Malaysia Import Tax Rate 2016

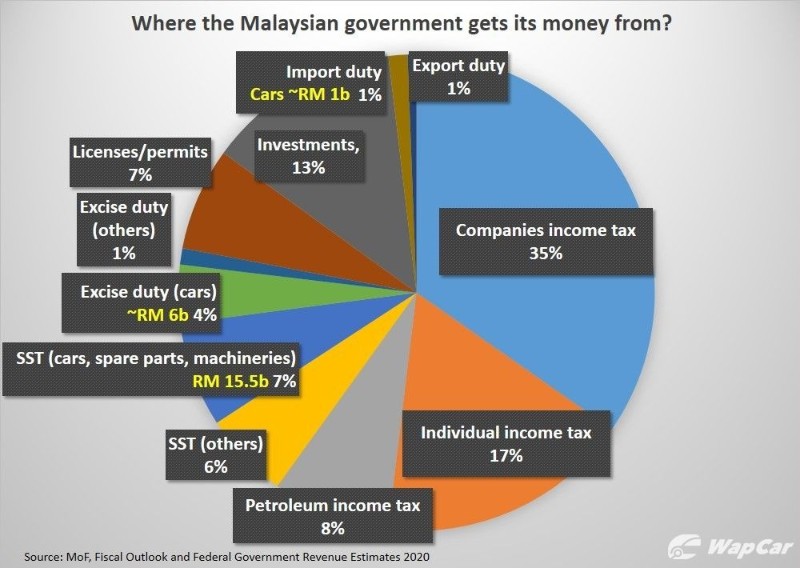

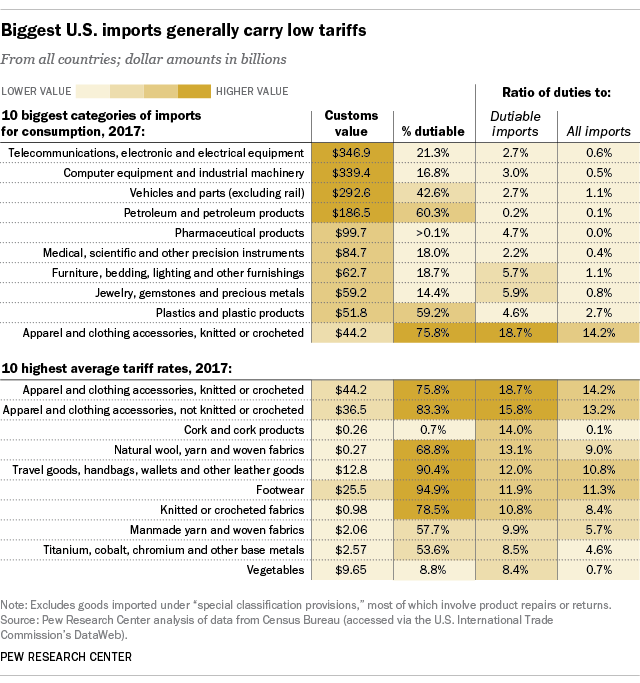

Duty rates duty rates in malaysia vary from 0 to 50 with an average duty rate of 5 74.

Malaysia import tax rate 2016. Prescribed drugs can only be imported into or exported from the country by virtue of a licence issued by the ministry of health malaysia. Register login gst shall be levied and charged on the taxable supply of. A qualified person defined who is a knowledge worker residing in iskandar malaysia is taxed at the rate of 15 on income from an. Agency browse other government agencies and ngos websites from the list.

Some goods are not subject to duty e g. 1 for non residents of malaysia people who have been living in the country for less than 182 days per year the tax rate has been set at 25 on all the income that has been earned in malaysia regardless of your citizenship or nationality. Laptops electric guitars and other electronic products. Event calendar check out what s happening.

W e f ya 2016 tax rates for resident individuals whose chargeable income from rm600 001 to rm1 000 000 be increased by 1 and chargeable income exceeding rm1 000 000 increased by 3. When shipping something internationally your shipment may be subject to import duties and taxes. Complaint suggestion public complaint system. Import duty local taxes cbu.

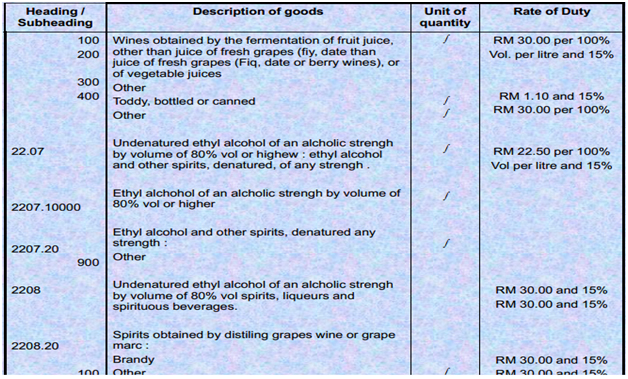

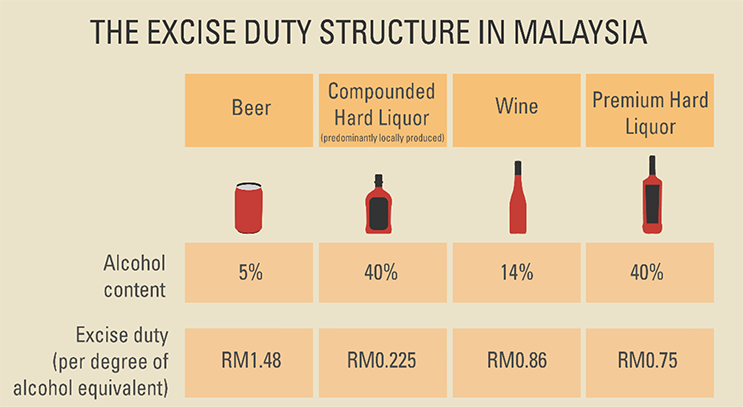

Cbu ckd class. Things to know about duties taxes. Every country taxes items differently see how duties are applied in malaysia. Sales tax imports are subject to gst at a standard rate of 6 of the sum of the cif value duty and any excise if applicable.

Malaysia taxation and investment 2016 updated november 2016 contents 1 0 investment climate 1 1 business environment 1 2 currency 1 3 banking and financing 1 4 foreign investment 1 5 tax incentives 1 6 exchange controls 2 0 setting up a business 2 1 principal forms of business entity 2 2 regulation of business. Import and export of illicit drugs eg. The ministry of finance announced on july 16 2018 the sst is chargeable on the manufacture of taxable goods in malaysia and the importation of taxable goods into malaysia at the rate of 5 percent or 10 percent or a specific rate depending on the category of goods. Morphine heroine candu marijuana etc are strictly prohibited.

These additional charges are calculated based on the item type and its value.