Malaysia Housing Loan Interest Rate

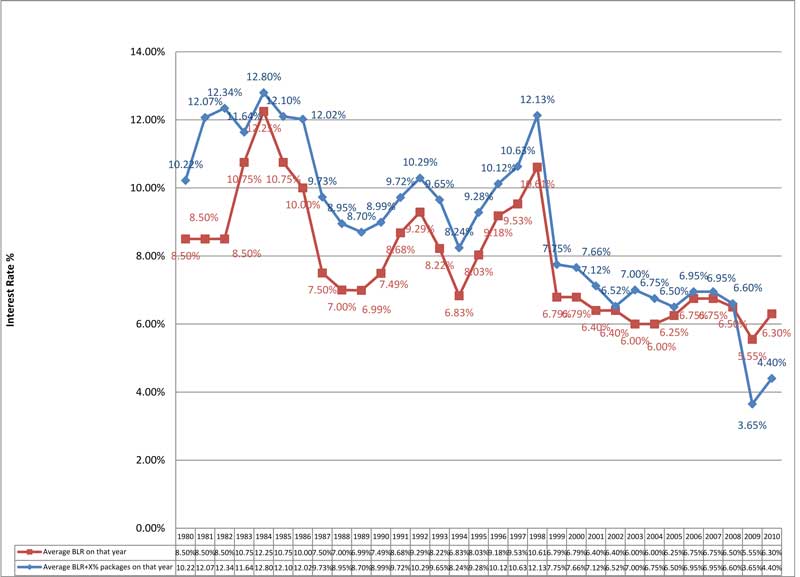

Interest rate in malaysia averaged 2 96 percent from 2004 until 2020 reaching an all time high of 3 50 percent in april of 2006 and a record low of 1 75 percent in july of 2020.

Malaysia housing loan interest rate. Lower loan interest rates. Enter housing loan period in years. Monthly repayment rm 2967 32. This page provides malaysia bank lending rate actual values historical data forecast chart.

Max up to 90 5 compulsory mrta. Margin of finance mof. Enter property price in malaysian ringgit. Br 2 52 0 70 3 22 special approval rates br 2 52 0 63 3 15 subject to special terms and conditions by the bank.

