Malaysia Housing Loan Interest Rate Calculator

The loan eligibility is only an estimate based on the total monthly commitment amount filled up in this calculator.

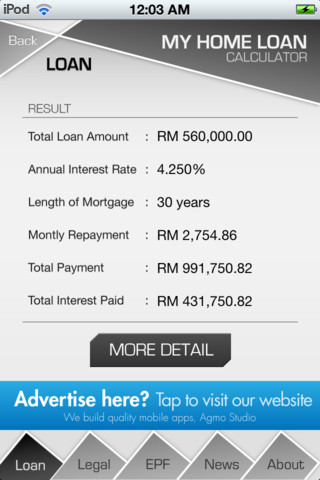

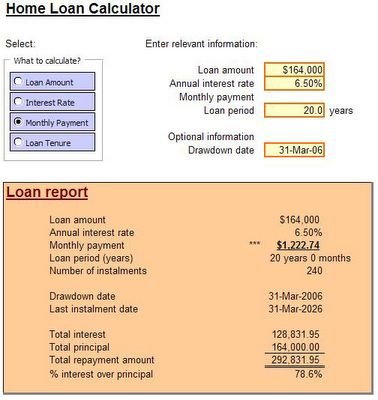

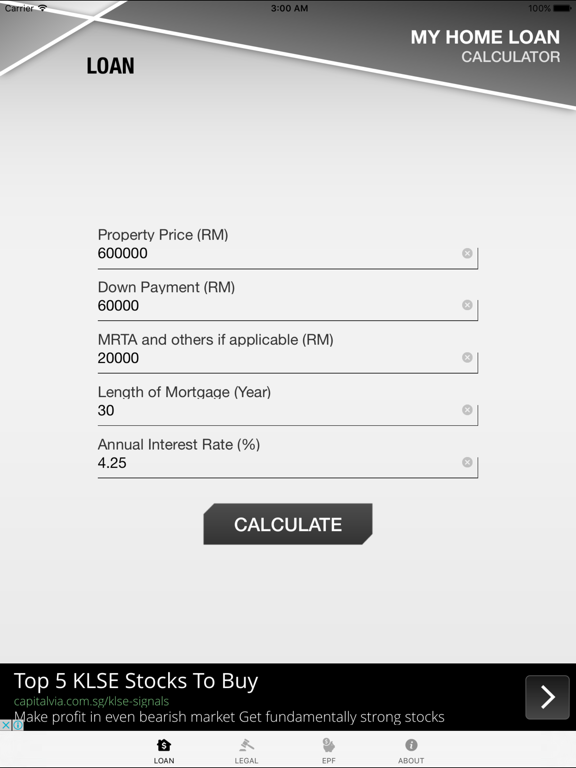

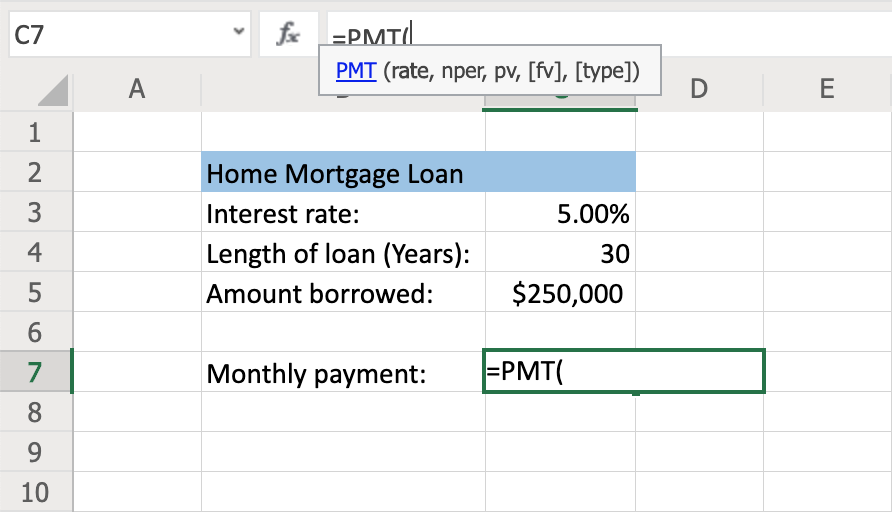

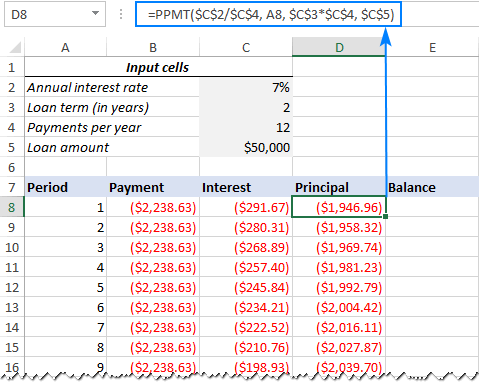

Malaysia housing loan interest rate calculator. Bookmark this page for your quick reference. As of 2nd january 2015 base lending rate blr has been updated to base rate br to reflect the recent changes made by bank negara malaysia and subsequently by major local banks the interest rate on a br 0 45 loan would be 4 45. Enter property price in malaysian ringgit. Generate principal interest and balance loan repayment table by year.

