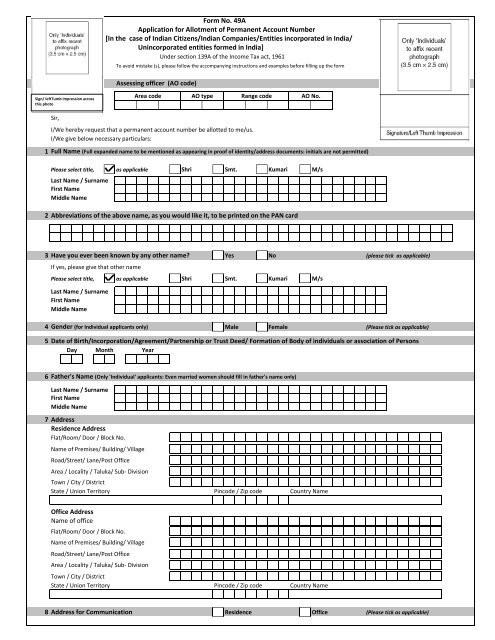

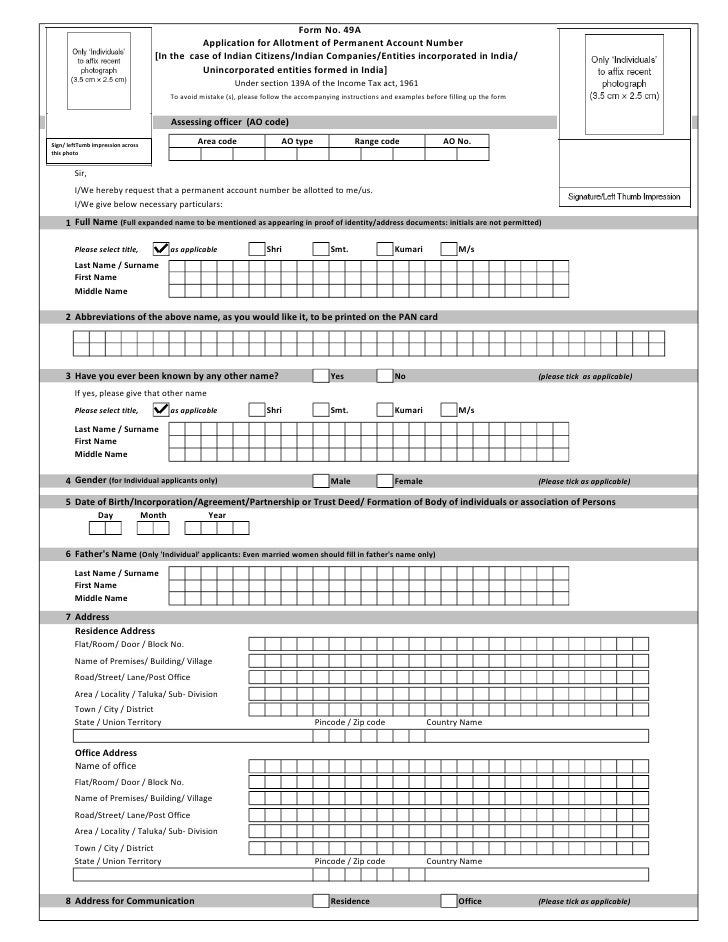

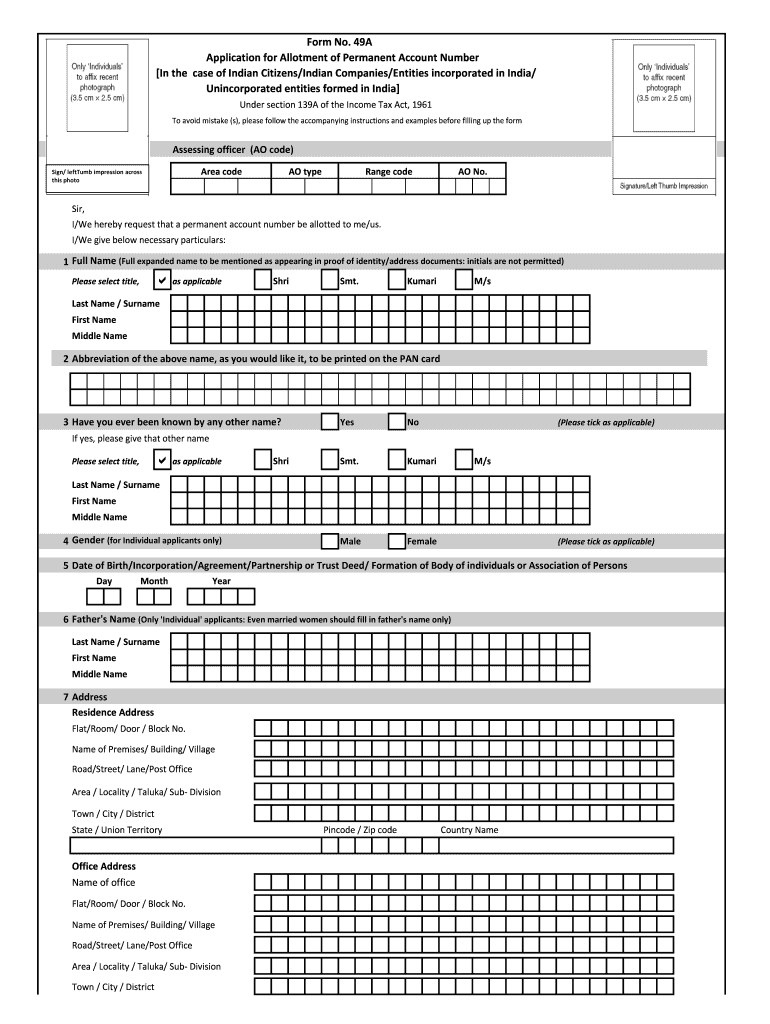

