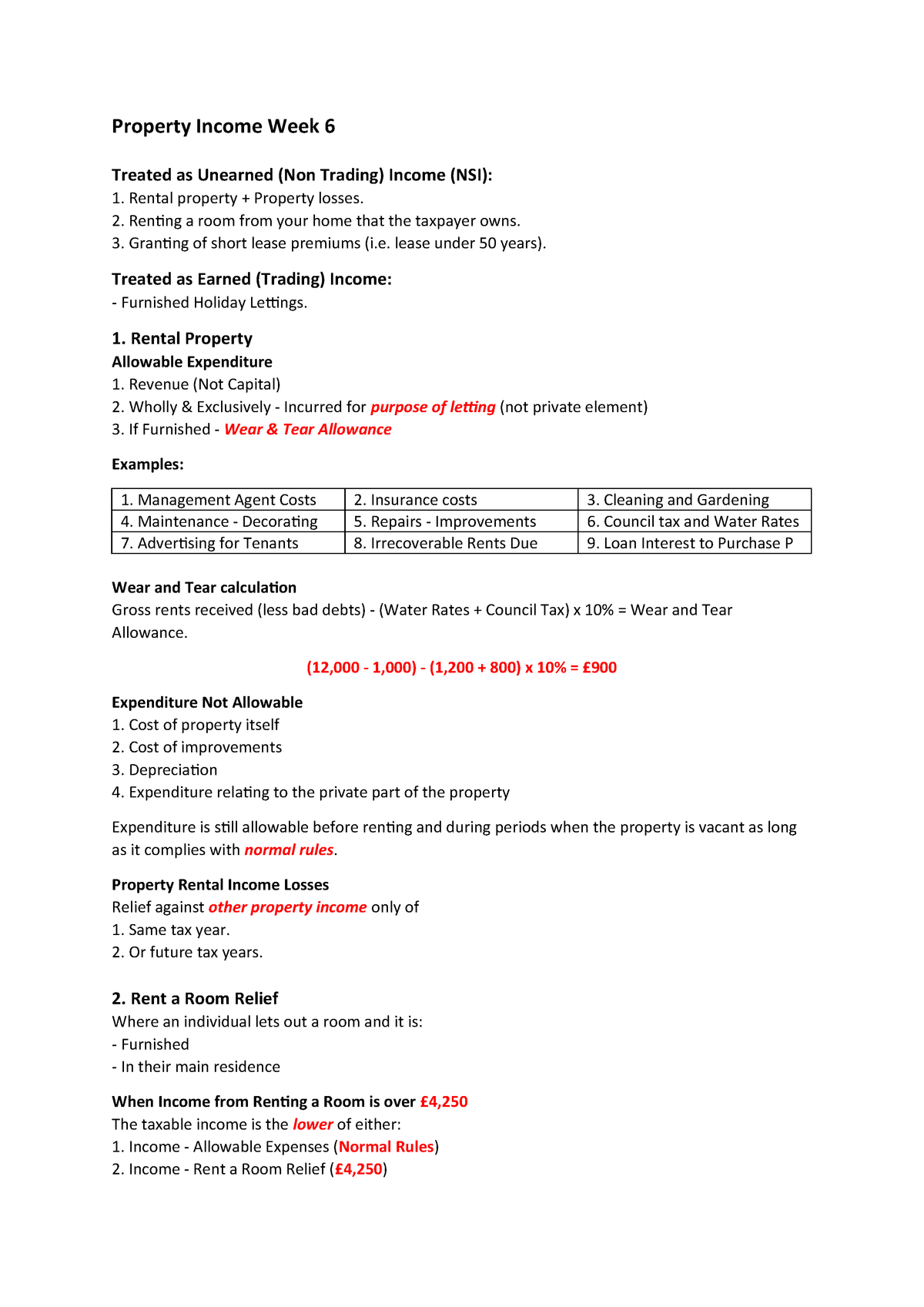

What Is Capital Allowance On Rental Property

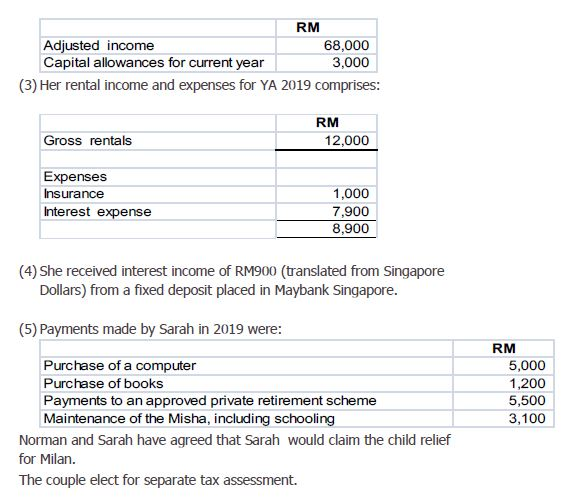

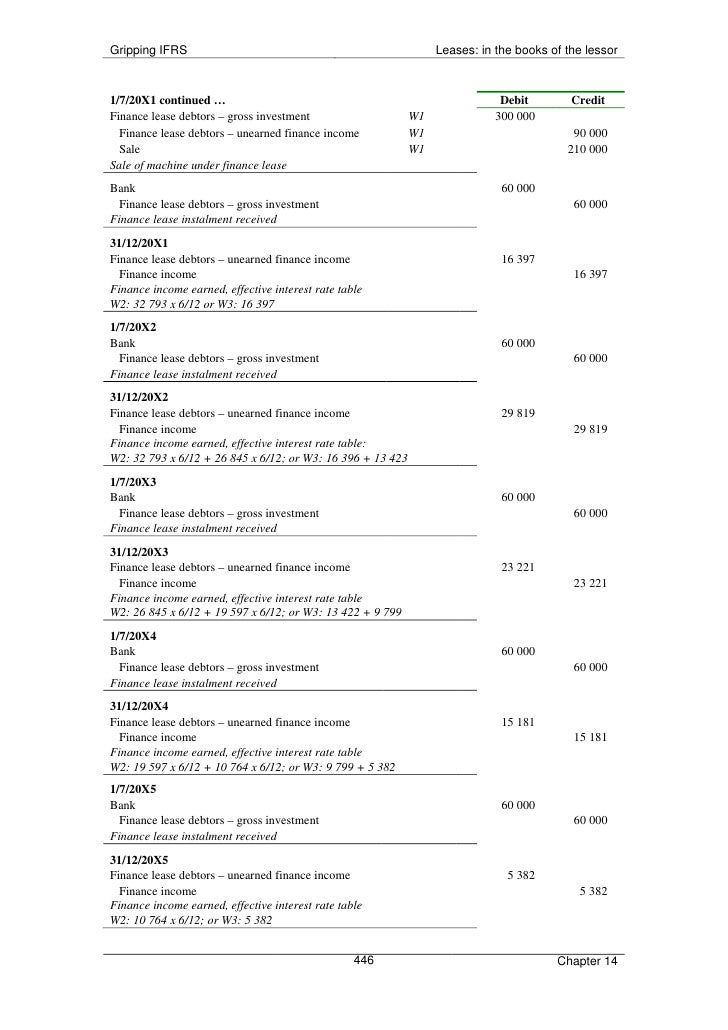

The total cost of this furniture cannot be written off in one go instead the expense is claimed over a number of years hence the idea of capital allowance.

