When Is Gst Payable On Sale Of Property In Malaysia

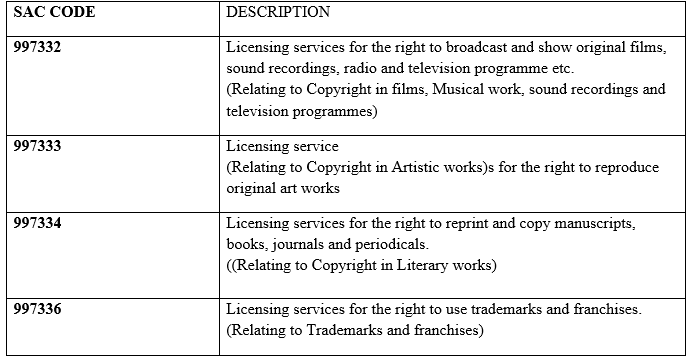

In malaysia the sale of commercial properties including land zoned for commercial purposes is usually subject to 6 gst.

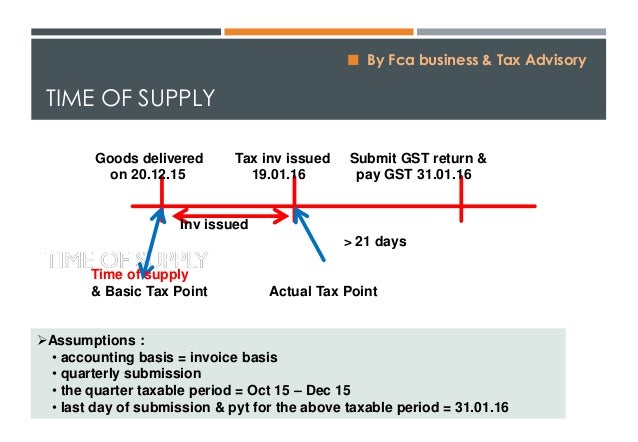

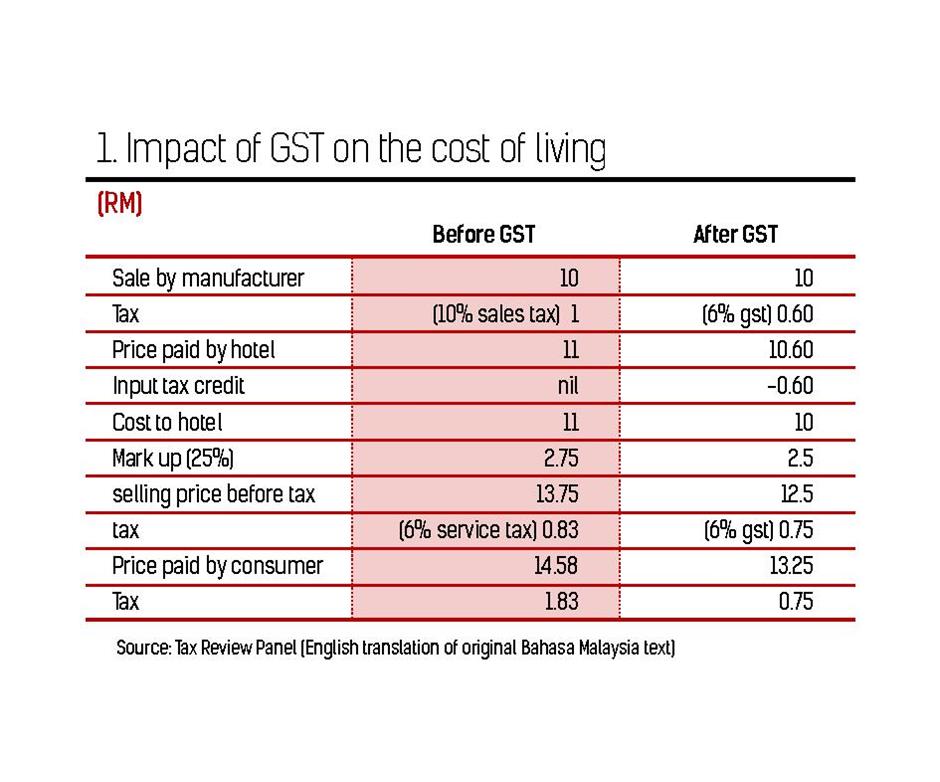

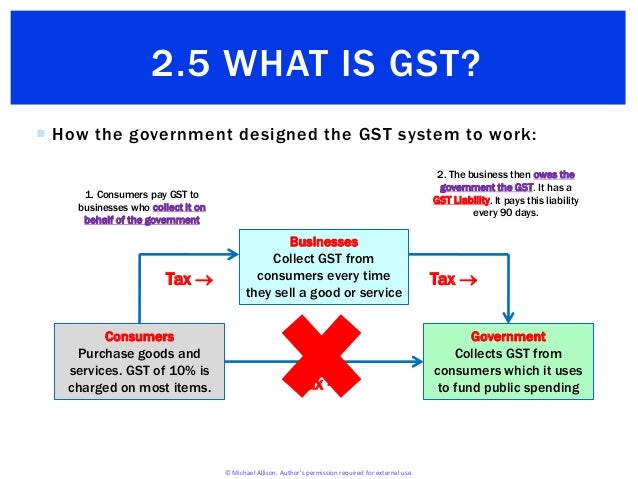

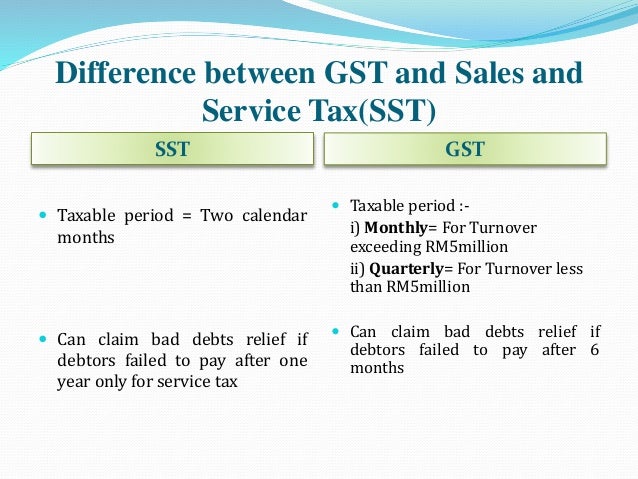

When is gst payable on sale of property in malaysia. He is allowed to claim back any gst incurred on his purchases input tax. Gst is generally payable on commercial property and the entity obtaining the real property may account for gst and recover the same through their business as an input tax credit. Recovery of expenses gifts and samples the issue of vouchers please refer to common scenarios do i charge deem claim gst. This means that the commercial property buyers or investors will pay gst to the gst registered seller on the purchase of commercial properties such as shops or retail lots factories warehouses hotels and offices.

While calculating the value of supply in case of sale of under construction property 1 3 rd of total amount charged for transfer is deducted to arrive at the taxable value of supply. A registered person is required to charge gst output tax on his taxable supply of goods and services made to his customers. Gst is a tax on the supply of most goods and services in new zealand. If you would like to know whether you need to charge gst or deem gst on other business transactions e g.

When the same property is leased out an additional 6 0 percent gst will be imposed on the tenant. Gst is charged at the prevailing rate of 7 gst registered businesses must charge gst on all sales of goods and services made in singapore. In malaysia a person who is registered under the goods and services tax act 2014 gsta is known as a registered person. As a result the investor s rental yield would decrease unless he can find tenants willing to pay a higher rent.

