What Is Limited Liability Partnership Firm

It s a structure most commonly used by professionals such as doctors attorneys and accountants who go into practice together.

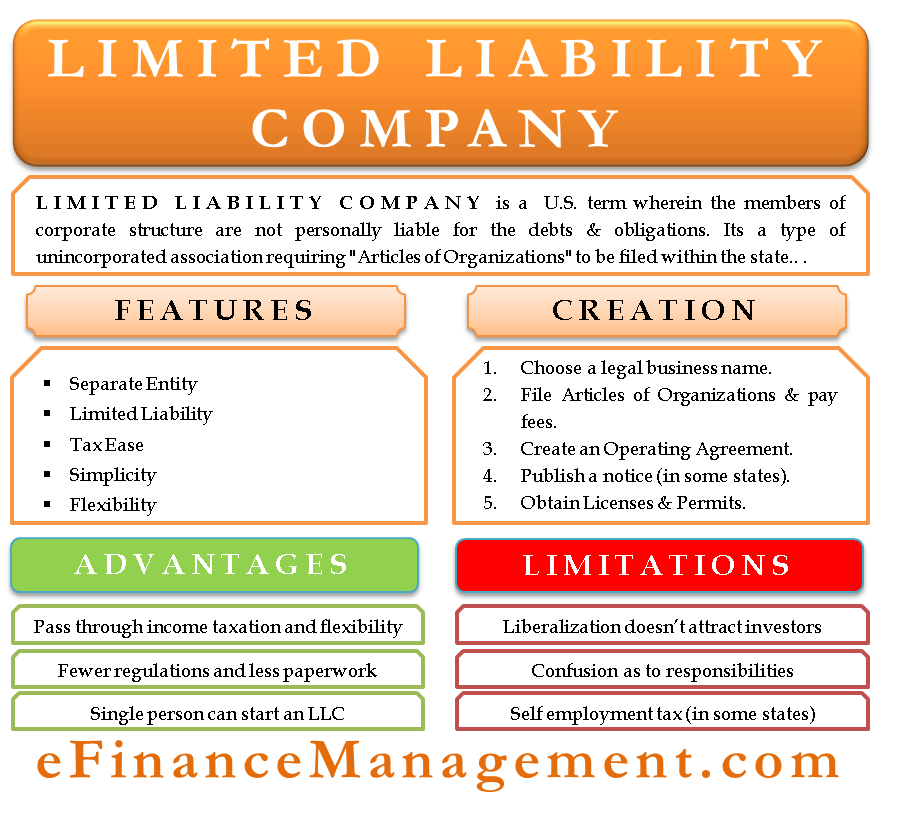

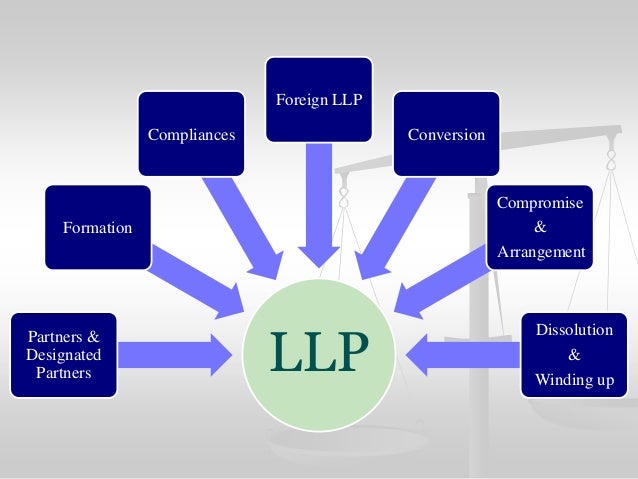

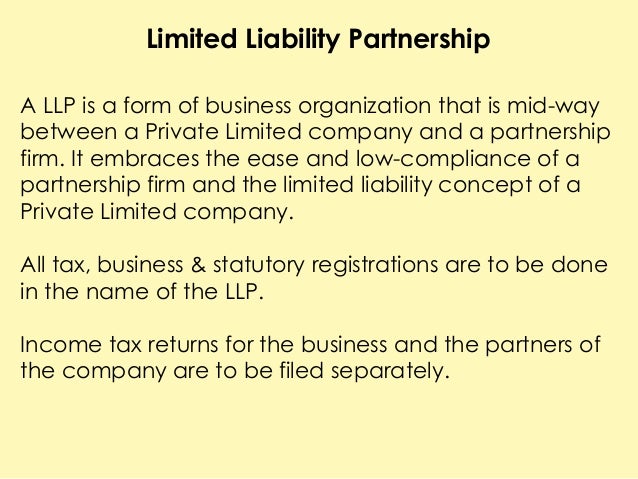

What is limited liability partnership firm. For organising their internal composition and operation as a partnership. Llp is a business vehicle that integrates the advantages of limited liability of a company and the flexibility of the partnership i e. A limited liability partnership llp is a business structure that provides some liability protection for its owners along with some potential tax breaks and other advantages. Background for conversion of partnership firm into llp a firm may convert into a limited liability partnership in accordance with the provisions of section 55 of llp act 2008 read with second schedule.

