What Is Form 49b

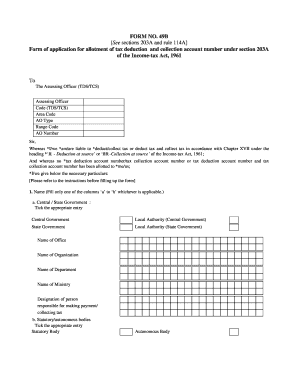

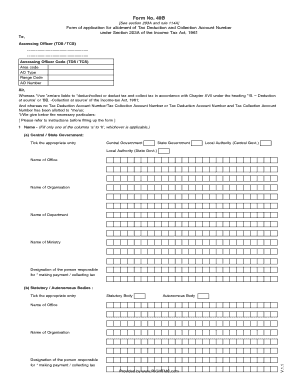

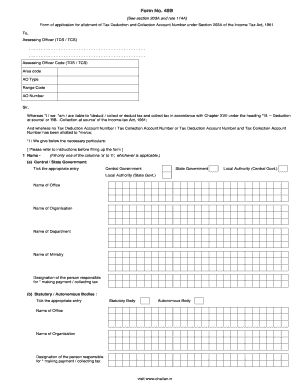

49b see sections 203a and rule 114a form of application for allotment of tax deduction and collection account number under section 203a of the income tax act 1961 to the assessing officer tds tcs assessing officer code tds tcs area code ao type range code ao number sir.

