Upkeep Of Office Equipment Accounting

Examples would include items such as letterhead and other stationery business cards and the like.

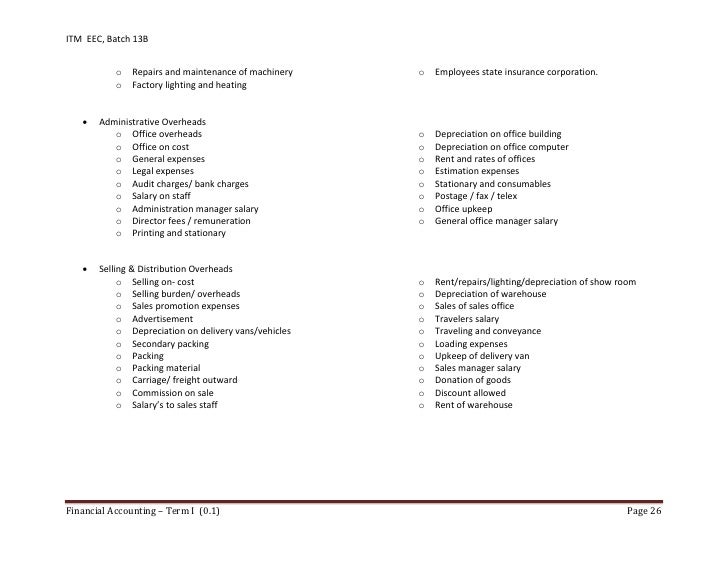

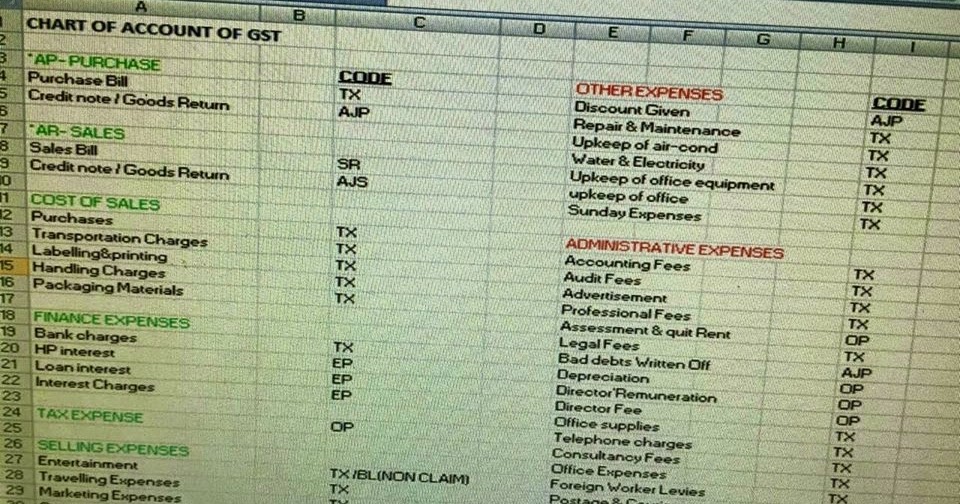

Upkeep of office equipment accounting. Notably office supplies and office furniture are typically categorized and tracked separately from office equipment. Office equipment is a fixed asset account in which is stored the acquisition costs of office equipment. The stationery plays an important role in doing some key functions at the workstations in an efficient and effective manner. The third large office equipment or furniture should each be classified as a fixed asset to be depreciated over time.

This account is classified as a long term asset account since the asset costs recorded in it are expected to be held for more than one year. R m expenses are inevitable that is unless the company has an extremely neurotic replacement policy and replaces serviceable equipment instead of fixing. The accounting for the above listed costs may be different. After getting plant assets up and running repair and maintenance r m expenses will eventually follow.

Furniture fixtures and equipment abbreviated ff e or ffe are movable furniture fixtures or other equipment that have no permanent connection to the. Office supplies include materials that you would normally expect to consume and replace more regularly. Planned maintenance is usually associated by a one time event. Desks desk chairs guest or client seating tables and other furniture are included in the office furniture category.