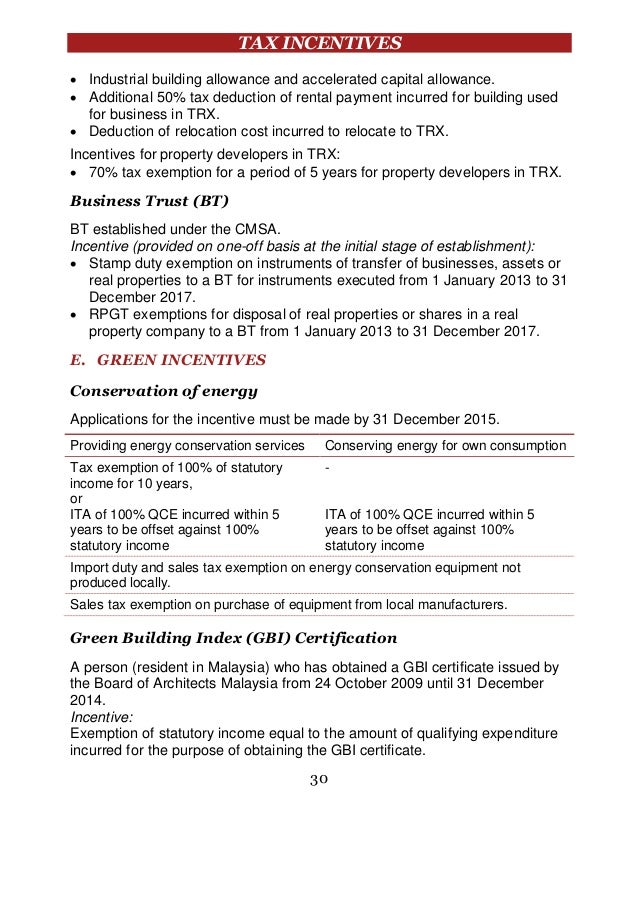

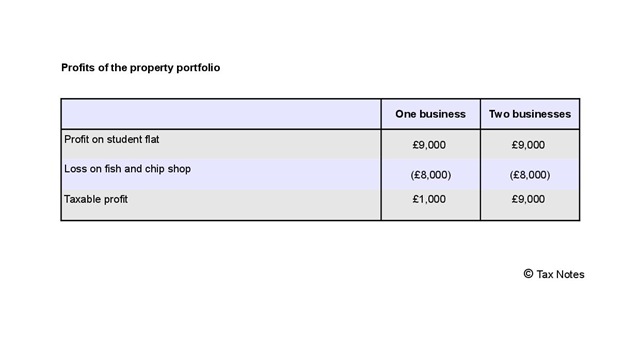

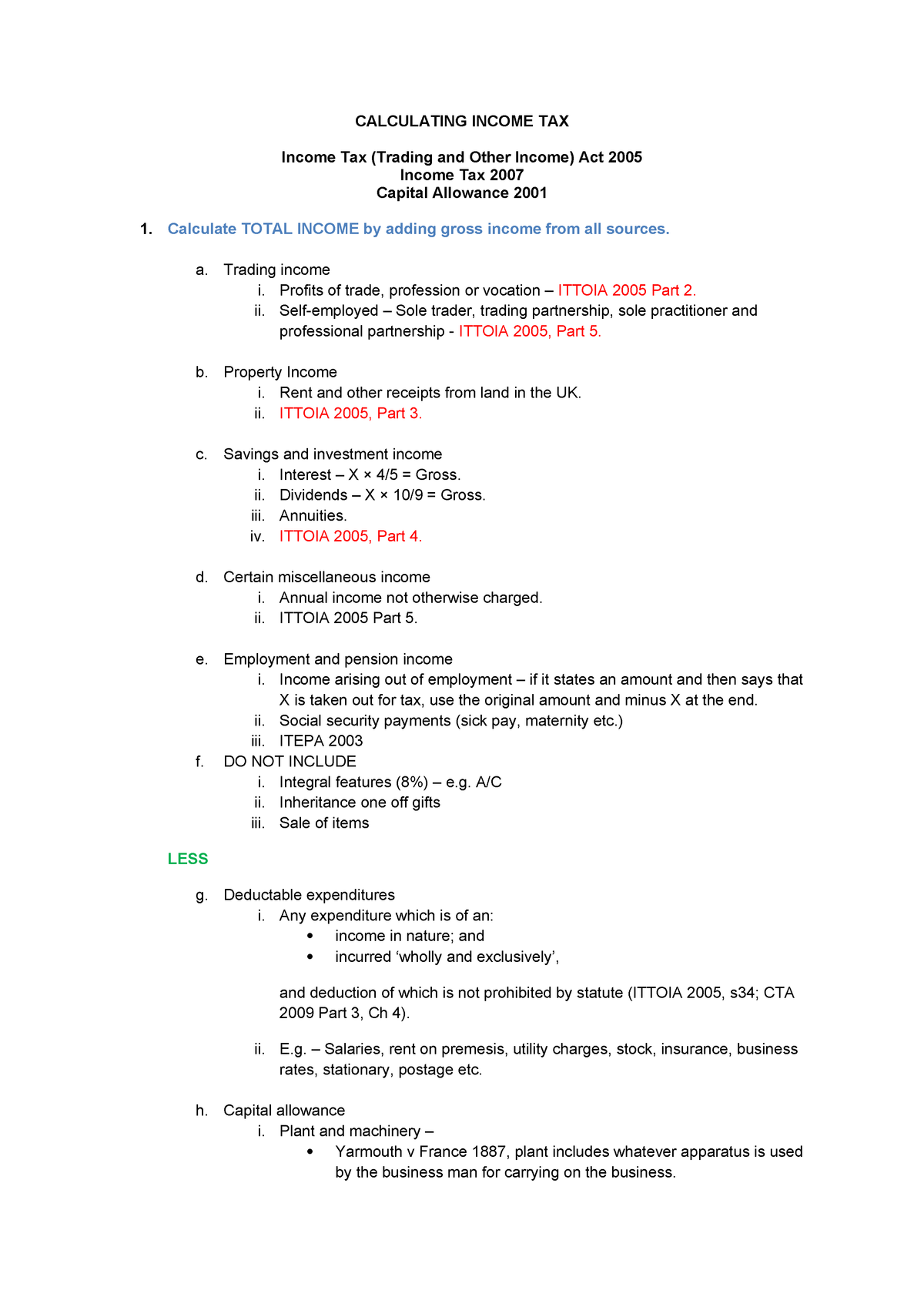

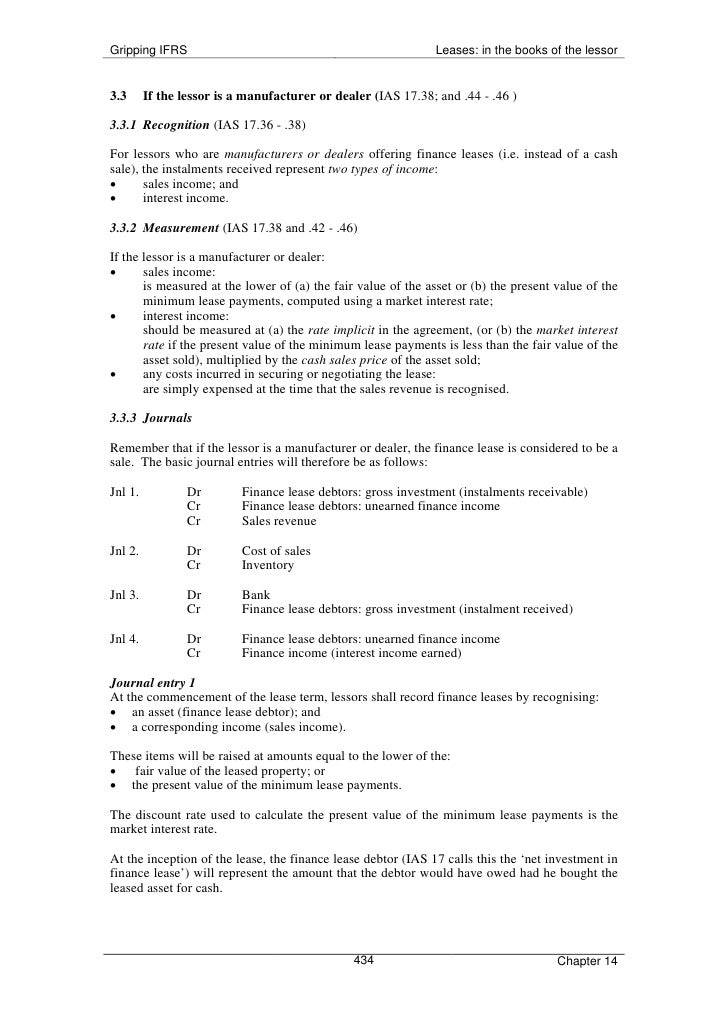

What is capital allowance on rental property. These rules set out the amounts capital allowances that can be claimed based on the asset s effective life. Can landlords claim capital allowances. Typically these will be in the form of a general cash payment contribution to tenant fit out or a rent free period. However since these properties may wear out or become obsolete over time you can deduct their cost over a period of several years.

More specifically capital cost allowance cca is the depreciation of fixed assets excluding land that is allowed to be claimed as an income tax deduction. The most common example of a capital allowance is furniture purchased to initially furnish a rental property. Can property developers claim capital allowances. Yes when they put the property or p m in use for the purposes of a trade or rental business.

You cannot deduct the cost of the property when you calculate your net rental income for the year. Generally yes where the property is let. Claiming capital cost allowance on a rental property capital cost allowance is a deductible expense taken off your taxable income for the depreciation wear and tear of something. The deduction is called capital cost allowance cca.

Capital allowances are one of the most overlooked expenses by landlords. Under the general depreciation rules an immediate write off applies to.