Malaysia Housing Loan Interest Rate Public Bank

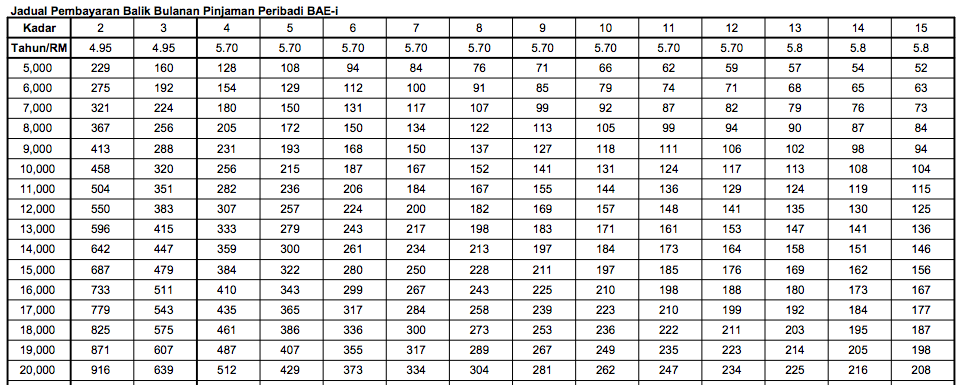

Rm200 00 per approved request.

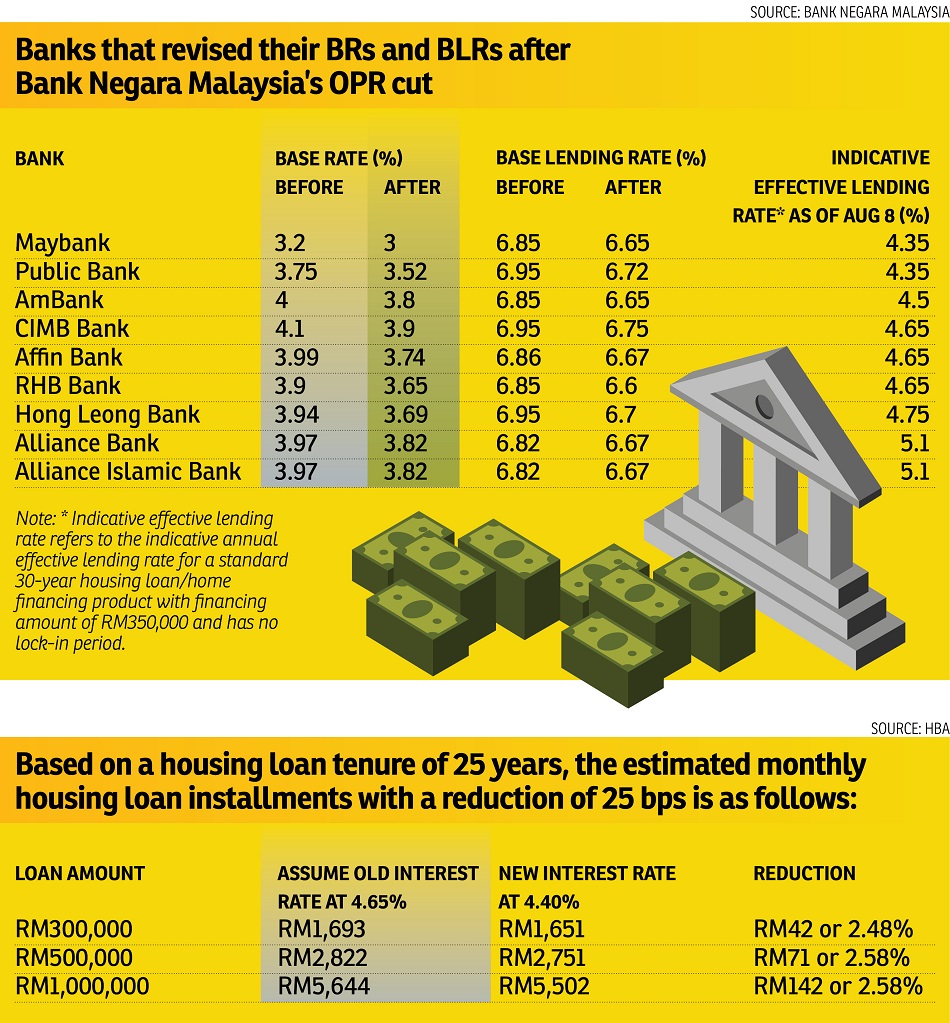

Malaysia housing loan interest rate public bank. Read more apply now. Get interest rates from as low as 4 15 on your housing loan. Borrowing rm 450000 over 20 years. Compare the cheapest home loans from over 18 banks in malaysia.

Public bank abba financing i home loan. Public bank housing loan interest rates. Bank islam provides a housing loan rate starting from base rate br 3 90. Reinstatement of housing loans fixed loans or term loans which have been paid down.

