Stamp Duty Act Malaysia

Exemptions relief from stamp duty.

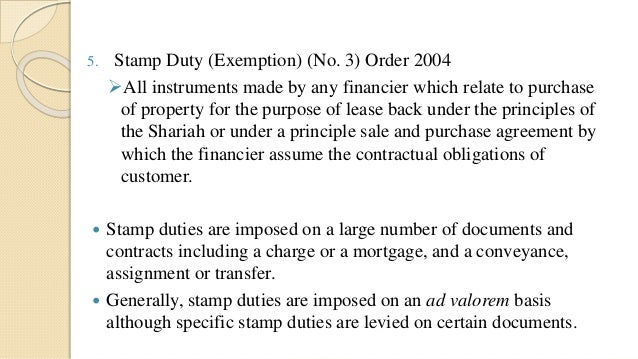

Stamp duty act malaysia. There are two types of stamp duty namely ad valorem duty and fixed duty. In malaysia stamp duty is a tax levied on a variety of written instruments specifies in the first schedule of stamp duty act 1949. Sale and purchase agreement legal fees latest update starting. The schedule below as a reference of stamp duty and legal fees 2020 when purchasing a house.

Stamp duty exemption on contract notes for sale and purchase transaction of shares of a medium and small capital company in bursa malaysia securities berhad executed from 1 march 2018 to 28 february 2021. B 441 1989 part i preliminary short title and application 1. Peninsular malaysia 5 december 1949. 1 this alert summarizes the key aspects of the guidelines.

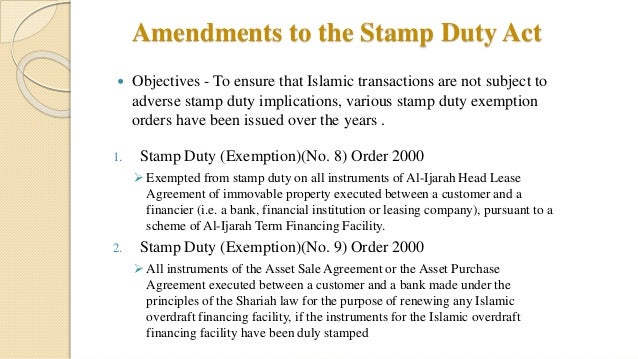

Item description of instrument proper stamp duty 64 laws of malaysia act 378 6 appointment of a receiver under rm10 00 a mortgage 7 appointment of a new trustee and rm10 00 appointment in execution of a power of any property or of any share or interest in any property by any instrument not being a will 8 deleted by act 274. The transfer of shares attract stamp duty at the ad valorem stamp duty rate of 0 3 of the price or value of any shares on the date of transfer whichever is the greater. The exception to the above is the transfer of shares in unquoted companies on bursa malaysia which will attract ad valorem stamp duty at the rate of 0 1. Amendments to the rpgt act effected in sections 69 69a 69b and 70 of the finance act.

