Islamic Interbank Money Market

T h e m a j o r m a r k e t p l a y e r s a r e t h e c o m m e r c i a l b a n k s m e r c h a.

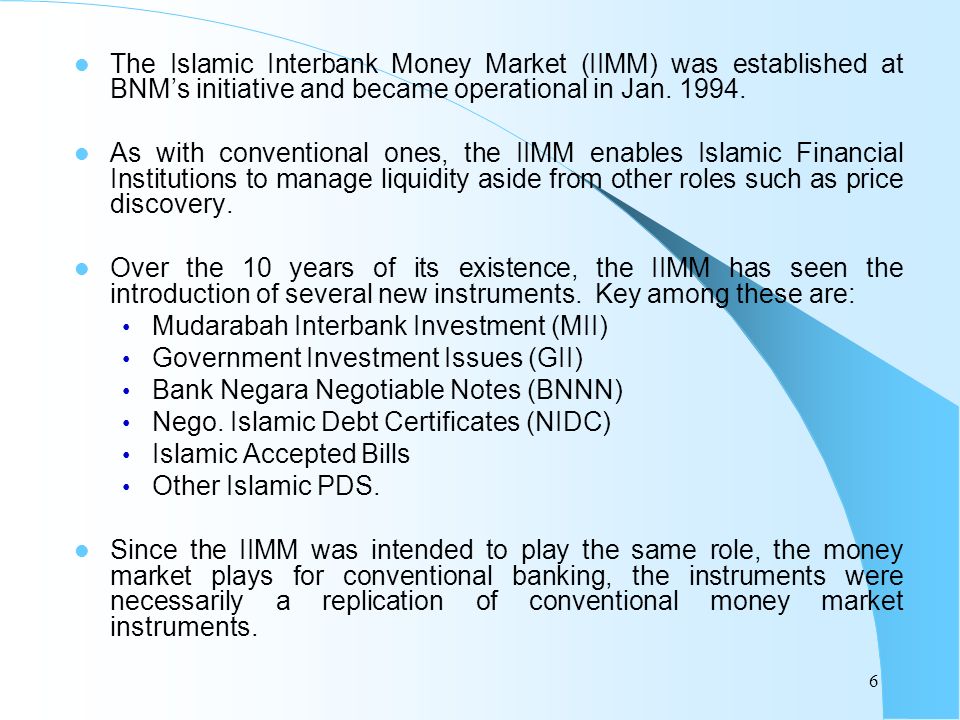

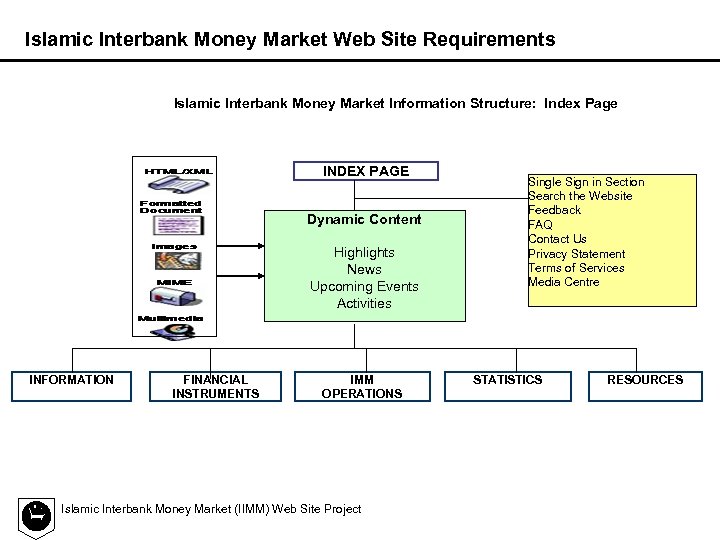

Islamic interbank money market. 10 05 2012 tnb s rm5b sukuk bags ram award posted date. Through the iimm the islamic banks and banks participating in the islamic banking scheme ibs would be able to match the funding requirements effectively and efficiently. Malaysians to bring islamic banking to germany posted date. 14 05 2012 new ifsb guidelines focus on islamic bank risk posted date.