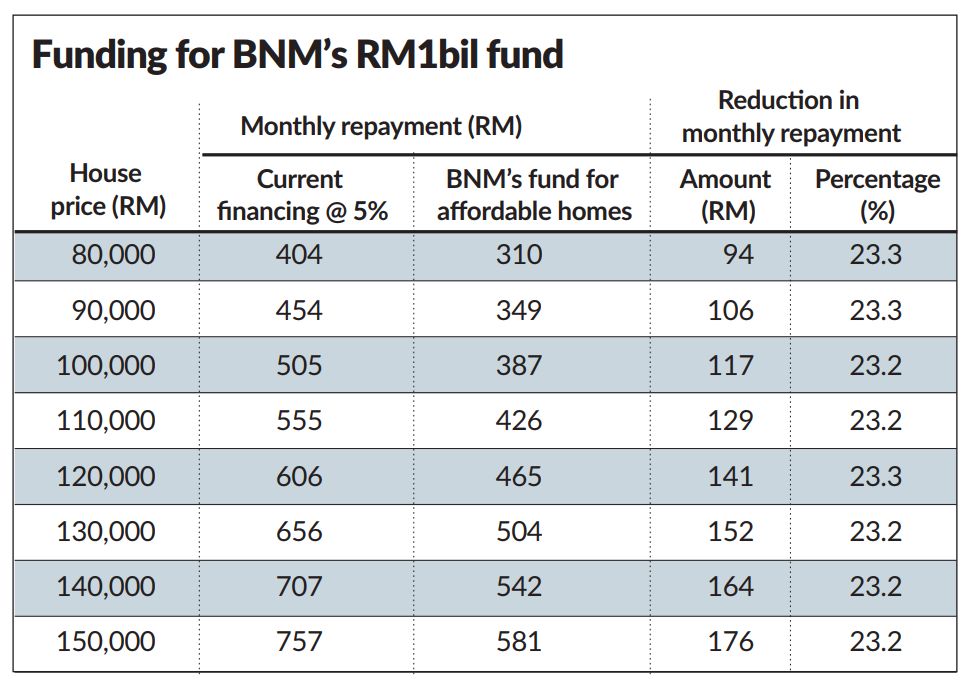

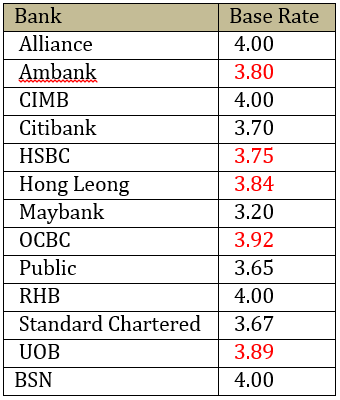

Starting 2 january 2015 br replaced the base lending rate blr to reflect the changes made by bank negara malaysia and later on by major local banks. Read more apply now. Do a quick calculation on your monthly repayments using our online housing loan calculator and save more. Public bank housing loan interest rates.

Bank lending rate in malaysia averaged 6 28 percent from 1996 until 2020 reaching an all time high of 13 53 percent in may of 1998 and a record low of 3 64 percent in august of 2020. For refinance and subsale. Terms conditions apply. For example if the current br rate is 4 00 update.

Generate principal interest and balance loan repayment table by year. Enter down payment amount in malaysian ringgit. As of 2nd january 2015 base lending rate blr has been updated to base rate. Affin tawarruq home financing i.

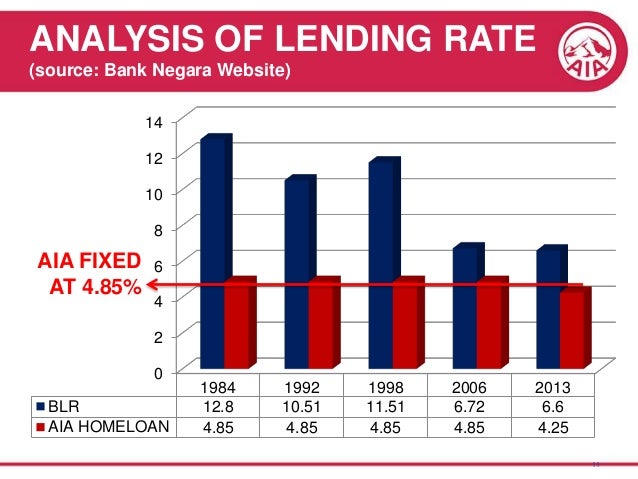

Get interest rates from as low as 4 15 on your housing loan. Borrowing rm 450000 over 20 years. If the opr reduces by 0 25 and banks decide to stick to their current profit margins then your loan s br will also reduce by 0 25. Interest rates for housing loans in malaysia are usually quoted as a percentage below the base rate br.

The best home loan rate malaysia interest rates. Enter loan interest rate in percentage. This page provides malaysia interest rate actual values historical data forecast chart statistics economic calendar and news. In malaysia interest rates for housing loans are generally cited as a percentage below or above the base rate br.

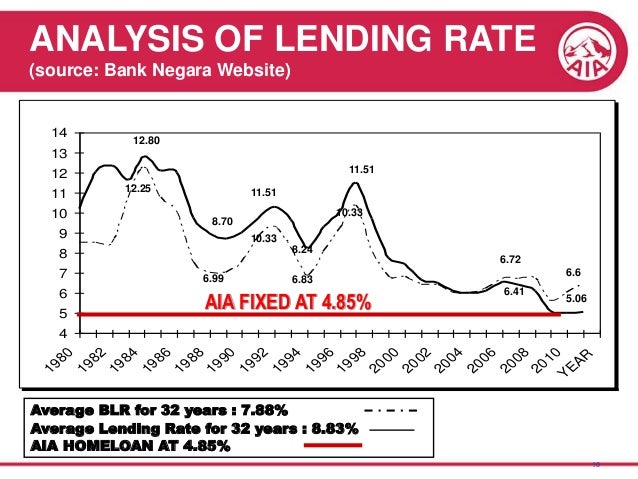

Affin tawarruq home financing i. Base lending rate blr 6 6 maximum loan amount 90. Any changes in the opr will impact loans that use the base rate br or the base financing rate bfr to determine the interest rate by which it will lend to consumers. Aia conventional term home loan has a fixed interest rate for entire tenure giving you financial protection against changes in the market rate.

Estimated interest rate 4 99 p a. Bank lending rate in malaysia remained unchanged at 3 64 percent in september from 3 64 percent in august of 2020.