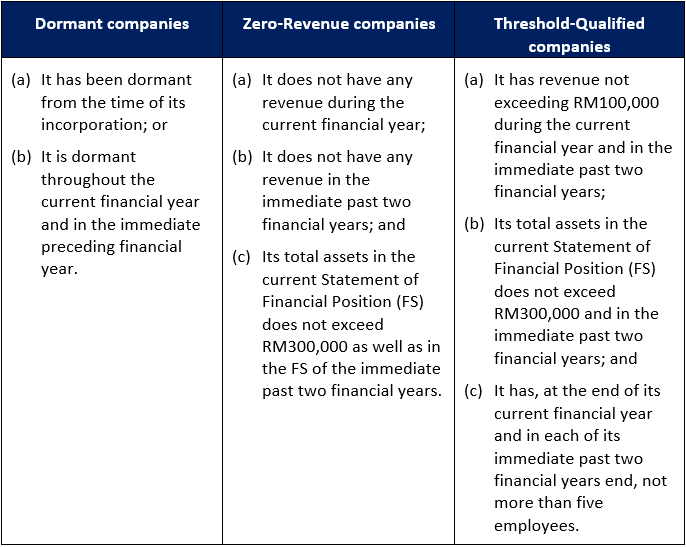

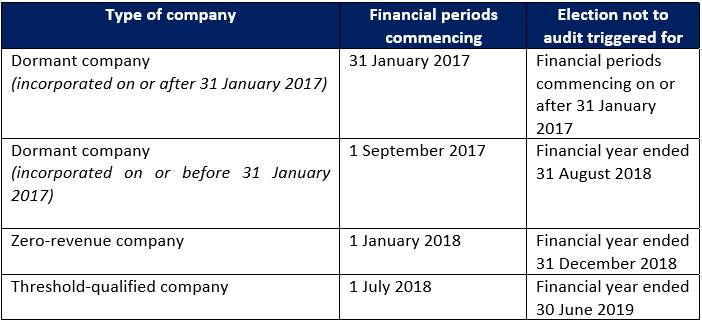

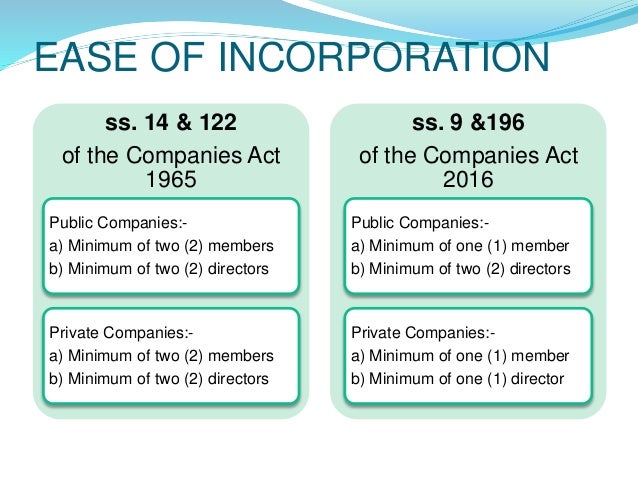

Law of malaysia. Issued pursuant to section 20c of the companies commission of malaysia act 2001 and subsection 267 2 of the companies act 2016 ca 2016 this practice directive rolls out the qualifying criteria for private companies from having to appoint an auditor in a financial year i e. This provision allows the incorporation of a company with only one member. As a starting point section 267 2 of the companies act 2016 allows the registrar of companies to exempt any private company from the requirement to appoint an auditor for each financial year.

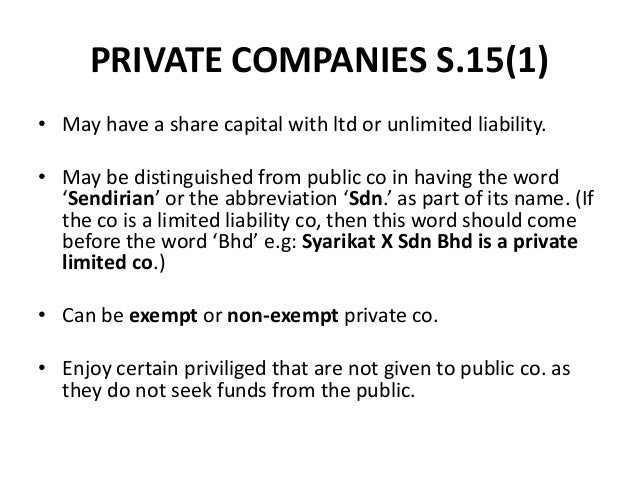

Enacted by the parliament of malaysia as follows. This practice directive sets out the qualifying criteria for. Which has not more than 20 members none of whom is a corporation. Now the companies commission of malaysia ccm has initiated a public consultation of subsidiary legislation under the companies act 2016.

Short title and commencement. Qualifying criteria for audit exemption for certain categories of private companies 1. Faqs on the companies act 2016 act 777 background to the review process and new malaysian companies act faqs on the companies amendment bill 2019 documents to be lodged with the registrar for execution by directors officers or members of a company under the companies act 2016. Section 9 b ca 2016 act stipulates that a company shall have one or more members.

The ca 2016 reformed almost all aspects of company law in malaysia. This practice directive is issued pursuant to section 20c of the companies commission of malaysia act 2001 and subsection 267 2 of the companies act 2016 ca 2016. Exempt private company in malaysia. This article will provide an overview of the ca 2016.

Notwithstanding this section 267 2 of the companies act 2016 empowers the registrar of companies to exempt any private company from auditing its financial statements. The companies act 2016 ca 2016 repealed the companies act 1965 ca 1965 and changed the landscape of company law in malaysia. The shares of an exempt private company should not be held and are not held directly or indirectly by any corporation. Based on the ca 2016 exempt private company means a private company.

The registrar has the power to exempt certain categories of private companies from having to appoint auditor. Appointment of auditors of a private company under the companies act 2016. Minimum number of members. An auditor ceases office thirty days from the circulation of the financial statements unless he is reappointed.