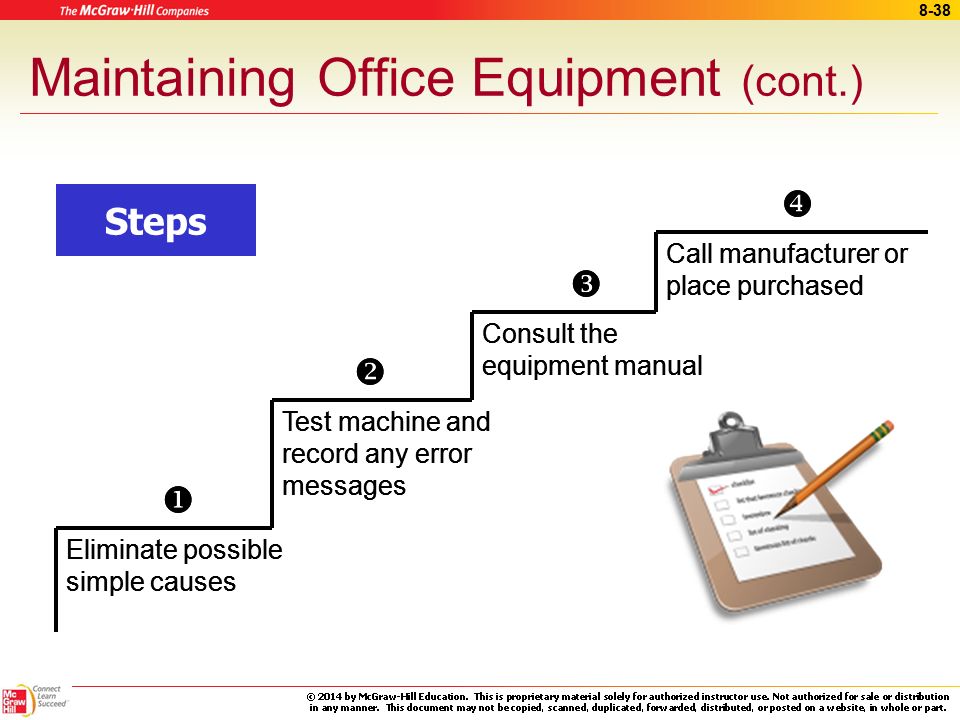

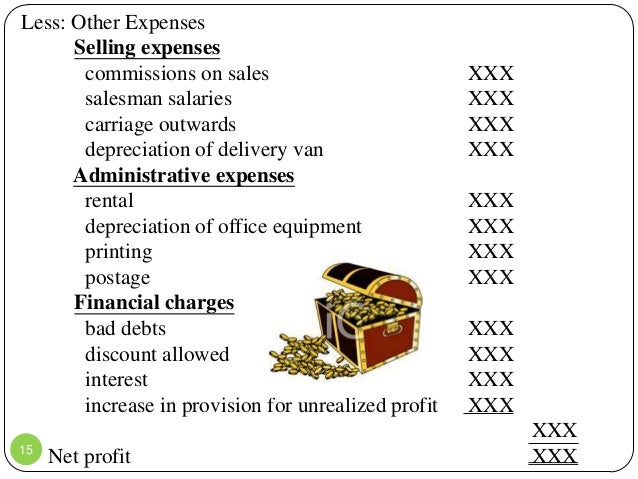

Join pro or pro plus and get. Let us look at the accounting practices for such costs. Examples of office equipment are copiers fax machines computers and printers. The accounting for maintenance and repair expenditures depends on the nature of the repairs.

Furniture fixtures equipment ff e. Planned maintenance is the term used to describe the scheduled maintenance activities identified through predictive maintenance inspections facilities audits and monitoring for the upkeep of property machinery and facilities including buildings utility systems roads and grounds. The capitalization limit is the amount of expenditure below which an item is recorded as an expense rather than an asset for example if the capitalization limit is 5 000 then record all. Your office expenses can be separated into two groups office supplies and office expenses.

It s important to correctly classify your office expenses supplies and equipment to make things easier for tax time. Office equipment definition a long term asset account reported on the balance sheet under the heading of property plant and equipment. When assets are acquired they should be recorded as fixed assets if they meet the following two criteria. Sad but true costs related to property plant and equipment pp e don t stop at the purchase point.

Exceeds the corporate capitalization limit. Some of the items in the list of office stationery include papers folders files pens diaries organizers calendars paperweights staplers punch machines paperclips pins pen stands etc.

:max_bytes(150000):strip_icc()/GettyImages-1174783581-020e7504020947dc979f864f2ebee096.jpg)