Estimated interest rate 4 99 p a. Quick and fast home loan calculator. Monthly net income after income tax epf and socso existing monthly debt repayment other mortgages personal loans and hire purchases. Enter the price of the property total downpayment current interest rate and number of years for financing.

Enter loan interest rate in percentage. In malaysia interest rates for housing loans are generally cited as a percentage below or above the base rate br. Compare the cheapest home loans from over 18 banks in malaysia. Aia conventional term home loan has a fixed interest rate for entire tenure giving you financial protection against changes in the market rate.

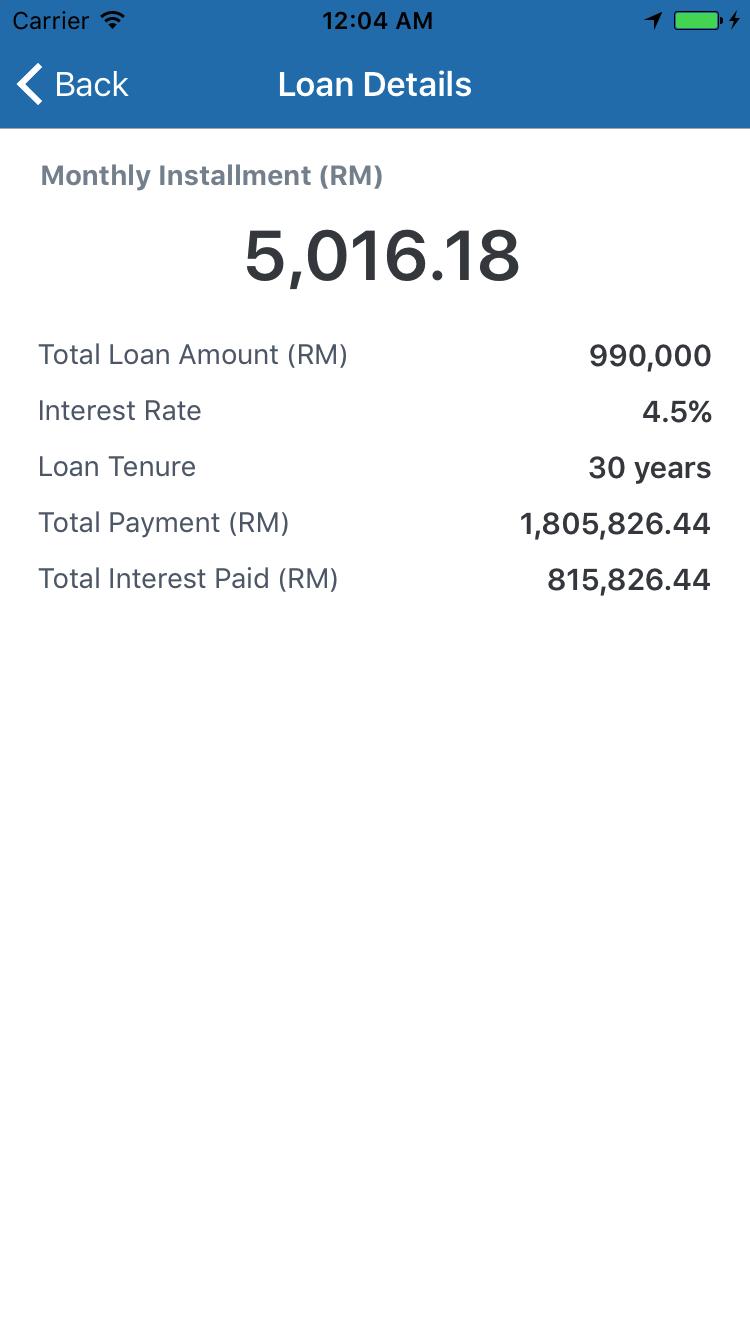

Enter housing loan period in years. In malaysia maximum years of financing is until 75 years old. Indicative interest rate is 4 5. Visualize the monthly instalment legal fees and stamp duties for buying a house in malaysia using this all in one home loan calculator next up.

Base lending rate blr 6 6 maximum loan amount 90. This calculator helps you estimate your home loan eligibility and what is the maximum amount you can borrow. Enter down payment amount in malaysian ringgit. Get interest rates from as low as 4 15 on your housing loan.

Check out bank of china flexi housing loan with rates as low as 2 85 p a. Do a quick calculation on your monthly repayments using our online housing loan calculator and save more. For example if the current br rate is 4 00 update. Based on loan of up to 90 residential 85 non residential of property value.

Best housing loans in malaysia calculate rates and apply for the best housing loans in malaysia. There are a few factors that determine your eligibility and may differ from bank to bank. The maximum loan tenure is 35 years or up to 70 years of age whichever is earlier.