What Is Capital Allowance In Accounting

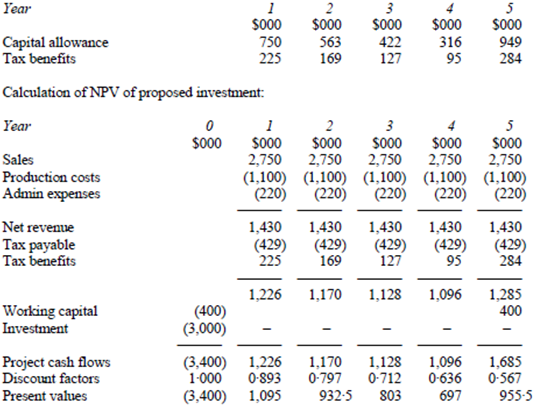

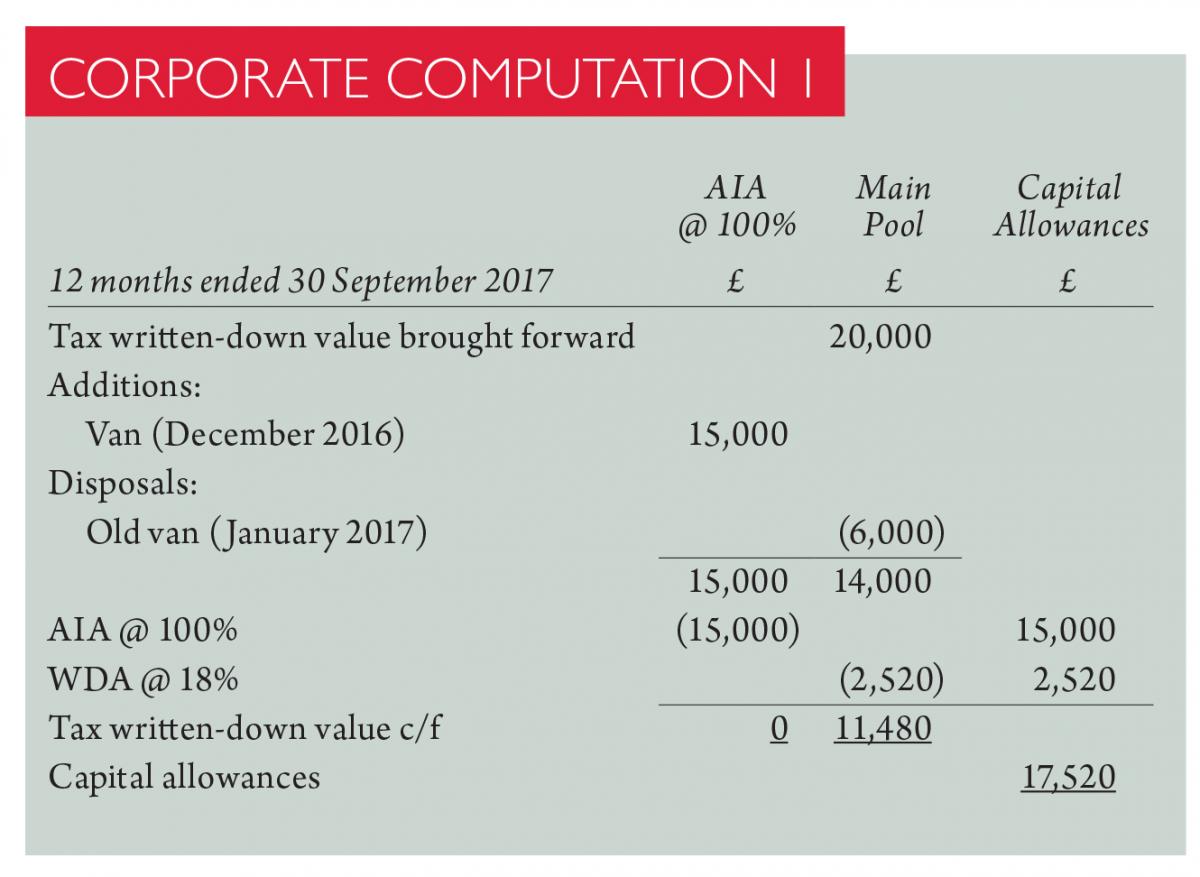

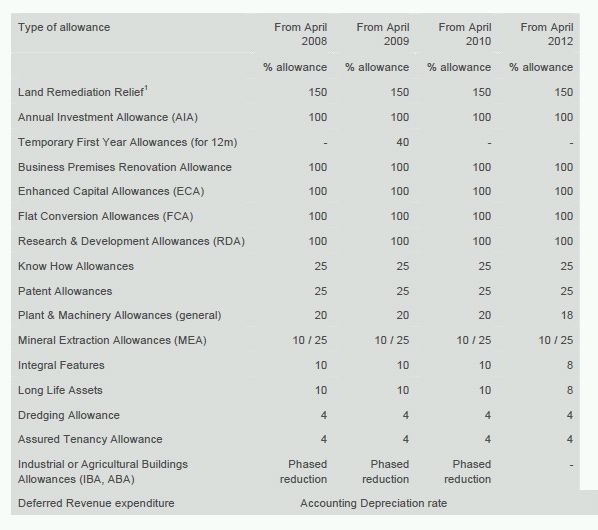

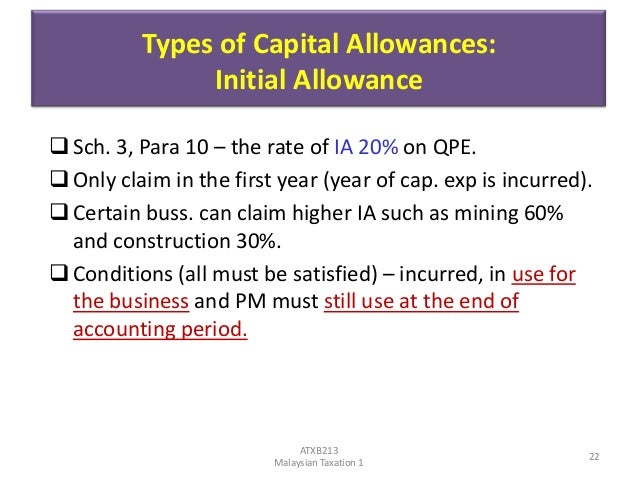

Generally the capital allowances will exist for only specified items of tangible capital expenditure and the expensing is usually spread over a fixed period of years.

What is capital allowance in accounting. Capital allowance review service has acted for properties of all types from a chain of karaoke bars for which capital allowance savings of 412 791 were made to a property which a landlord rented out for which unclaimed capital allowances were identified to the tune of 22 of the property cost. Capital allowances are generally granted in place of depreciation which is not deductible. A capital cost allowance cca is a yearly deduction or depreciation that can be claimed for income tax purposes on the cost of certain assets. Capital allowances is the practice of allowing a company to get tax relief on tangible capital expenditure by allowing it to be expensed against its annual pre tax income.