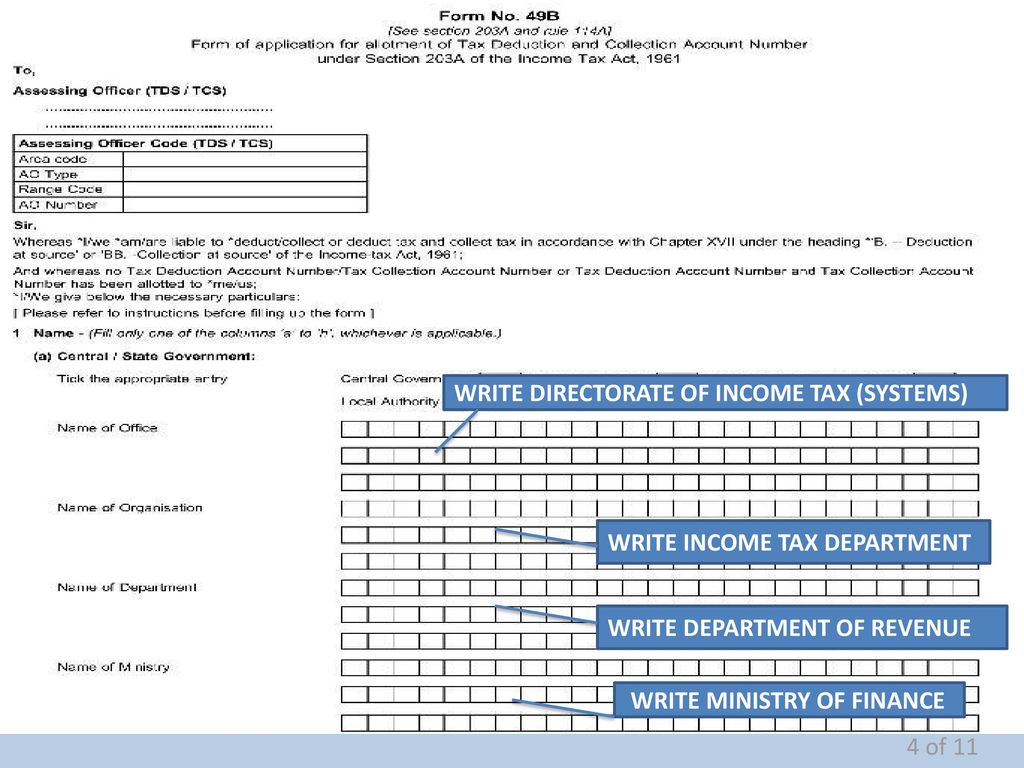

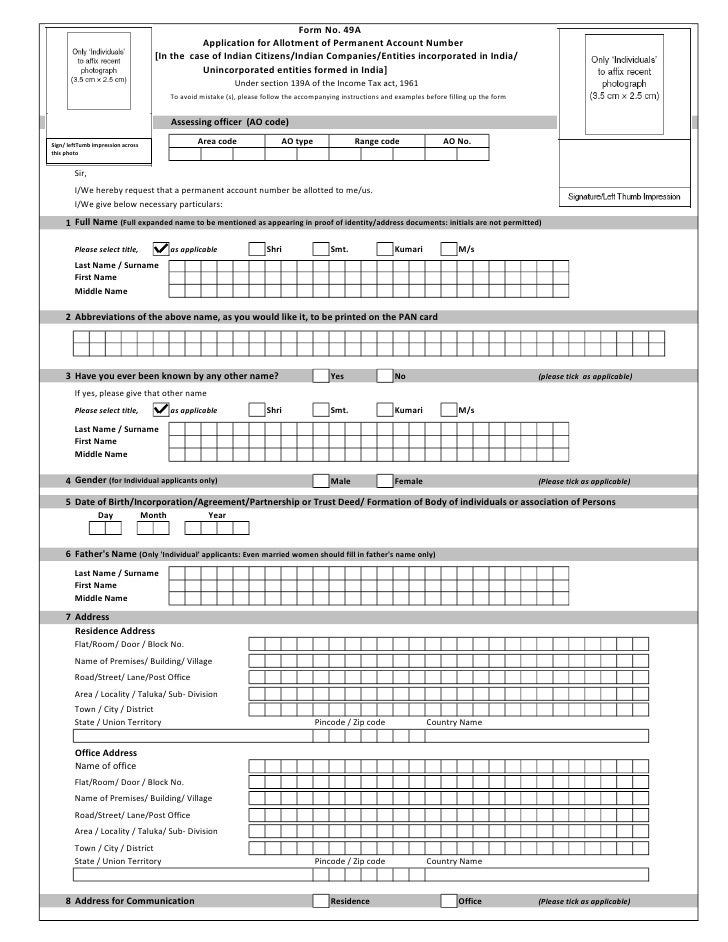

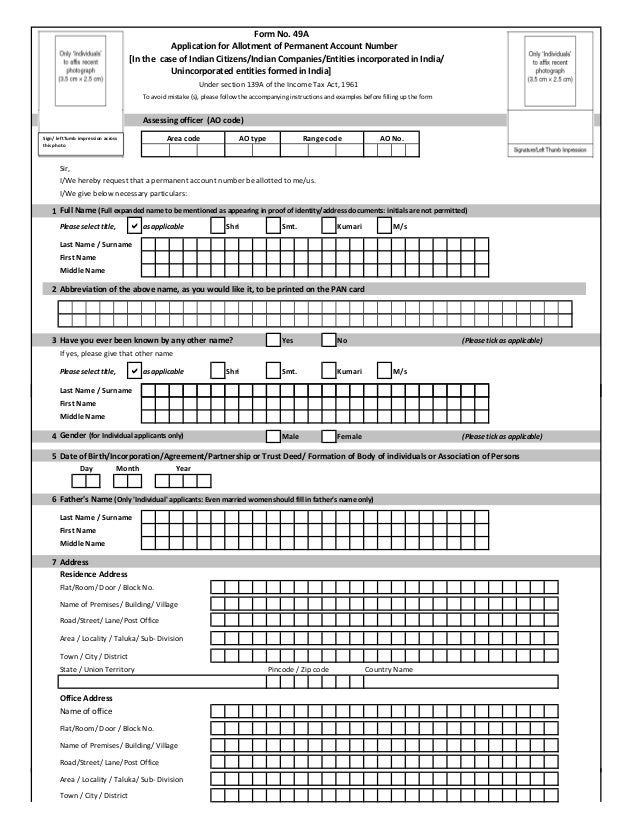

What is form 49b. E deductor collector will receive an acknowledgment containing a 14 digit unique number from the tin fc on submission of form no. Listed below are the contents of the form that need to be filled and submitted. 49b is the form of application for allotment of tax deduction and collection account number under section 203a of the income tax act 1961. Form 49b is an application form under section 203a of the income tax act 1961 for the assignment of tan number or tan deduction and payment account number.

Form 49b is a form for application for tan number or collection and deduction account number under section 203a of the income tax act 1961. Form 49b is an application form for allotment of tan number or tax deduction and collection account number under section 203a of the income tax act 1961. Up form for changes for correction in tan data for tan allotted and submit the same at any tin facilitation centre. Form 49b is a long application form consisting of various types of information.

B if there are any errors rectify them and re submit the form. C a confirmation screen with all the data filled by the applicant will be displayed. Contents of form 49b. Tan registration would be required for all persons required to deduct tds on transactions.

However for online application the acknowledgement received after submitting form 49b is to be saved and sent to the income tax department as proof. This acknowledgment number can be used by the deductor collector for tracking the status of its application. D the applicant may either edit or confirm the same.