What Is Capital Allowance Uk

These sums derive from certain purchase or investments outfined in the capital allowances act 2001.

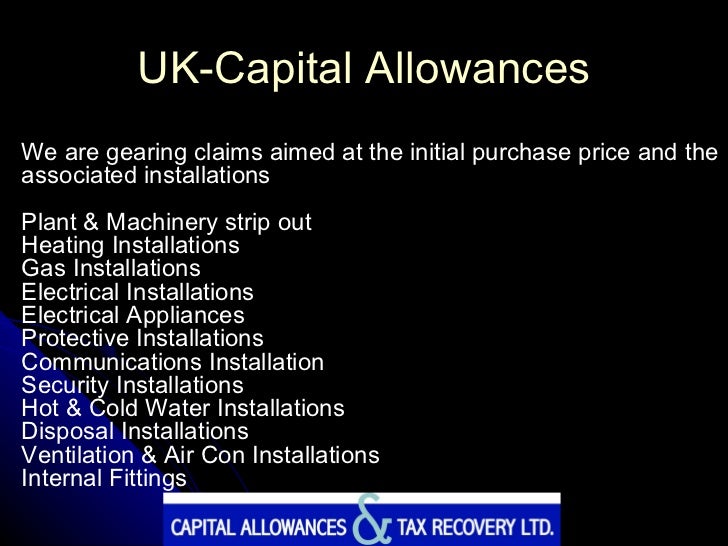

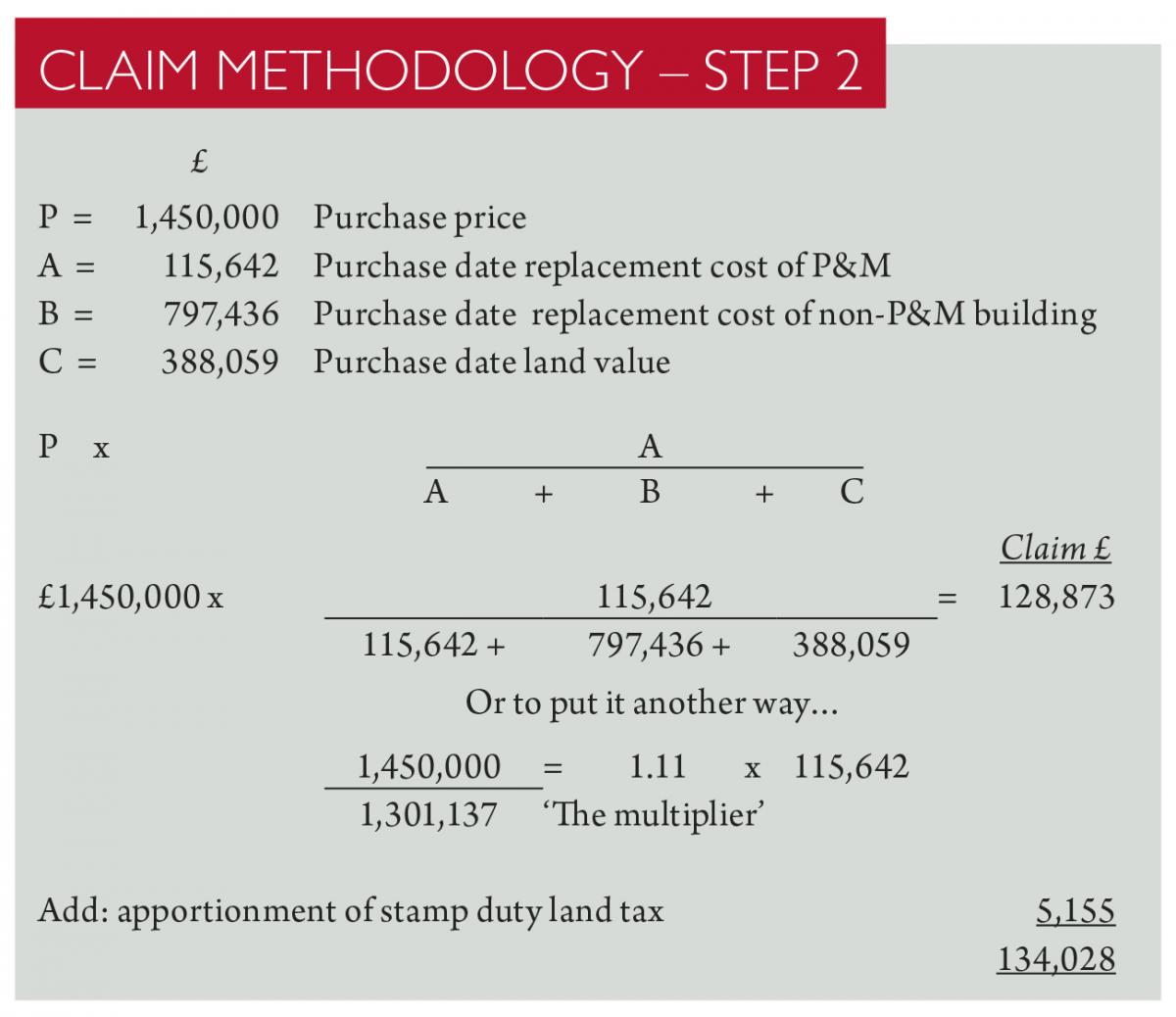

What is capital allowance uk. Generally the capital allowances will exist for only specified items of tangible capital expenditure and the expensing is usually spread over a fixed period of years. Claim capital allowances so your business pays less tax when you buy assets equipment fixtures business cars plant and machinery annual investment allowance first year allowances. Capital allowances is the practice of allowing a company to get tax relief on tangible capital expenditure by allowing it to be expensed against its annual pre tax income. However capital allowance does not apply to all types of assets.

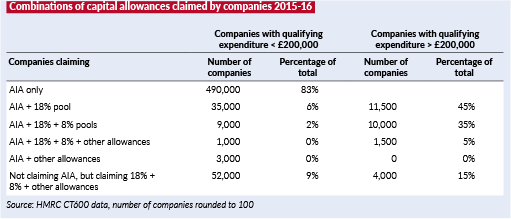

The average on property improvements is 50. Capital allowance review service has acted for properties of all types from a chain of karaoke bars for which capital allowance savings of 412 791 were made to a property which a landlord rented out for which unclaimed capital allowances were identified to the tune of 22 of the property cost. Capital allowance are the sums of money a uk business can deduct from the overall corporate or income tax on its profits. The catch is that you can claim it only in the year you bought the equipment.

In the uk a business can claim capital allowance based on the assets that are bought over the course of the tax period that are kept for use in the business. Claim capital allowances so your business pays less tax when you buy assets equipment fixtures business cars plant and machinery annual investment allowance first year allowances. Capital allowances are really not so scary and you could potentially work them out yourself or if you choose to have your accounts done at least know what your accountant is talking about. A capital allowance is g.

Capital allowances are actually pretty good for your business and should be considered your friend. More than 160 000 was identified for one client in. A capital allowance is an expenditure a british business may claim against its taxable profit under the capital allowances act. Cavity wall insulation.

.jpg)