Lhdn Tenancy Agreement Stamp Duty Calculation

Online calculator to calculate tenancy agreement stamp duty.

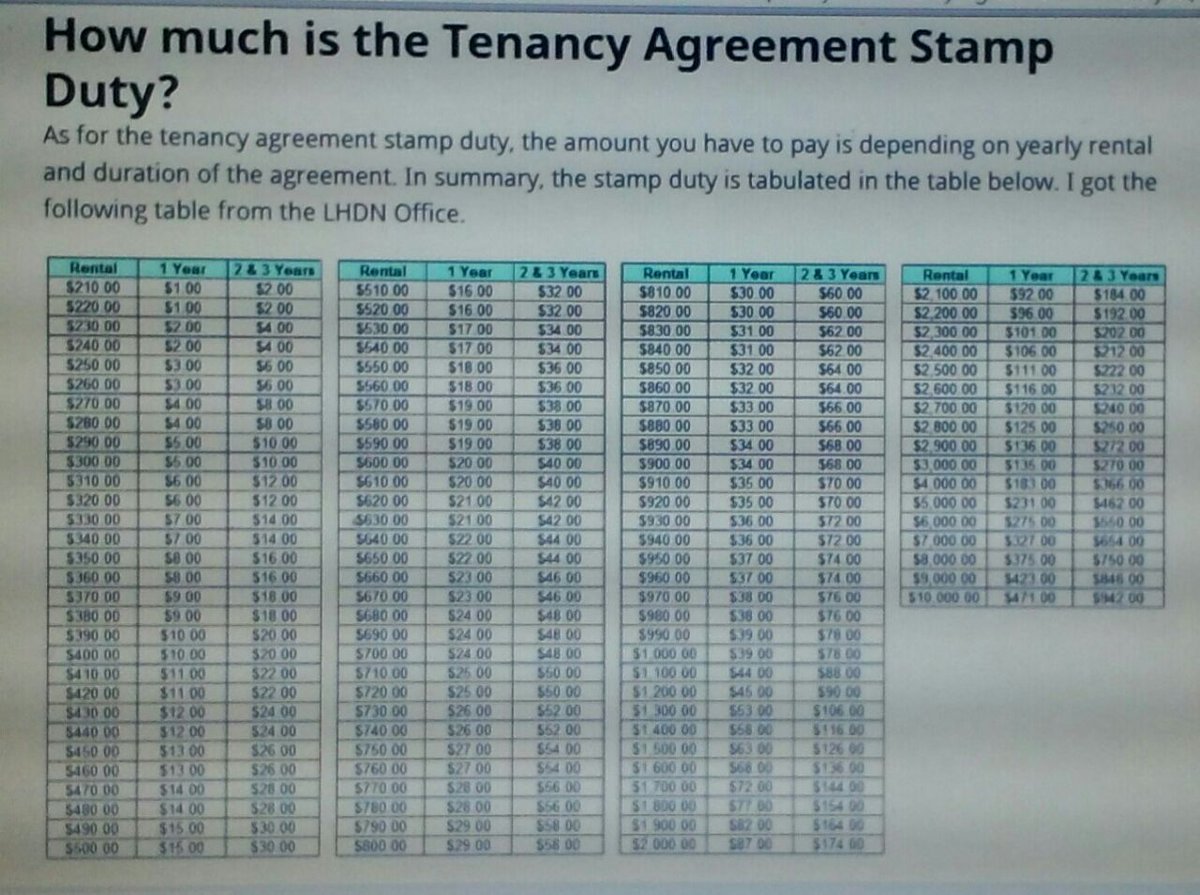

Lhdn tenancy agreement stamp duty calculation. As the first rm2 400 is exempted from stamp duty the taxable rental amount would be rm12 000 rm14 400 rm2 400. I got the following table from the lhdn office. The amount of stamp duty currently payable on the instrument will be shown. For example by clearly stating that the tenant is responsible for all payable charges such as water.

Stamp duty computation landed properties tenancy agreement. How much is the tenancy agreement stamp duty. For second copy of tenancy agreement the stamping cost is rm10. Stamp duty for lembaga hasil dalam negeri malaysia.

Tenancy agreement i s a printed document that states all the terms and conditions which the tenants and landlords have agreed upon before the tenant moves in. More than rm 100 000 negotiabl e. To use this calculator. Total cost involved for tenancy period of 1 year diy tenancy agreement stamp duty stamping for 2nd copy rm120 rm10 rm130.

The stamp duty would be charged according to the duration of the tenancy refer to table above. Calculate the taxable rental. Tenancy period 3 years payable stamp duty rm30 000 rm250 x rm4 120 x rm4 rm480 figures will be rounded up step 4. Next rm 90000 rental 20 of the monthly rent.

It is very crucial for property leasing in order to protect the landlords and tenants. Please input the tenancy details and then press compute. Importance of tenancy agreement stamping. In summary the stamp duty is tabulated in the table below.

As for the tenancy agreement stamp duty the amount you have to pay is depending on yearly rental and duration of the agreement. Less than 1 year. First rm 10 000 rental 50 of the monthly rent. Legal fee for tenancy agreement period of above 3 years.

Rental for every rm 250 in excess of rm 2400 rental. The amount of the current stamp duty payable is computed according to the information that you have entered. Variation of lease or supplemental agreement if there is an increase in rental or the lease period is extended stamp duty is payable on the document based on the increase in rental or the rental for the extended lease period.