What Wages Are Subject To Eis Contribution

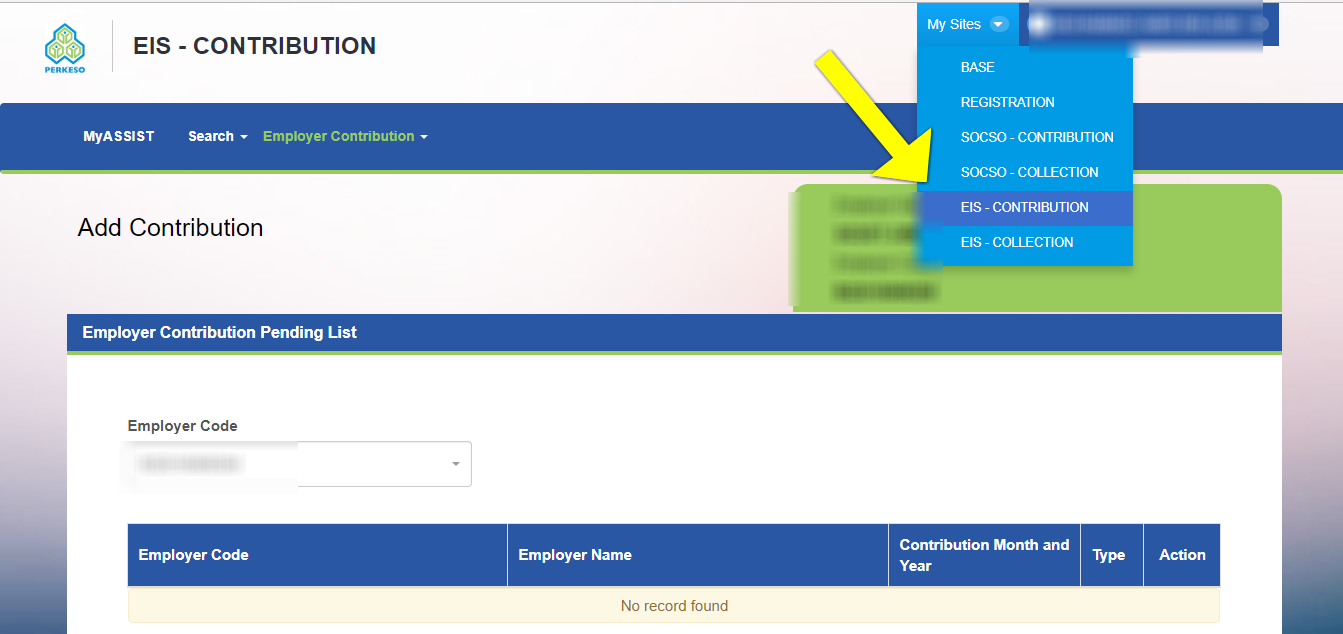

Registering as an employer and knowing your responsibilities.

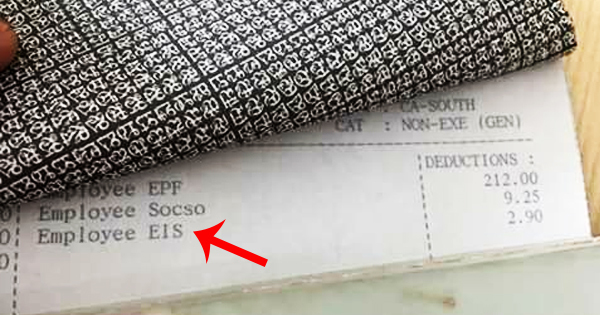

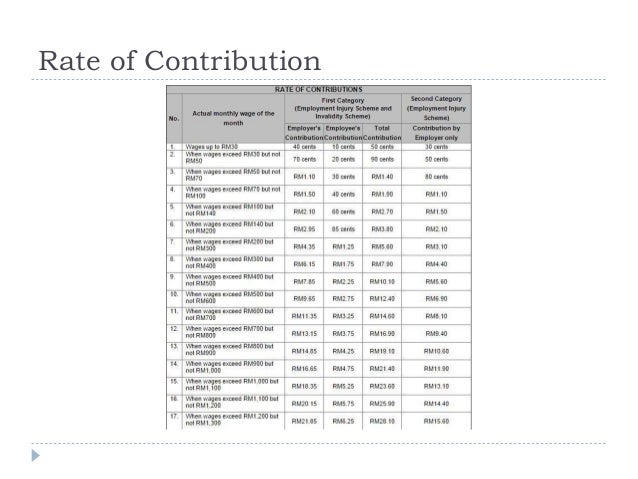

What wages are subject to eis contribution. The actual contribution amount follows section 18 second schedule of the employment insurance act 2017 not the exact 0 2 percent calculation. Payments subject to socso contribution wages for contribution purposes refers to all remuneration payable in money by an employer to an employee. Therefore the amount reflected on your payslip will not be exactly 0 2 percent of your salary wages gaji. Wages not subject to epf contribution.

Service charge any money or payment either in the form of a service charge a service fee a tip or other payments which has been paid by charged on. This system is introduced by the malaysian government to provide workers who lost their jobs with temporary financial assistance. Foreign worker levy fwl. Payment of contributions 21.

However the following payments are not considered as wages. Cpf contributions for your employees currently selected. An employee is defined as a person who is employed for wages under a contract of service or apprenticeship with an employer. Assessment of contributions arrears of contribution and interest in certain cases 23.

With the eis enforced starting from january 1 2018 employers are not allowed to reduce an employee s salary indirectly or directly owing to contributions made to the scheme. Any employers that do not comply with the scheme or make false claims could lead to a maximum rm10 000 fine or a jail term of up to two years or both upon conviction. Wages not subject to socso contribution. Government employees domestic workers and the self employed are exempted.

Which payments are subject to socso contribution and which are exempted. For example if an employee s gross monthly wages is rm2 900 but less than rm3 000 then the eis contribution would look like this employee contribution rm5 90 employer contribution rm5 90 total contribution rm11 80 it is noted that the contributions to eis is capped at a monthly salary level of rm4 000. Looking at the table above why is my eis contribution not exactly 0 2 of my wages salary gaji. Setting up a company.

Contributions where employee has more than one employer 20. Among the payments that are exempted from epf contribution. All payments made to an employee paid at an hourly rate daily rate weekly rate piece or task rate is considered as wages. Interest on arrears of contributions 22.

Employer not to reduce wages etc. Recovery of arrears of contributions and interest 24.