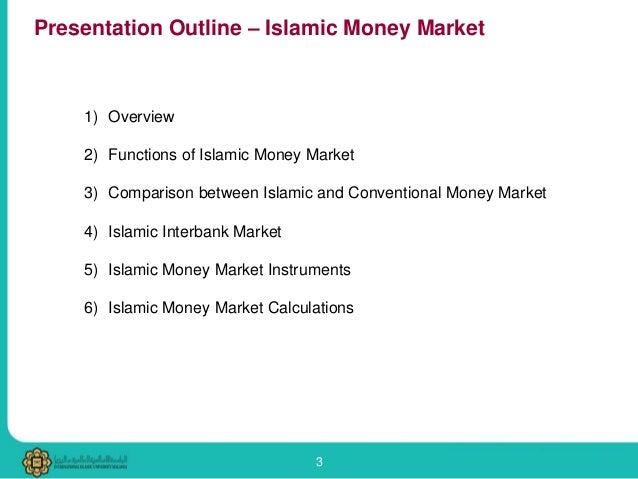

Pricing of islamic money market instruments. Islamic money market islamic money market is known as islamic interbank money market iimm in malaysia. Iimm and issues of risk. The scope of activities of the iimm include the purchase.

The kuala lumpur islamic reference rate. It makes a comparison between the leading countries in the practice of islamic banking. Key islamic money market instruments. Bank negara malaysia introduced iimm as an integral to the functioning of the islamic banking system on january 3 1994.

