What Is Limited Liability Partnership In Malaysia

Who is it for.

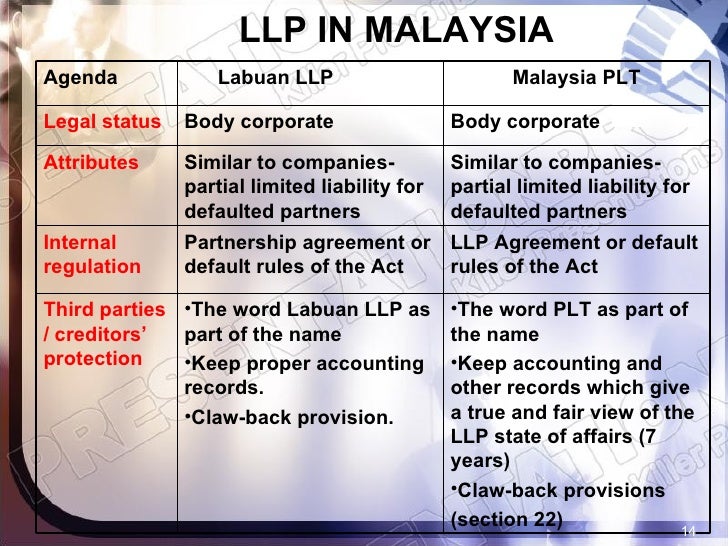

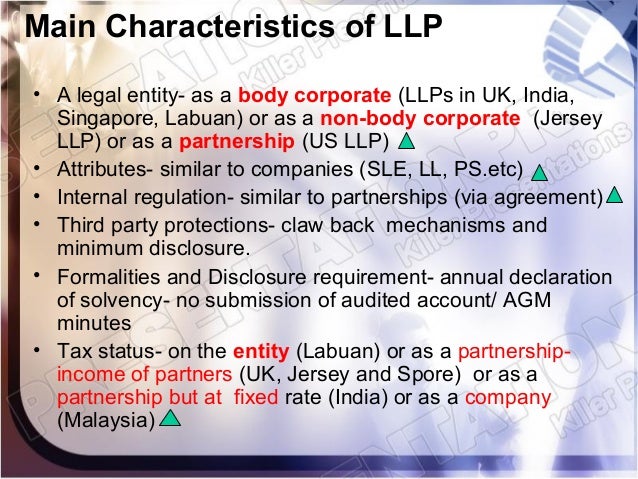

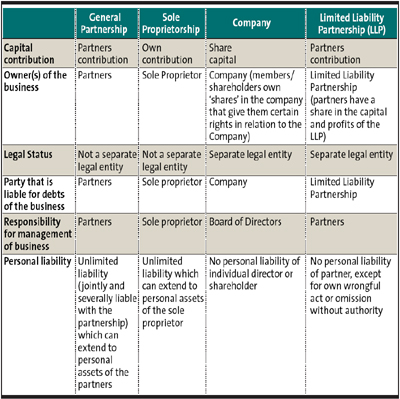

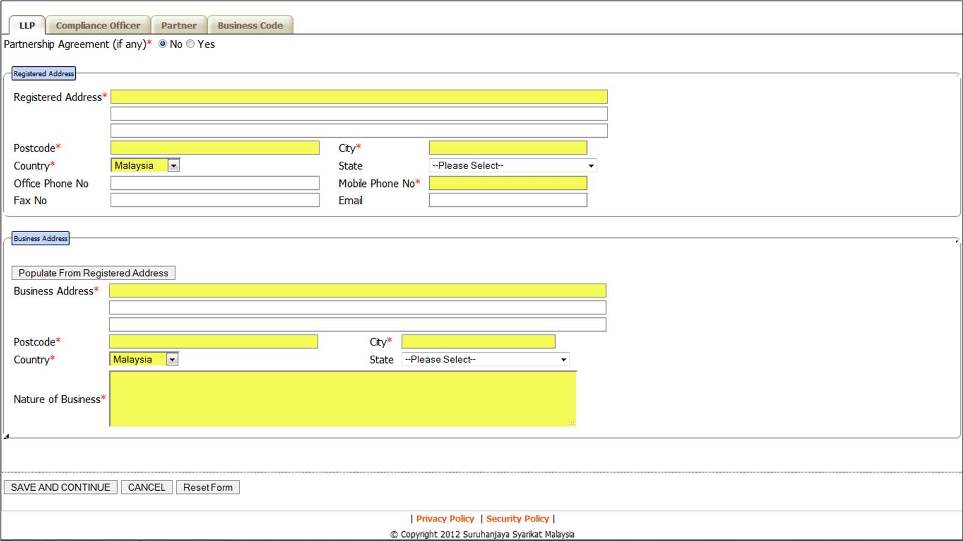

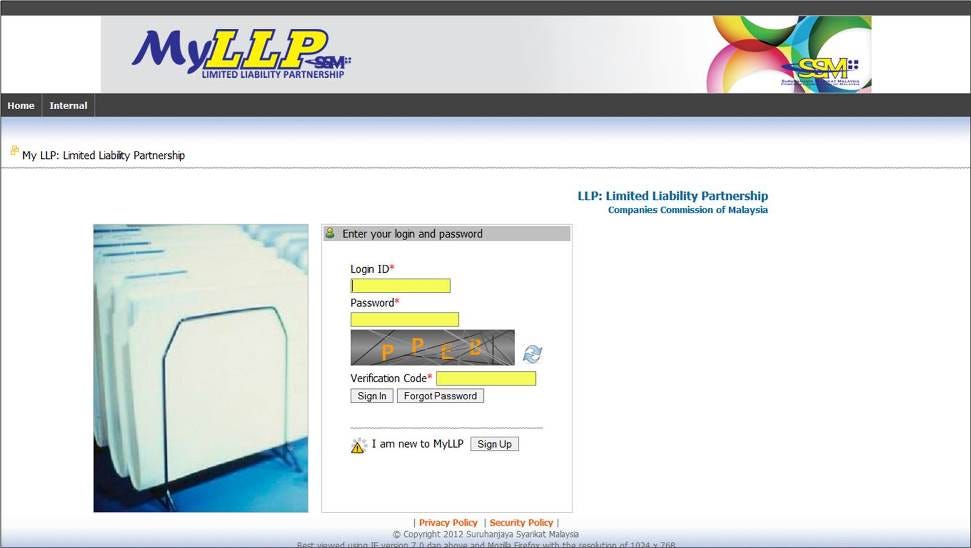

What is limited liability partnership in malaysia. A limited liability partnership contains features of both a limited liability company and a partnership. The llp business structure is designed for all lawful business purposes with a view to make profit. Limited liability partnership llp is an alternative business vehicle regulated under the limited liability partnerships act 2012 which combines the characteristics of a company and a conventional partnership. And then the most important point of all.

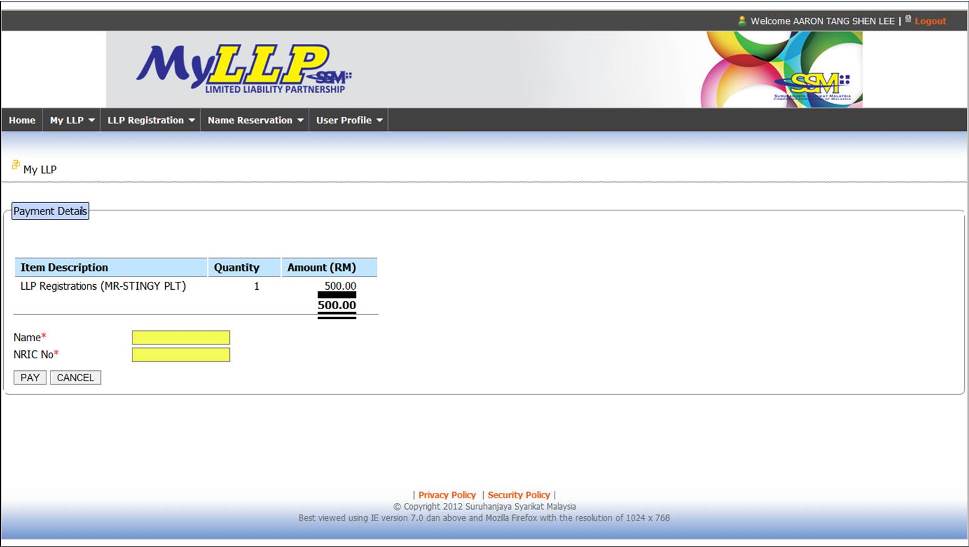

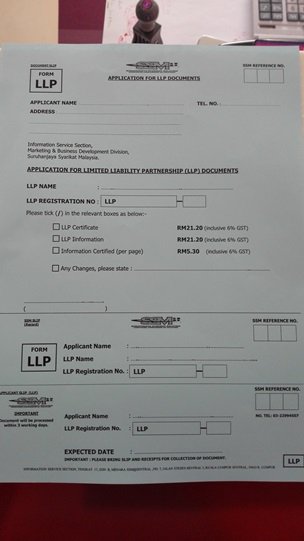

Limited liability partnership llp faq in malaysia this page provides a list of the questions most frequently asked by our customers in relation to the set up of limited liability partnership llp in malaysia. Limited liability partnership plt is governed by companies commission of malaysia suruhanjaya syarikat malaysia and limited liability partnership act 2012. It is certainly a viable option for those planning to start a business in malaysia. Meaning even if the llp is sued and goes bankrupt one day creditors cannotcome after your personal assets.

These special incentives are only given exclusively to a company. Limited liability partnership llp is a business structure which is governed under the limited liability partnerships or llp act 2012 in malaysia. This type of company has both the characteristics of a limited liability company and a traditional partnership business. Limited liability partnership plt registration is an alternative business vehicle under limited liability partnerships act 2012 which combined the characteristic of a company and a conventional partnership.

Who is it for. Llp is an alternative form of business entity that combines protection of limited liabilities to its members whilst offering a degree of flexibility in a partnership arrangement for the internal management of the business. Limited liability partnership plt is governed by companies commission of malaysia suruhanjaya syarikat malaysia and limited liability partnerships act 2012. In general specific incentives provided to a company does not apply to an llp.

Under the income tax act 1967 llp means a limited liability partnership registered under the limited liability partnerships act 2012 different from company. One of the business entities which may be set up in malaysia is the limited liability partnership. But in a conventional sole proprietorship or partnership they can and they will. Limited liability partnership plt registration is an alternative business vehicle under limited liability partnership act 2012 which combined the characteristic of a company and a conventional partnership.