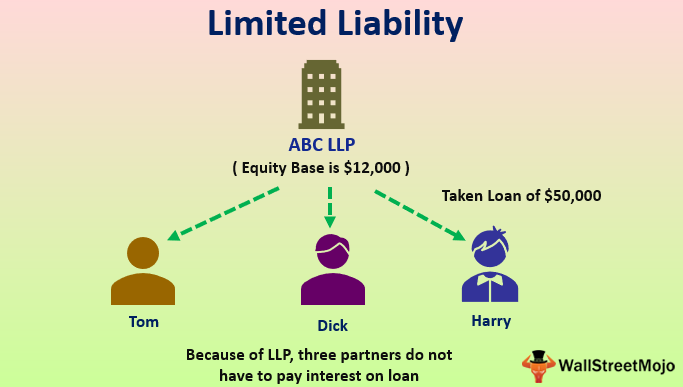

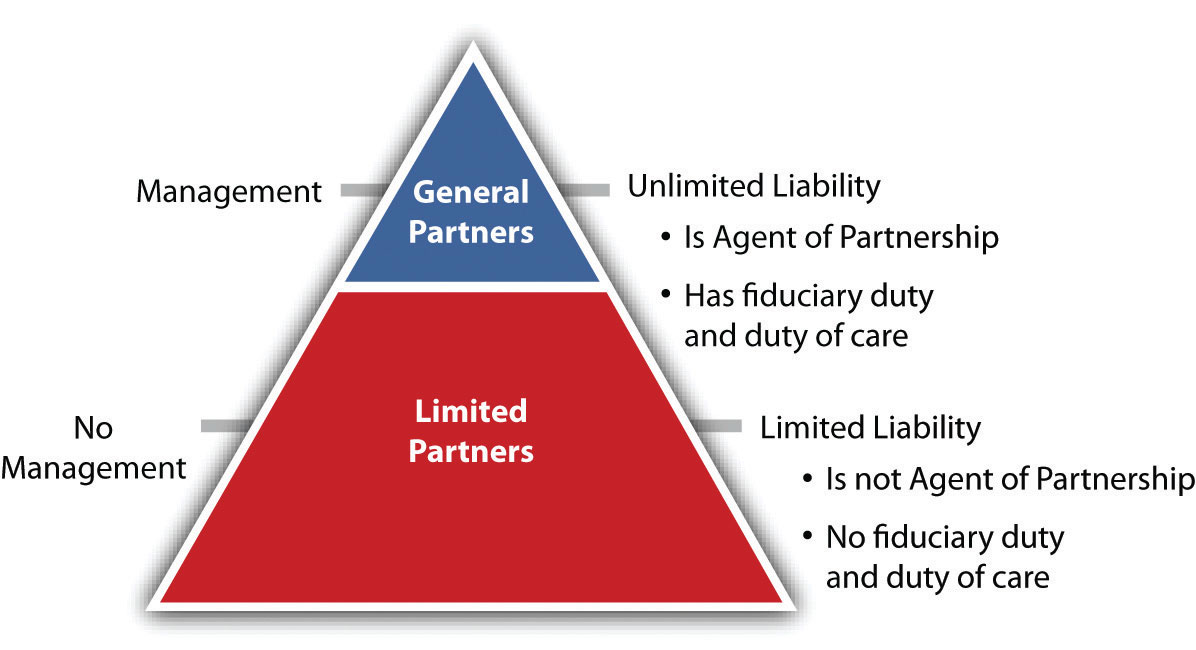

Limited liability partnerships llps are a flexible legal and tax entity that allows partners to benefit from economies of scale while also reducing their liability. Definition of limited liability partnership llp limited liability partnership llp is an incorporated partnership formed and registered under the limited liability partnership act 2008 the act with limited liability and perpetual succession. A typical partnership form of the business suffers from the problem of unlimited liability. Like in a common partnership all individuals identified in an llp can take part in the administration of the partnership.

Liabilities of partners of a firm extend right up to their personal assets this makes regular partnerships undesirable for a lot of entrepreneurs one solution for this issue exists in the form of limited liability partnerships better known as llp. Partnership firms are at a disadvantage when compared to the newly introduced limited liability partnership llp as they do not provide limited liability protection for. Therefore conversion of partnership firm into limited liability partnership is a good business decision to secure the partners rights and limit their liabilities. Llp is a separate legal entity and distinct from the individual partners.

Limited liability partnership shortly known as llp is described as a body corporate created and registered under limited liability partnership act 2008. Liability of each partner is limited to his share as mentioned in the agreement compared to regular partnership firms which have unlimited liability. A limited liability partnership llp is a partnership in which some or all partners depending on the jurisdiction have limited liabilities it therefore can exhibit elements of partnerships and corporations in an llp each partner is not responsible or liable for another partner s misconduct or negligence. Apply for din.

It has a low formation cost and is easy to set up. Process of conversion of partnership firm into limited liability partnership. This is an important difference from the traditional partnership under the uk.

/limited-liability-company-on-the-sticky-notes-with-bokeh-background-1158519140-44f25af400984f9a9433816c92076223.jpg)

/limited-liability-company-on-the-sticky-notes-with-bokeh-background-1158519140-44f25af400984f9a9433816c92076223.jpg)