What Is Capital Allowance Malaysia

Examples of assets used in a business are motor vehicles machines office equipment furniture and computers.

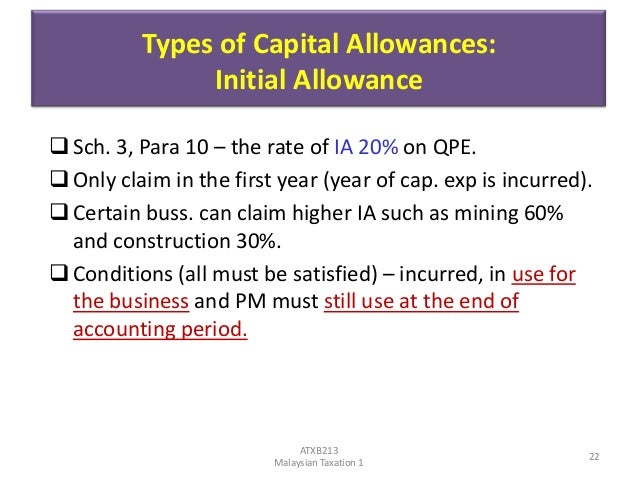

What is capital allowance malaysia. While annual allowance is a flat rate given every year based on the original cost of the asset. Small value assets not exceeding rm2 000 each are eligible for 100 capital allowances. The total capital allowances of such assets are capped at rm20 000 except for smes as defined. Initial allowance is fixed at the rate of 20 based on the original cost of the asset at the time when the capital expenditure is incurred.

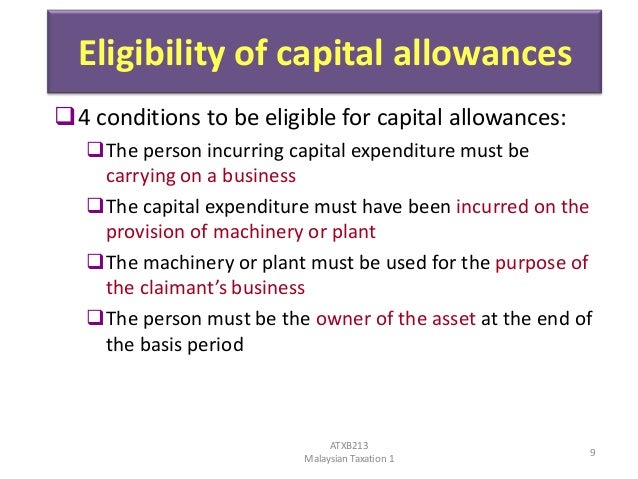

Examples of assets that are used in business are motor vehicles machines office equipments furniture etc. Capital allowance is given as deduction from business income in place of depreciation expenses incurred in purchase of business assets. The person who has the right to claim capital allowance is the person who has expended on the purchase or acquisition of the said asset. Capital allowance is only given to business activity.