What Is Capital Allowances Ato

It can only be carried out by a qualified and professional quantity surveyor that is registered as a tax agent with the australian taxation practitioners board.

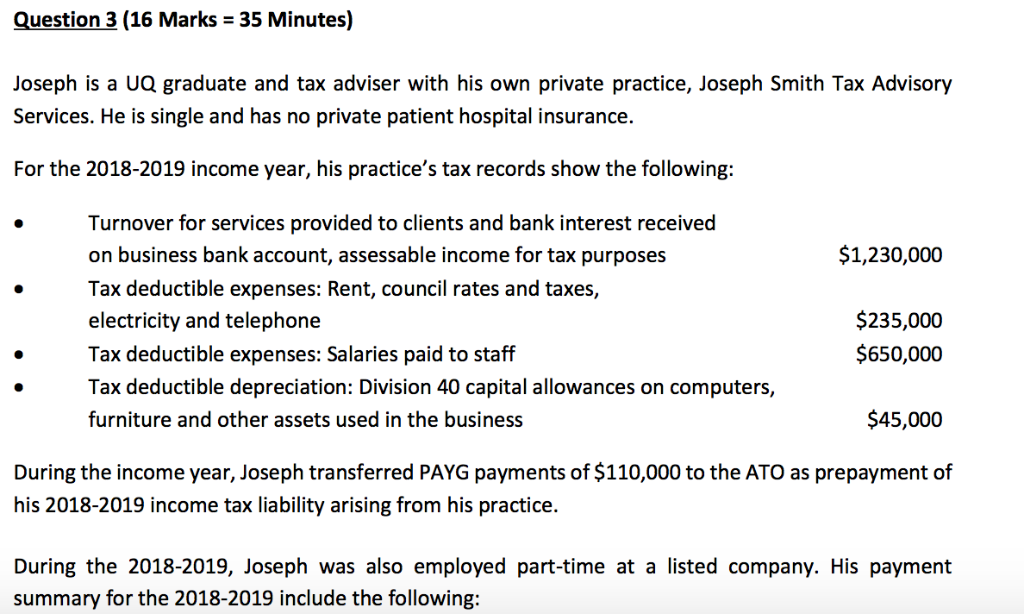

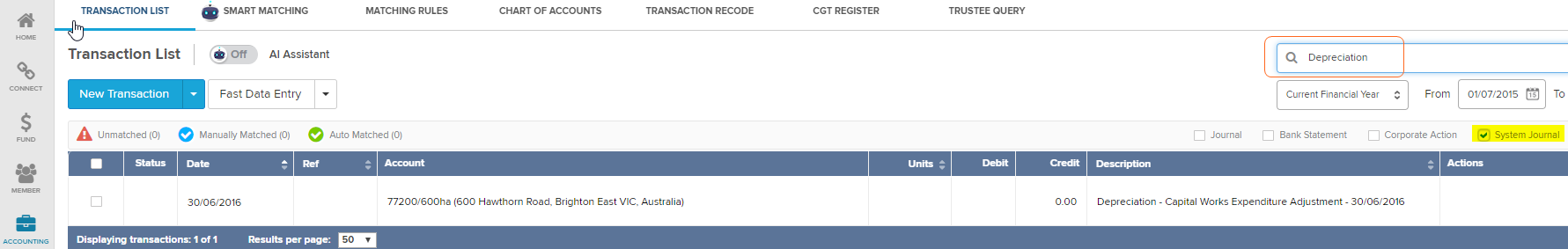

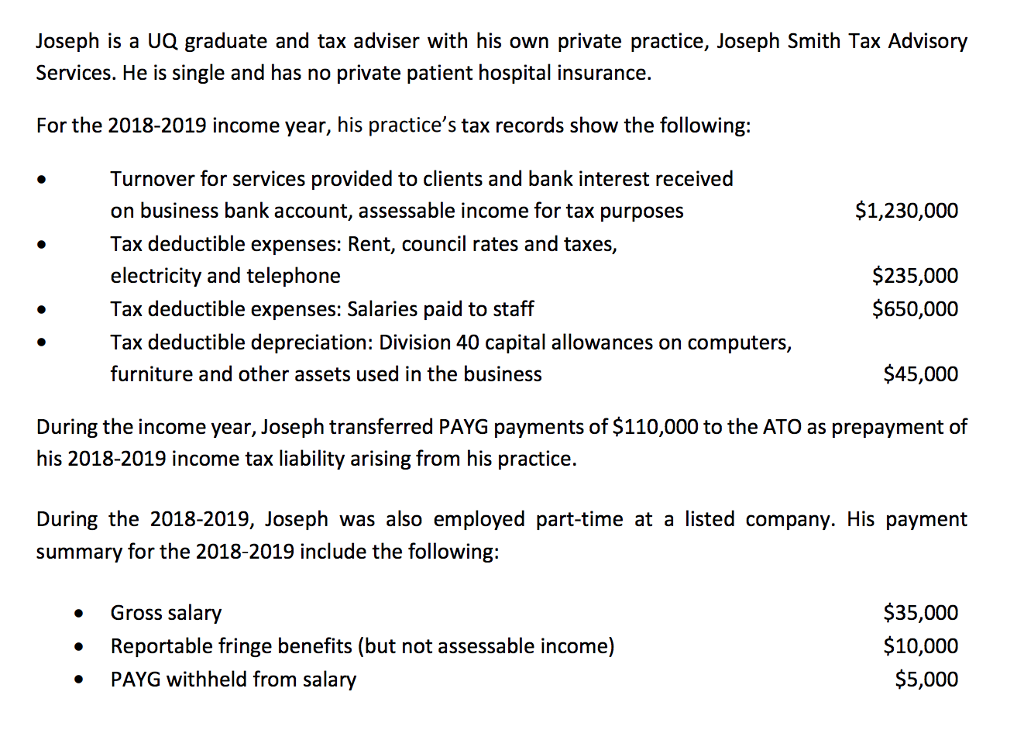

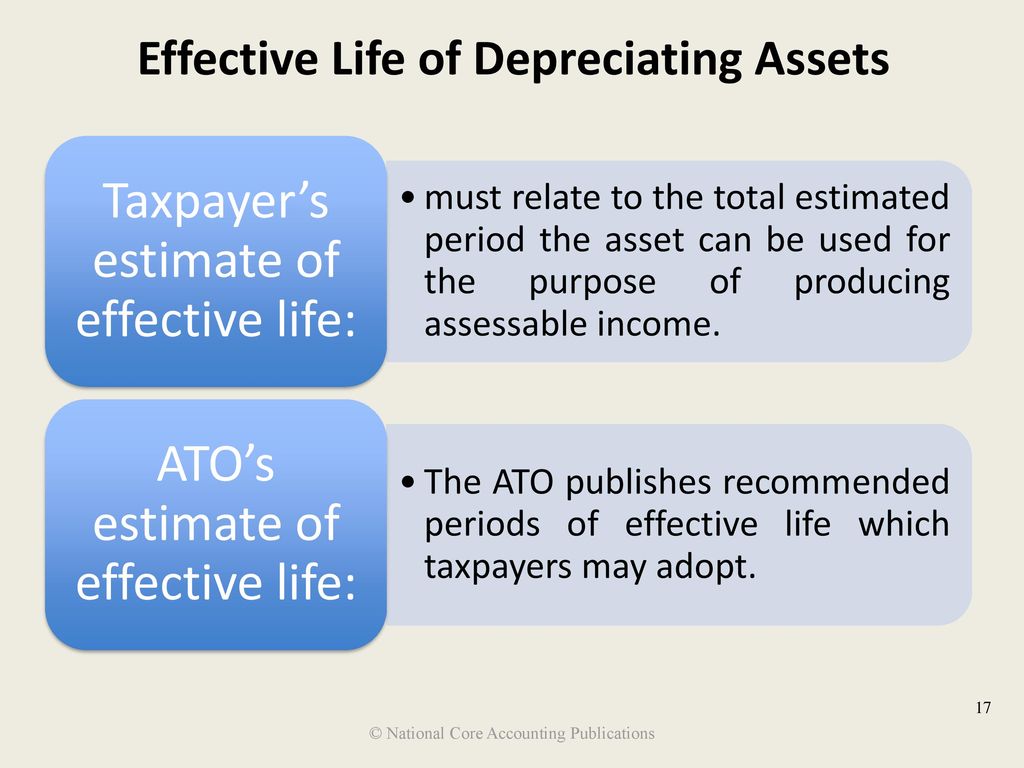

What is capital allowances ato. Ato community is here to help make tax and super easier. General depreciation rules capital allowances. The general depreciation rules set the amounts capital allowances that can be claimed based on the asset s effective life. Items costing up to 100 used to earn business income but note the higher immediate write off limit for small businesses below.

