Malaysian Income Tax Deadline 2019

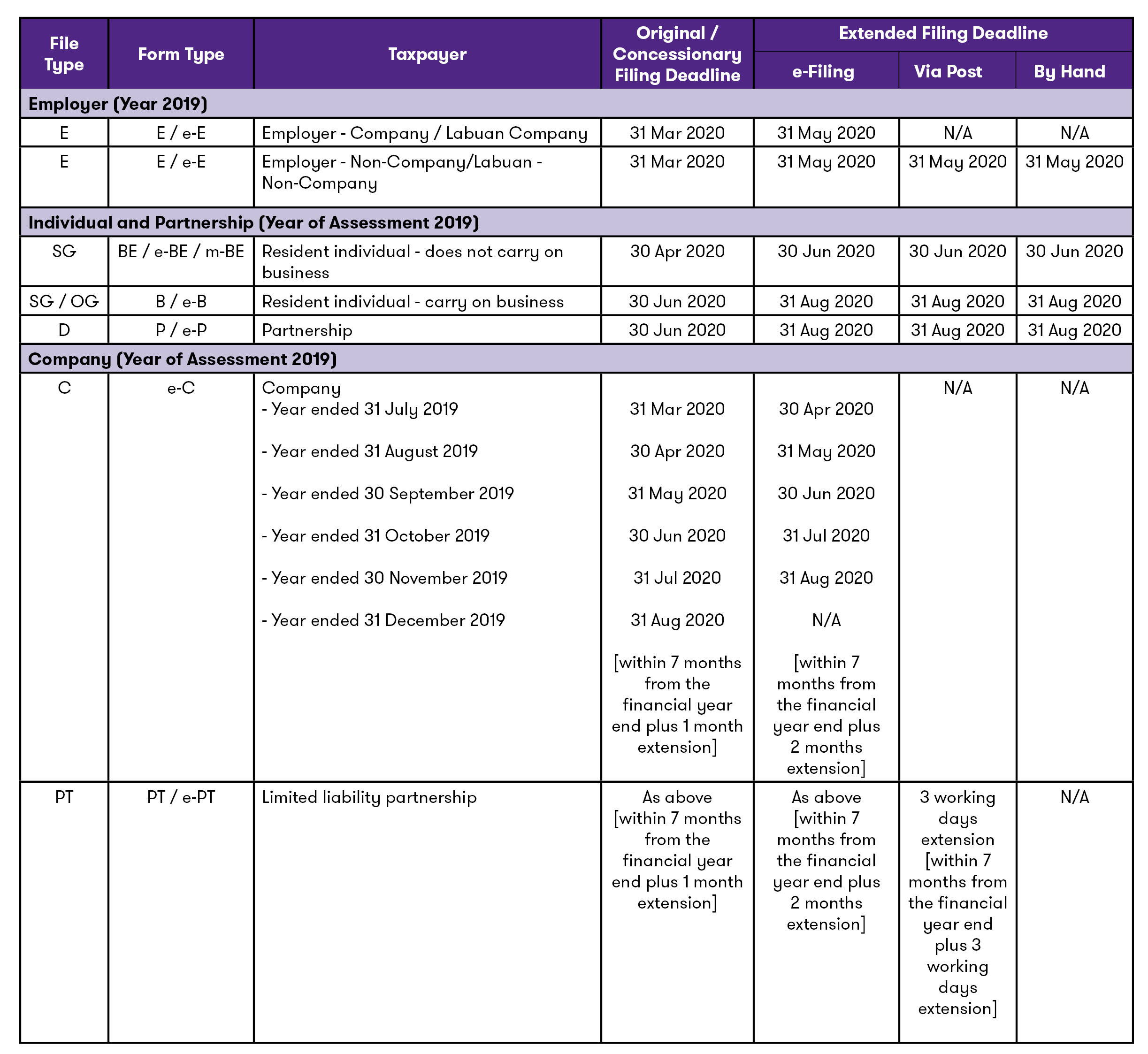

The new deadline for filing income tax returns in malaysia is now 30 june 2020 for resident individuals who do not carry on a business and 30 august 2020 for resident individuals who do carry on a business.

Malaysian income tax deadline 2019. Calculations rm rate tax rm 0 5 000. Income tax deadline 2019. If you fulfill the requirements then you are definitely taxable. The deadline for filing your income tax returns form in malaysia varies according to what type of form you are filing.

Kuala lumpur march 18. The inland revenue board irb has announced an extension of two months from the regular deadline for income tax filings amid the movement restriction order imposed by the government. Ibu pejabat lembaga hasil dalam negeri malaysia menara hasil persiaran rimba permai cyber 8 63000 cyberjaya selangor. Thus the new deadline for filing your income tax returns in malaysia via e filing is 30 june 2020 for resident individuals who do not carry on a business and 30 august 2020 for resident individuals who carry on a business.

The date for filing of income tax return forms which falls between march 2020 and june 2020 have been given an extension of two months. You can file your taxes on ezhasil on the lhdn website. How to file your personal income tax online in malaysia. You can see the full amended schedule for income tax returns filing on the lhdn website.

150 tarikh kemaskini. File estimated chargeable income eci dec year end 31 mar 2020. On the first 5 000 next 15 000. As for a non resident taxpayer who has business source income the deadline for filing the tax return and payment of tax payable is 30 june of the following year.

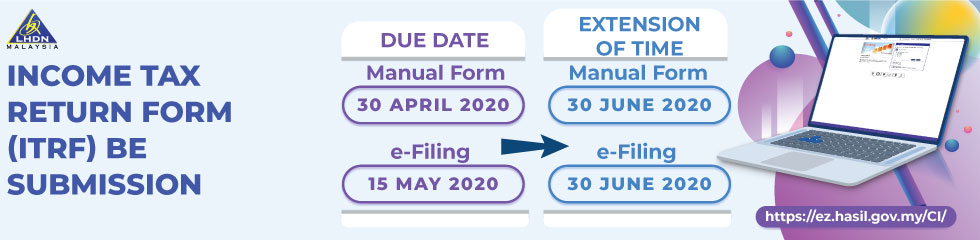

The next thing you should do is to file your income tax do it online. For the be form resident individuals who do not carry on business the deadline for filing income tax in malaysia is 30 april 2020 for manual filing and 15 may 2020 via e filing. The mirb also has announced that. On the first 2 500.