What Is Limited Liability Partnership Company

Limited liability companies allow you to enjoy the liability protections of a corporation with many of the structural and tax.

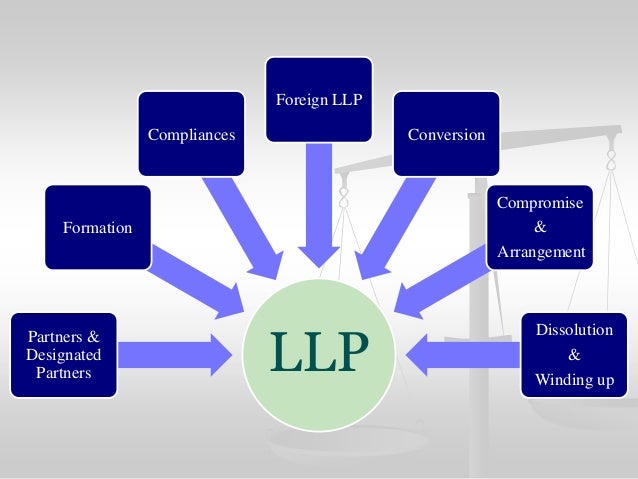

What is limited liability partnership company. Limited liability partnership llp is an alternative business vehicle regulated under the limited liability partnerships act 2012 which combines the characteristics of a company and a conventional partnership. It s a structure most commonly used by professionals such as doctors attorneys and accountants who go into practice together. A limited liability partnership is one of the available legal structures that you can use to set up and run a business in the uk. More uniform partnership act upa.

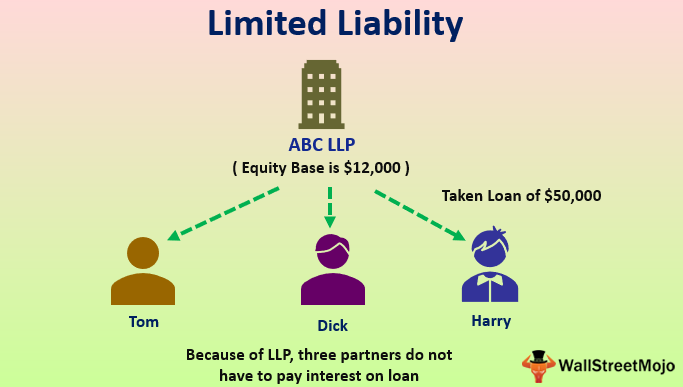

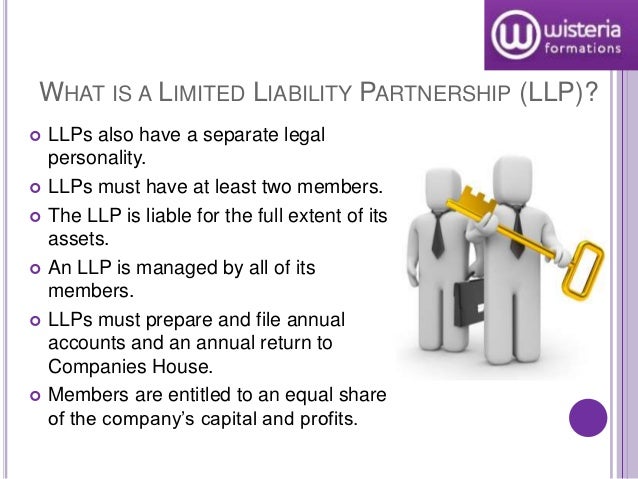

It is a legal form of a company that provides limited liability to its owners in many jurisdictions. Often referred to as an llp a limited liability partnership is simply a business partnership that is owned by two or more members a k a. Limited liability is a type of liability that does not exceed the amount invested in a partnership or limited liability company. In simple terms an llp has the organisational and tax flexibility of a partnership but in.

It is a popular business structure in professional occupations such as accountancy and legal industries. This is an important difference from the traditional partnership under the uk. Limited liability partnership vs. Partners who have limited liability for the llp s debts.

An llc is not a corporation under state law. A partnership business is a type of business that is formed by two or more people coming together to start up a profit making business whereas a limited liability company is a corporate structure that is a separate legal entity from its owners. A limited liability company is a corporate structure in the united states wherein the company members are not personally liable for the company s debts or liabilities. An llp provides its members with limited liability like a limited company but they are taxed in a similar way to self employed partners.

/limited-liability-company-on-the-sticky-notes-with-bokeh-background-1158519140-44f25af400984f9a9433816c92076223.jpg)

.jpg?sfvrsn=2)