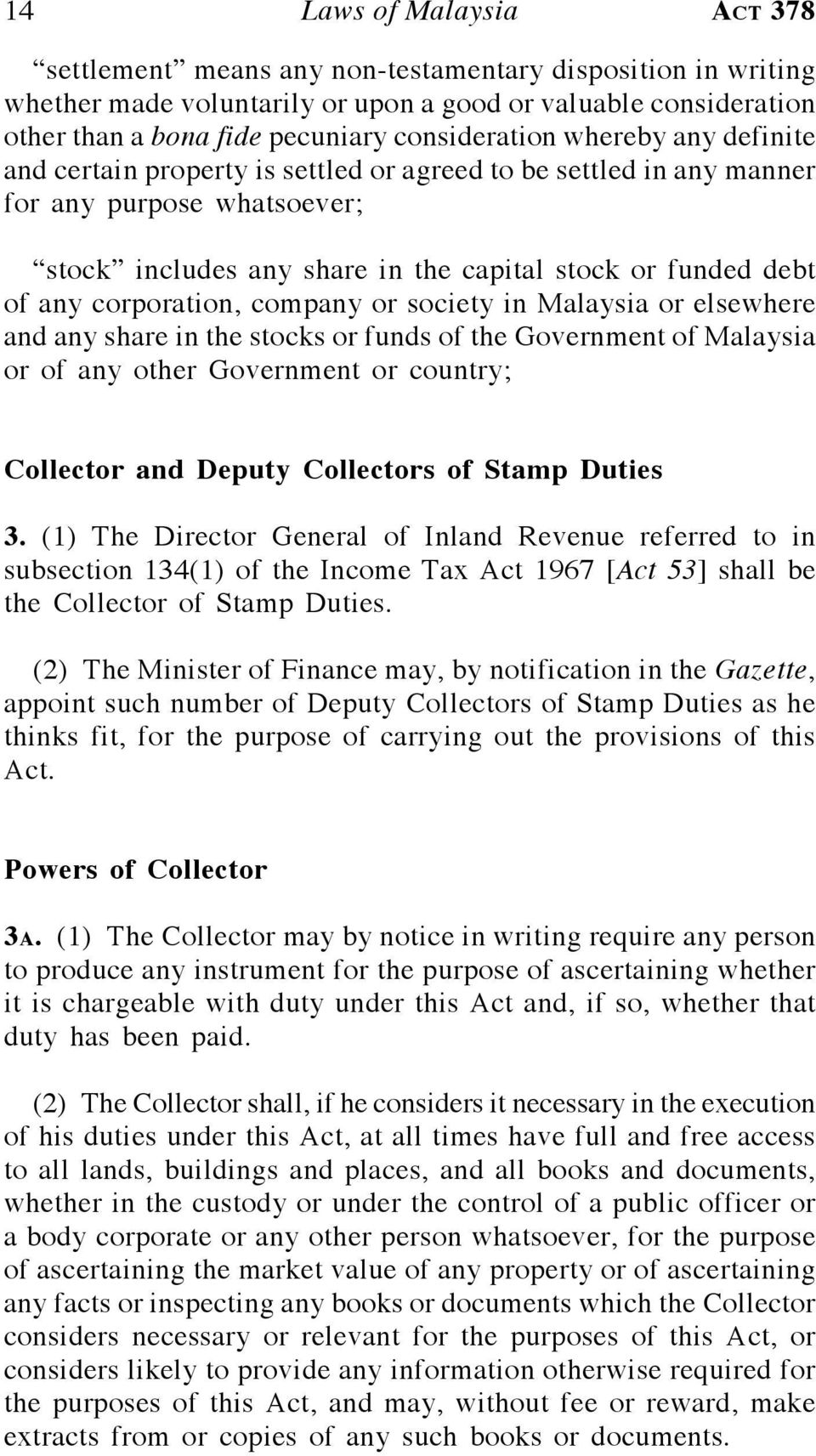

Stamp duty exemption on perlindungan tenang insurance policies and takaful certificates with a yearly premium contribution not exceeding. The above amendments came into operation on 1 january 2019. In this act unless the context. Stamp act 1949 an act relating to stamp duties.

Instruments liable to stamp duty are those listed in the first schedule of the stamp act 1949. You have millions of questions to ask about stamp duty malaysia stamp duty calculation and stamp duty exemption malaysia 2019 here are some of the most common stamp duty questions along with the best way to answer them. Instruments liable to stamp duty. 2 this act shall apply throughout malaysia.

A stamp duty on instrument of transfer of property pursuant to section 68 d of the finance act item 32a of the first schedule to the stamp act has been amended to read as follows. The malaysian inland revenue board mirb released on 26 february 2019 guidelines for stamp duty relief under sections 15 and 15a of the stamp act 1949 the guidelines the guidelines take into account the tightening of the stamp duty relief provisions proposed in the 2019 budget. 1 this act may be cited as the stamp act 1949.