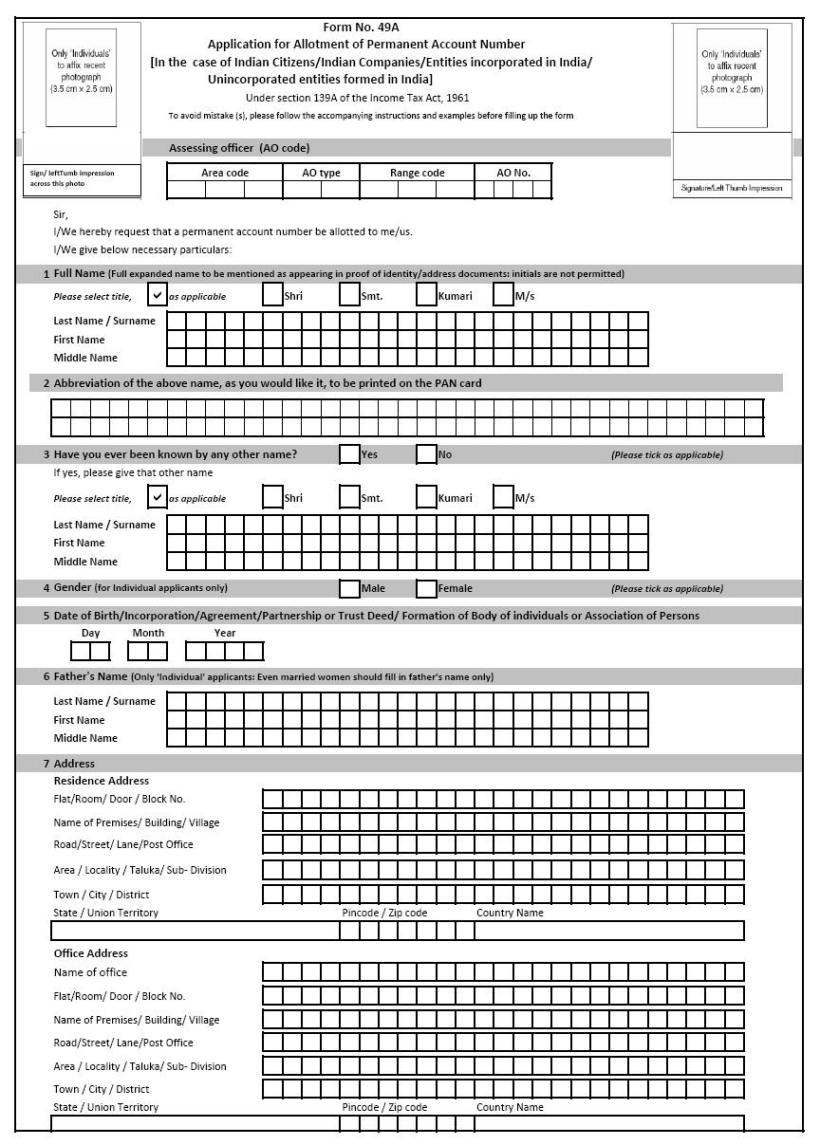

What Is Form 49a

One can download the application form online from nsdl e governance official website or utiitsl website.