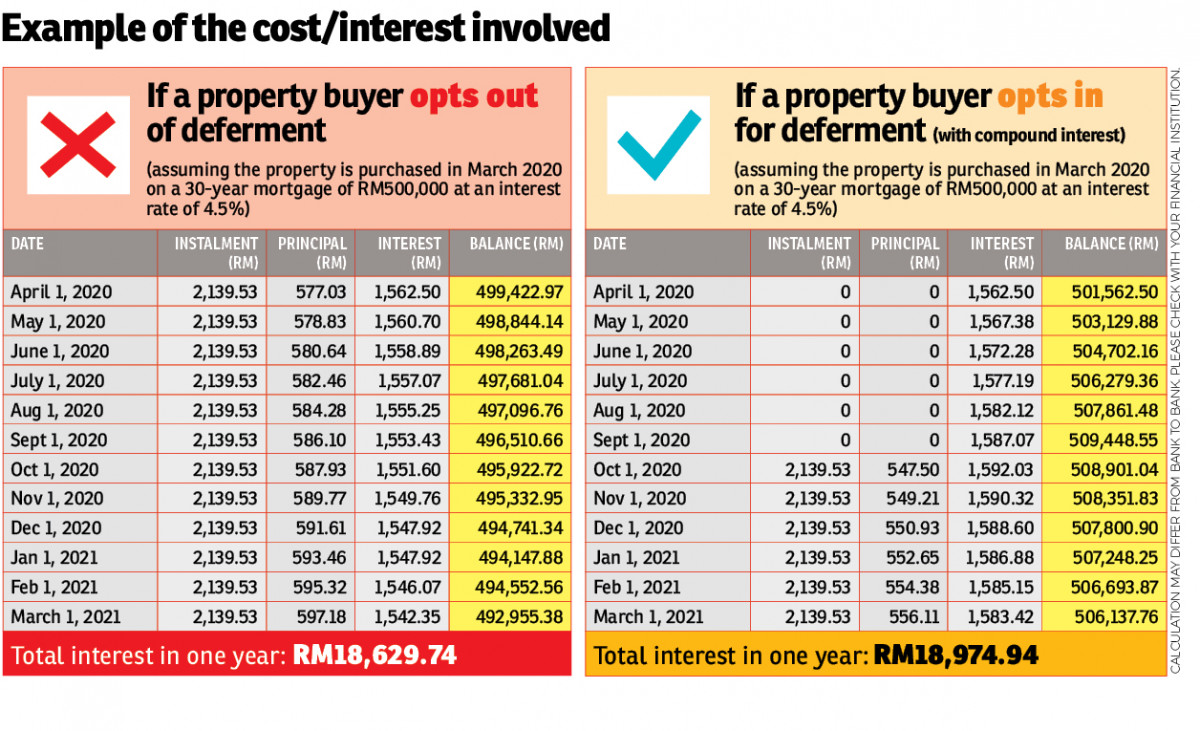

For example if the current br rate is 4 00 update. Generate principal interest and balance loan repayment table by year. Here are some of the details of the public bank home loan packages and features. Enter property price in malaysian ringgit.

A variable rate islamic home loan with option of redraw facility so that you can choose the best way to manage your money and mortgage. Credit cards with exclusive annual fee waiver for the entire loan tenure for eligible customers. Public bank abba financing i home loan. Base lending rate blr 6 6 maximum loan amount 90.

Enter down payment amount in malaysian ringgit. Enter housing loan period in years. Do a quick calculation on your monthly repayments using our online housing loan calculator and save more. As of 2nd january 2015 base lending rate blr has been updated to base rate br to reflect the recent changes made by bank negara malaysia and subsequently by major local banks the interest rate on a br 0 45 loan would be 4 45.

Request for redemption settlement statement for the purpose of partial full settlement of property loans housing loan individual commercial loan individual business or company with effect from 01 03 2017. The government recently reduced the minimum price threshold from rm1million to rm600 000 for foreign property purchase with selected properties and projects. Great savings as interest rates are calculated on daily rest. Br 2 52 0 70 3 22 special approval rates br 2 52 0 63 3 15.

Bank islam home loan. If these two things don t bother you then public bank housing loan is quite a catch. Option for redraw facility for new conventional housing loans with an approved amount of rm100 000 and above. Indicative effective lending rate refers to the indicative annual effective lending rate for a standard 30 year housing loan home financing product with financing amount of rm350k and has no lock in period.

Malaysia s government always encourages foreigners to choose malaysia as their second home whether for a long term stay retirement or investment purposes. Effective lending rate the indicative effective lending rate for public bank is 3 10 with effective from 10 july 2020. Monthly repayment rm 2649 30. Malaysia housing loan interest rates.

The best home loan rate malaysia interest rates.