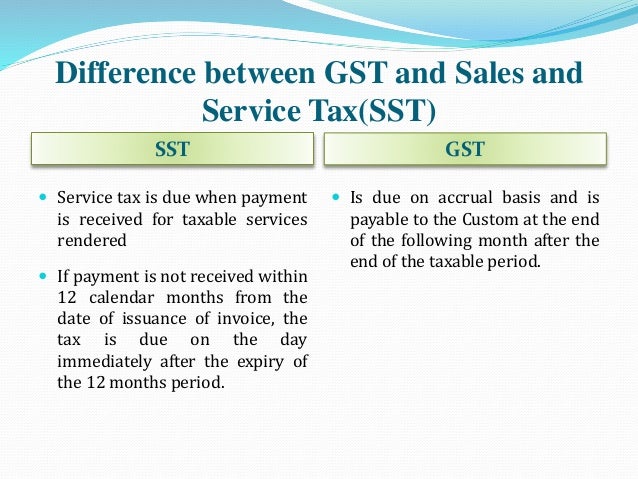

Many thought that private properties would fall outside of this category. Join kf cheong as he discusses the difference between service tax and gst on the real estate market in malaysia. 1 3 rd of the total amount is deemed as value of land or undivided share of land supplied to the buyer and is not taxable under gst. The gst registered seller is allowed to charge gst on the sale lease and rental of commercial properties.

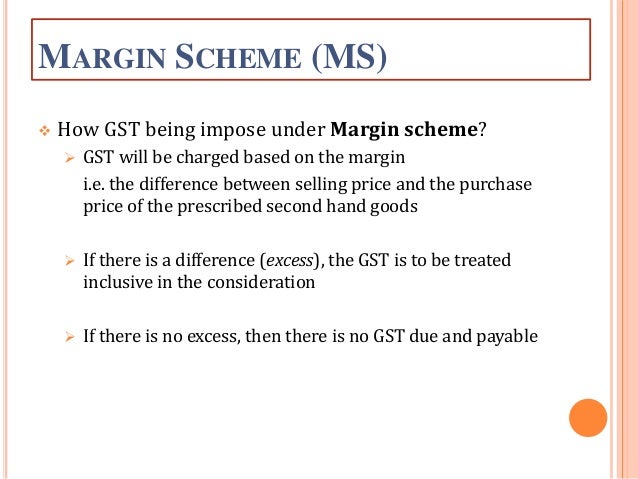

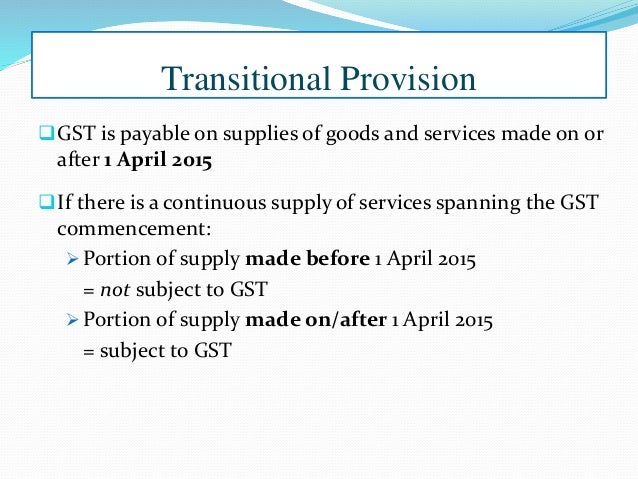

For instance a shop sold for rm3 million will be subject to gst of rm180 000 which will be borne by the buyer. The sale is part of their gst registered seller s business. In other words non commercial properties are not subject to the 6 gst. He will also be sharing on the margin scheme of gst for the real estate market covering on how gst will impact you as an agent as well as your buyers and investors with their property purchase or rental when gst kicks off on april 2015.

In many cases gst is not charged on the sale of a residential property but it can apply depending if the seller is gst registered and. Ii the sale was treated as input taxed but the gst group claimed input tax credits on the costs of constructing the development the contention was that the supply of real property between members of a gst group or a gst joint venture meant that the real property was not new residential premises within s 40 75 1 a as the property had previously been sold as residential premises and thereby.