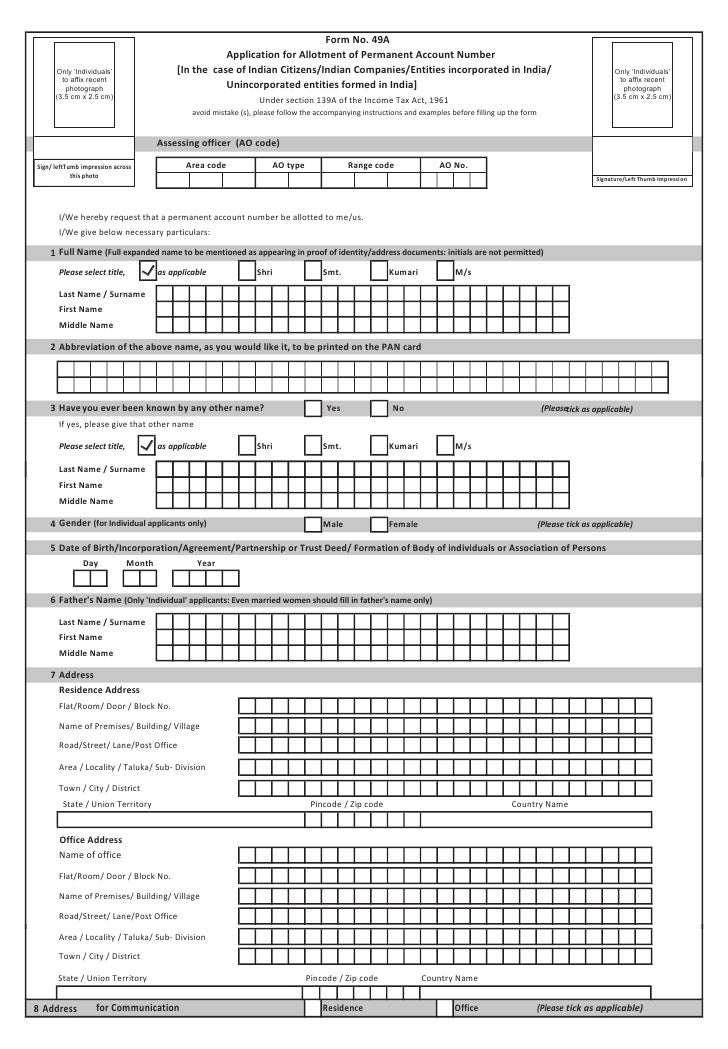

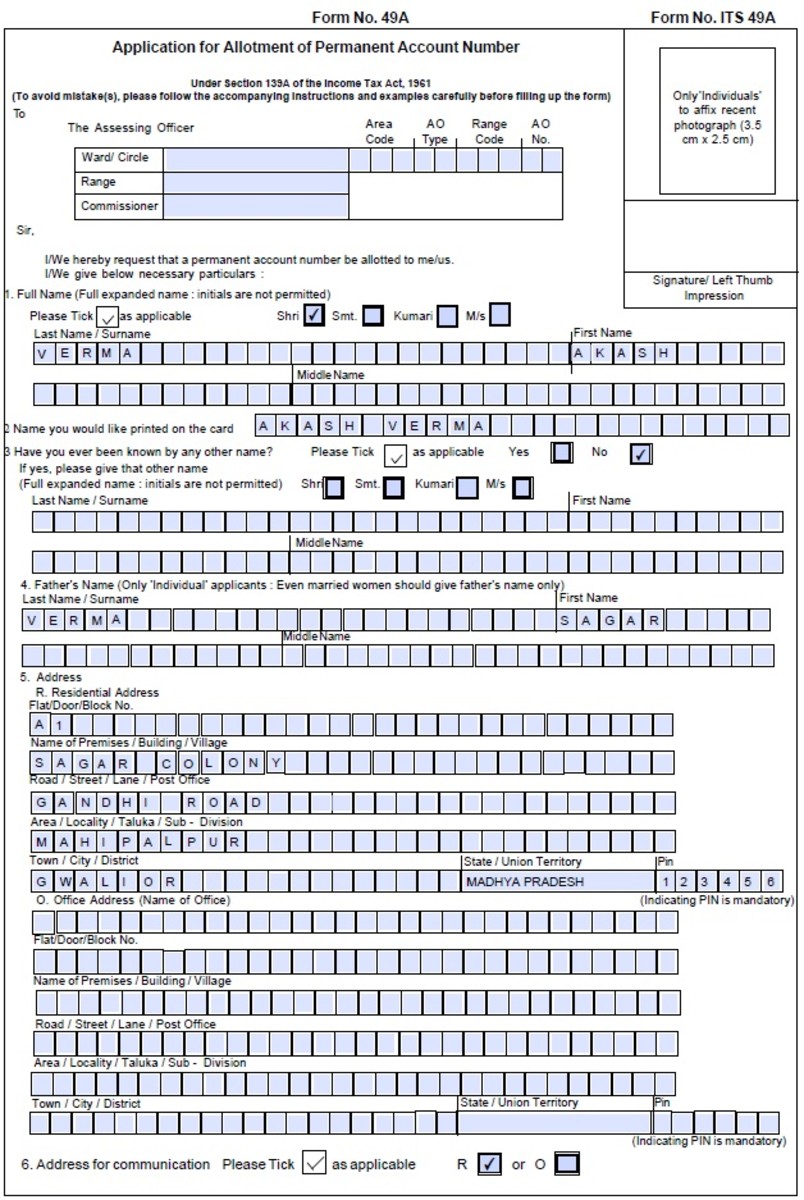

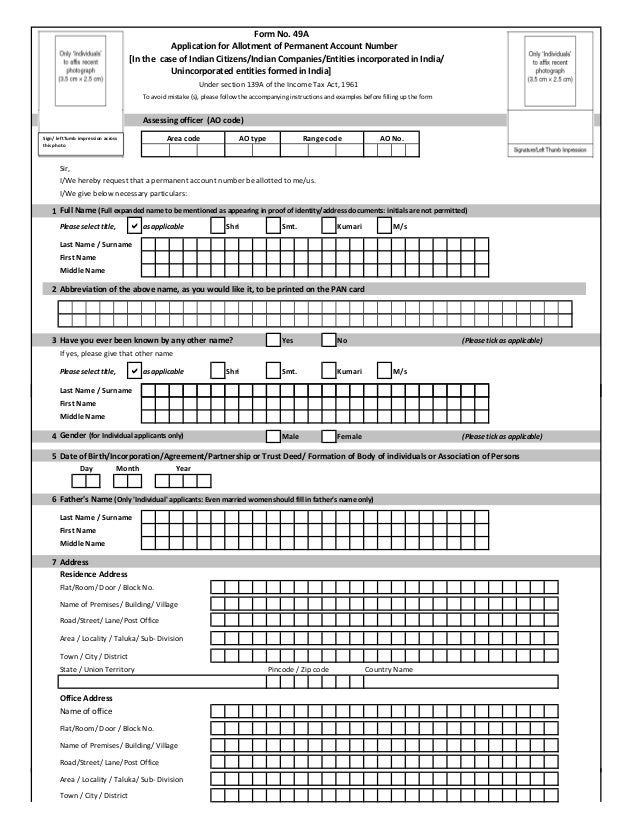

What is form 49a. Know all about pan card form 49a. Form 49a is the application form for the allotment of permanent account number for indian residents. Any individual who is a resident of india and wishes to apply for pan should compulsorily fill the form 49a as it is the application form. Any individual who is a resident of india and wishes to apply for pan should compulsorily fill the form 49a as it is the application form.

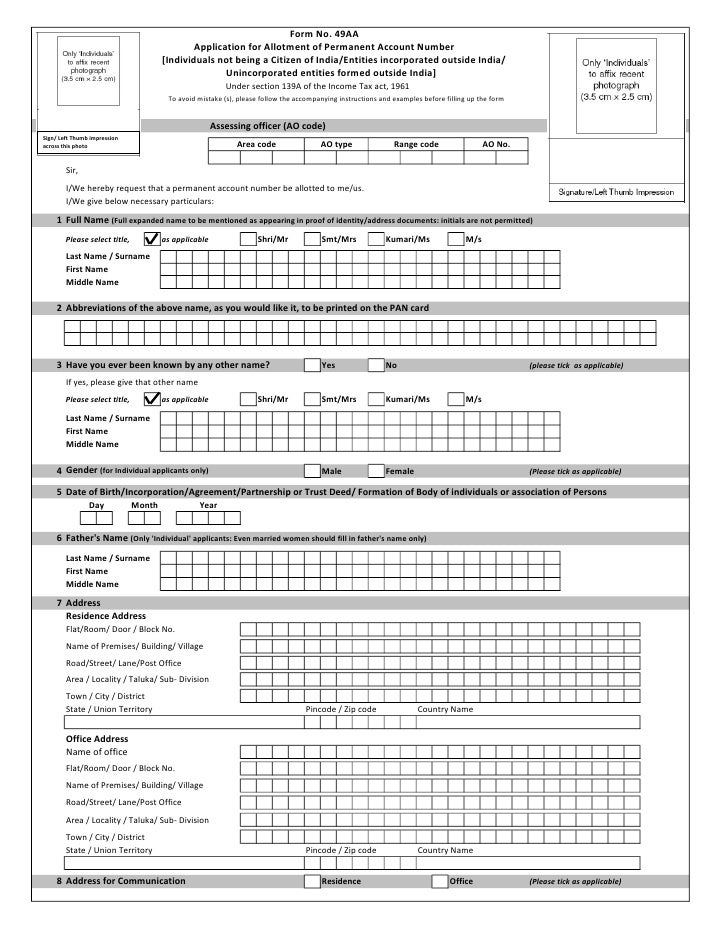

To avoid mistake s please follow the accompanying instructions and examples before filling up the form. Application for allotment of permanent account number in the case of indian citizens lndian companies entities incorporated in india unincorporated entities formed in india see rule 114. Those who are applying for pan card must know what pan card form 49a is. Learn how to fill the from 49a both online and offline by visiting our article today.

Rule 114 of the income tax rules 1962. This form is mandatory for obtaining the 10 digit permanent account number pan. Form is available both offline and online. Pan form 49 a is designed for the use of indian citizens entities incorporated in india unincorporated entities formed in india and indian companies.

Form 49a is the application form for the allotment of permanent account number for indian residents. In case if anyone wants to apply for a pan card it is compulsory to fill form 49a first as it is the application form. Form 49a is an application for allotment of permanent account number in case of indian citizen indian companies entities incorporated in india unincorporated entities formed in india. Income tax department issues pan card form.