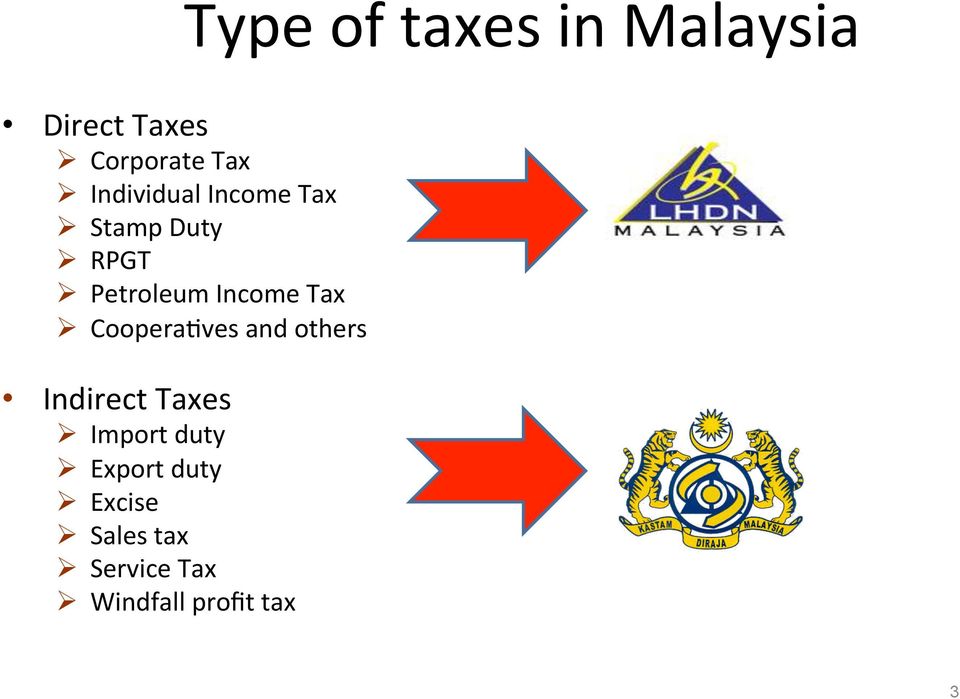

Type Of Tax In Malaysia

This type of tax is evaluated based on the annual rental value of a property set by the state government or local authority where the property is located.

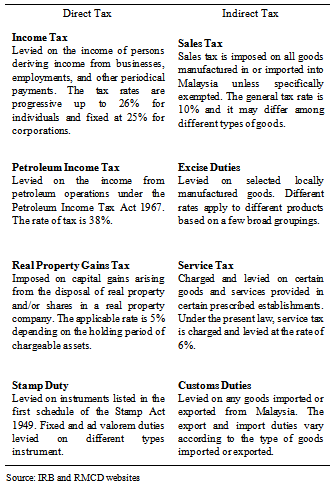

Type of tax in malaysia. 10 for sales tax and 6 for service tax. Payments made to non residents in respect of the provision of any advice assistance or services performed in malaysia and rental of movable properties are subject to a 10 wht unless exempted under statutory provisions for purpose of granting incentives. Sales tax and service tax were implemented in malaysia on 1 september 2018 replacing goods and services tax gst. In malaysia whether you buy or sell the property you must face the property taxes.

The deadline for filing your income tax returns form in malaysia varies according to what type of form you are filing. This deduction of tax at source does not represent a final tax which is determined upon the filing of the tax return. This publication is a quick reference guide outlining malaysian tax information which is based on taxation laws and current practices. Taxpayer is responsible to submit income tax return form itrf and make income tax payment yearly prior to due date.

In other words resident and non resident organisations doing business and generating taxable income in malaysia will be taxed on income accrued in or derived from malaysia. What supplies are liable to the standard rate. These proposals will not become law until their enactment and may be amended in the course of their passage through. Cars with less than a 1 6 litre engine capacity get charged a fixed base rate which varies depending on the type of car and whether it s a company registered or private vehicle.

Every individual in malaysia including resident or non resident who is liable to tax is required to declare his income to inland revenue board of malaysia irbm or lembaga hasil dalam negeri malaysia ldhn. For the be form resident individuals who do not carry on business the deadline for filing income tax in malaysia is 30 april 2020 for manual filing and 15 may 2020 via e filing. Type of indirect tax. In addition taxes like estate duties annual wealth taxes accumulated earnings tax or federal taxes are not levied in malaysia.

In malaysia corporations are subject to corporate income tax real property gains tax goods and services tax gst and etc taxes. This booklet also incorporates in coloured italics the 2020 malaysian budget proposals announced on 11 october 2019 and the finance bill 2019.