What Is Capital Allowance In Taxation Malaysia

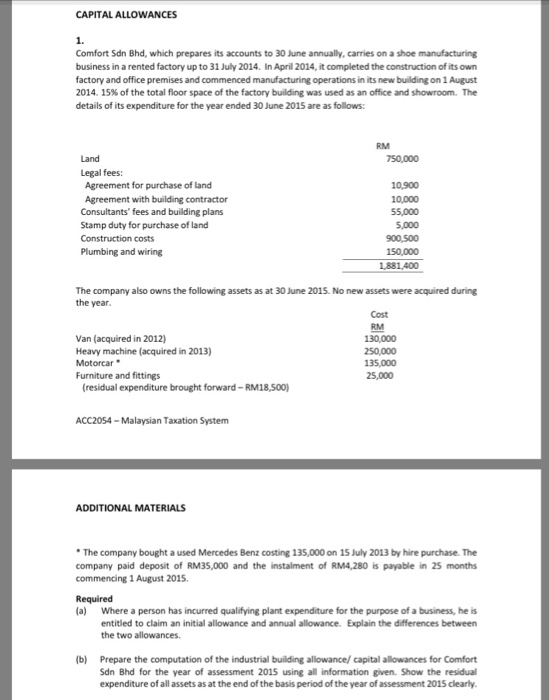

Some examples of assets that are normally used in business are motor vehicles machines office equipments and furniture.

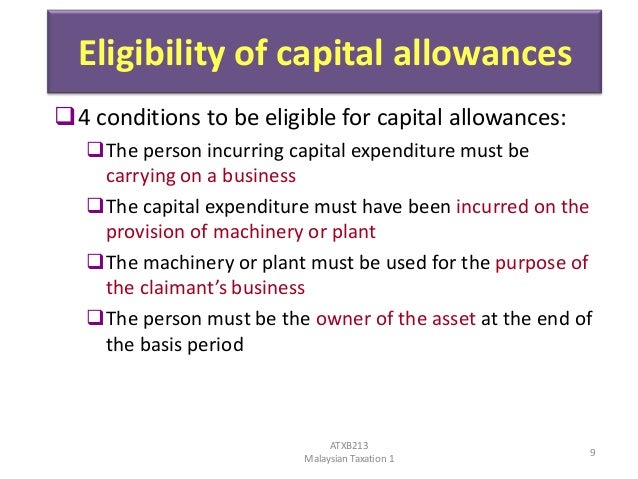

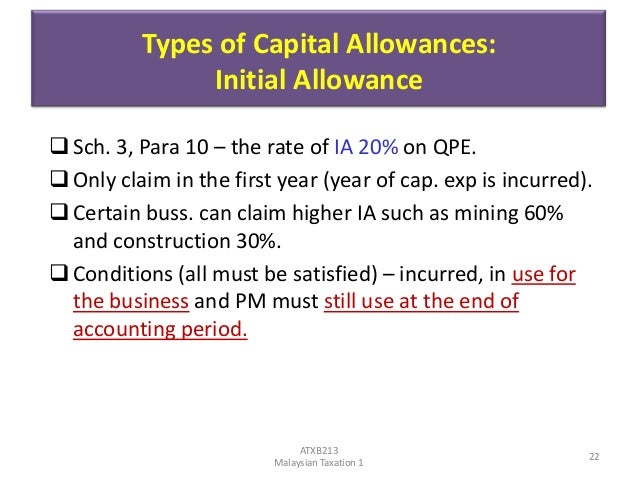

What is capital allowance in taxation malaysia. Conditions for claiming capital allowance are. The balancing charge is restricted to the amount of allowances previously claimed. Initial allowance is granted in the year the expenditure is incurred and the asset is in use for the purpose of the business. Relevant provisions of the law 3 1 this pr takes into account laws which are in force as at the date this pr is published.

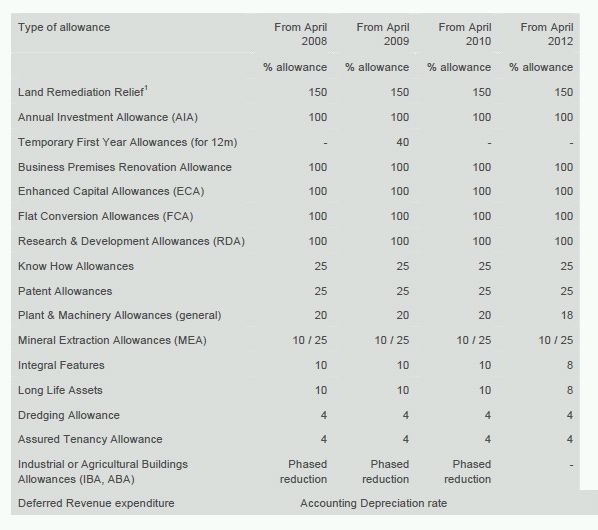

Capital allowance tax depreciation on industrial buildings plant and machinery is available at prescribed rates for all types of businesses. And b computation of capital allowances for expenditure on plant and machinery. In the current tax environment in malaysia the amount of tax declared by a taxpayer would constitute its own tax assessment. Income tax accelerated capital allowance security control equipment.

27 june 2014 page 2 of 28 3. 5 2014 date of publication. 3 2 the provisions of the income tax act 1967 ita related to this pr are. It is only calculated when a company is computing its tax liabilities.

Capital allowance is only applicable to business activity and not for individual. Capital allowance is a claim against assessable profits by companies when computing their tax liabilities. However schedule 3 of the income tax act 1967 has laid down several allowable deductions in the form of allowances for the capital expenditures that have been incurred. Inland revenue board of malaysia date of issue accelerate capital allowance public ruling no.

Capital allowance is only given to business activity. Balancing adjustments allowance charge will arise on the disposal of assets on which capital allowances have been claimed. Capital allowance is given as deduction from business income in place of depreciation expenses incurred in purchase of business assets. However there are different methods of calculating depreciation which.

15 april 2013 page 2 of 34 2 14. Relevant provisions of the law 2 1 this pr takes into account laws which are in force as at the date this pr is published. A tax treatment in relation to qualifying expenditure on plant and machinery for the purpose of claiming capital allowances. Generally the balancing adjustment is the difference between the tax written down value and the disposal proceeds.

The purpose of capital allowance is to give a relief for wear and tear of fixed assets for business. Usually when companies prepare income statement they always charge depreciation as an expense before arriving at their profit before tax.