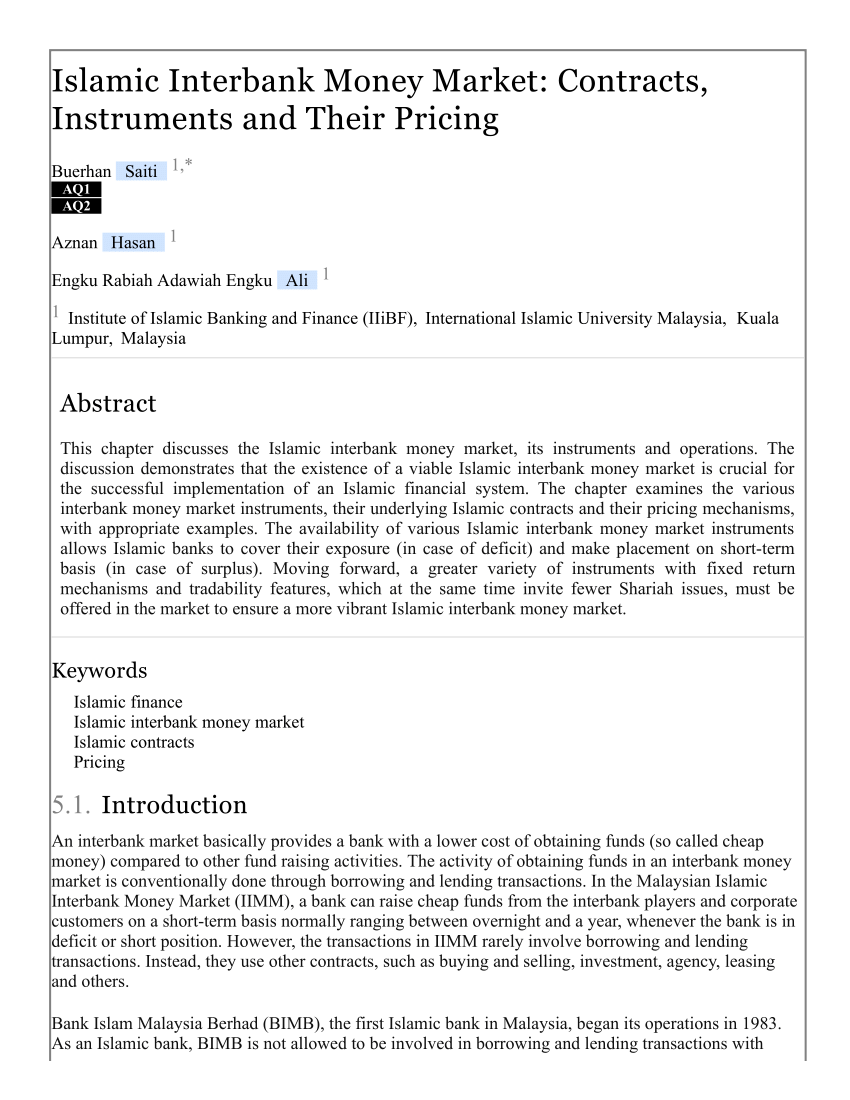

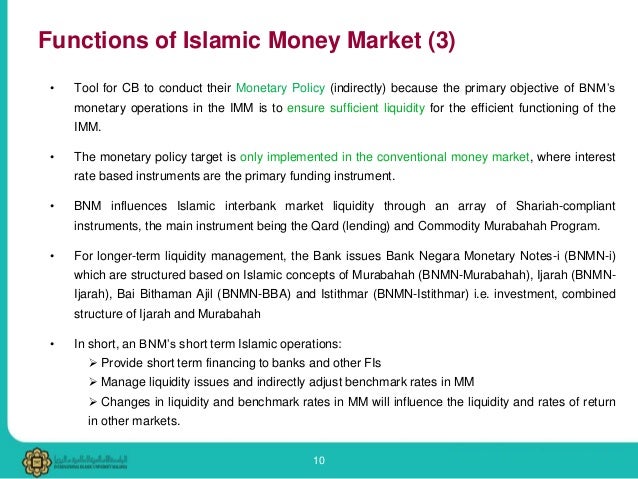

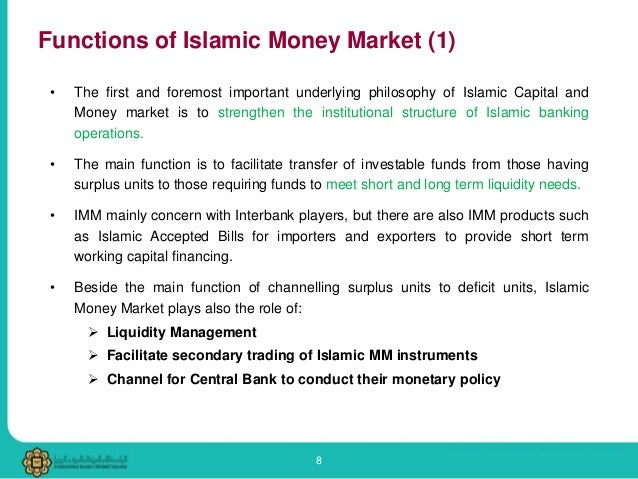

Iimm has been following the sha riah principle as a guideline in order to facilitate mobilisation of liquidity. This paper examines the operation of an islamic interbank money market iimm within a dual banking system. Its three main components are the interbank deposit facility the trading platform for islamic money market instruments and the islamic check clearing system. Based on a contract of wakalah agency with the objective of making a profit its features are all but not limited to the following.

Islamic money market instruments. Pricing the mudarabah interbank investment funds. The iimm can perform all the functions and provides the facilities that a conventional money market can. The islamic interbank cheque clearing system.

The paper argues that even though an islamic money market operates in an interest free environment and trades shariah compliant instruments many of the risks associated with conventional money markets including interest rate risk is. The iimm is the shariah compliant version of malaysia s conventional money market. The islamic inter bank money market iimm was introduced on january 3 1994 as a short term intermediary to provide a ready source of short term investment outlets based on syariah principle. It therefore proposed the adoption of the malaysian framework of the market for the other jurisdiction due to the fact that it is the most developed market in terms of regulations and availability of instruments.

The actual return is known only on the maturity date. Fundamentally the islamic money market comprises the interbank market and m o n e y m a r k e t. The islamic interbank market. This article discusses the islamic interbank money market its functions and its instruments.