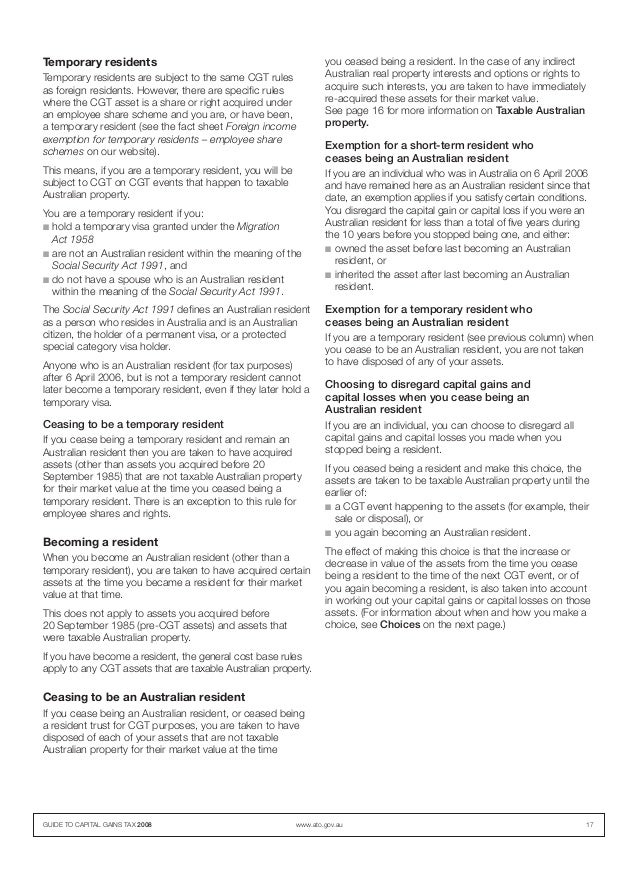

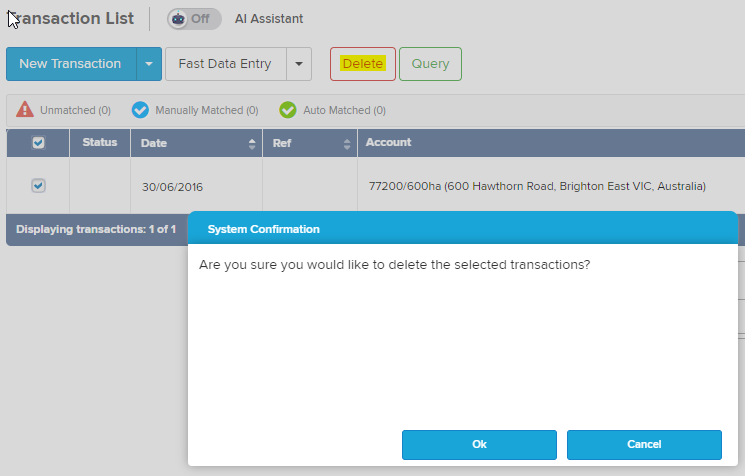

Capital allowance tax depreciation under ato legislation property investors are able to claim a non cash deduction in relation to the building and plant and equipment items associated. Definition of capital allowances. These rules set out the amounts capital allowances that can be claimed based on the asset s effective life. This deduction can be claimed by any owner of an income producing property.

What are capital allowances. Effectively this allows someone to claim a write off for the building construction costs over a period of time. Include here the cost of assets purchased for less than 30 000 each from 7 30 pm aedt 2 april 2019 to 30 june 2019 for businesses with a turnover from 10 million and less than 50 million. To calculate your depreciation deduction for most assets you apply the general depreciation rules unless you re eligible to use instant asset write off or simplified depreciation for small business.

Ask questions share your knowledge and discuss your experiences with us and our community. Under the general depreciation rules an immediate write off applies to. The annual investment allowance gives 100 capital allowances on expenditure up to 200 000 a year. To claim capital allowance you need to have a capital allowance and tax depreciation schedule for your investment property.

Businesses can claim an annual investment allowance for capital expenditure incurred on most items of plant and machinery. Capital allowances are a means of saving tax when your business buys a capital asset. Capital allowances are covered by division 43 of the tax act. A capital allowance is an expenditure a british business may claim against its taxable profit under the capital allowances act.

If a taxpayer is selling an investment property that was acquired after 13 may 1997 then they must reduce the cost base of that property by any division 43 capital allowances that they have claimed. Businesses which are members of a group of companies only get one annual investment allowance for the whole group. I m sure this has a very simple answer i am trying to determine the difference between capital works and capital allowances.