More than 160 000 was identified for one client in. Capital allowances are generally granted in place of depreciation which is not deductible. It is a core part of bookkeeping and usually applied at year end for larger businesses it is often calculated every month as part of management reporting. The average on property improvements is 50.

Capital allowances are a means of saving tax when your business buys a capital asset. A capital allowance is an expenditure a british business may claim against its taxable profit under the capital allowances act. Capital allowances are deductions claimable for the wear and tear of qualifying fixed assets such as industrial machinery office equipment and sign boards. Keeping track of your expenses and assets when starting a business is a pillar of ensuring long term success and getting the most out of your capital allowances when it comes time to file tax.

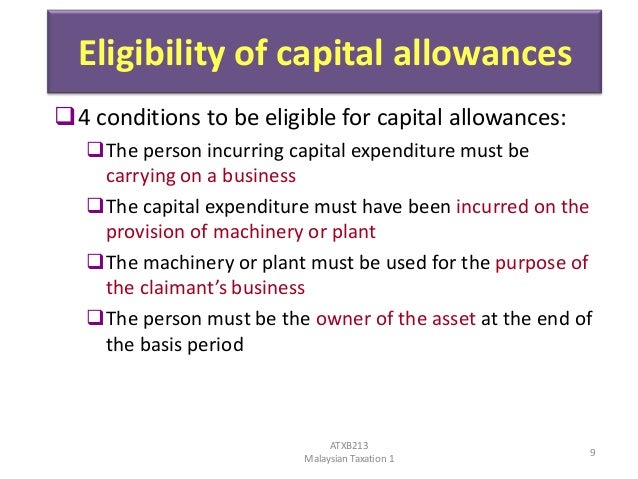

Depreciation is the amount an asset has reduced depending on age wear and tear and current market value. Capital cost allowance cca. Claiming capital allowances capital expenditure incurred by a person carrying on a trade profession or business on the provision of plant and machinery for purposes of the trade profession or business can qualify for capital allowances claim.