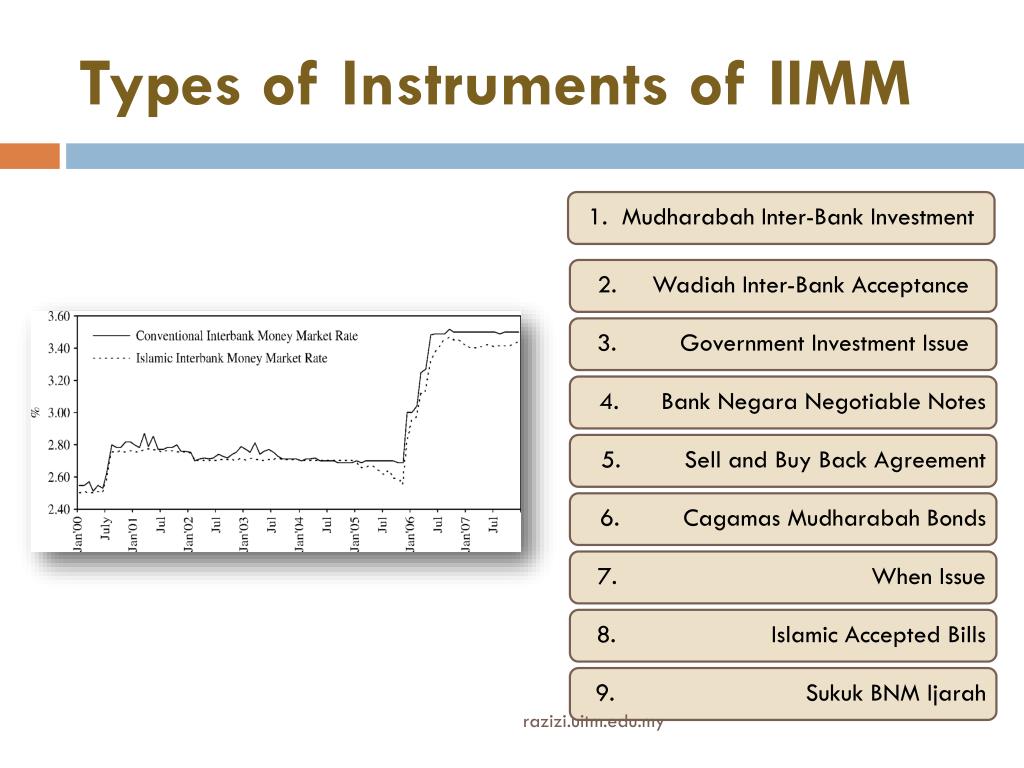

Islamic Interbank Money Market Rate

14 05 2012 new ifsb guidelines focus on islamic bank risk posted date.

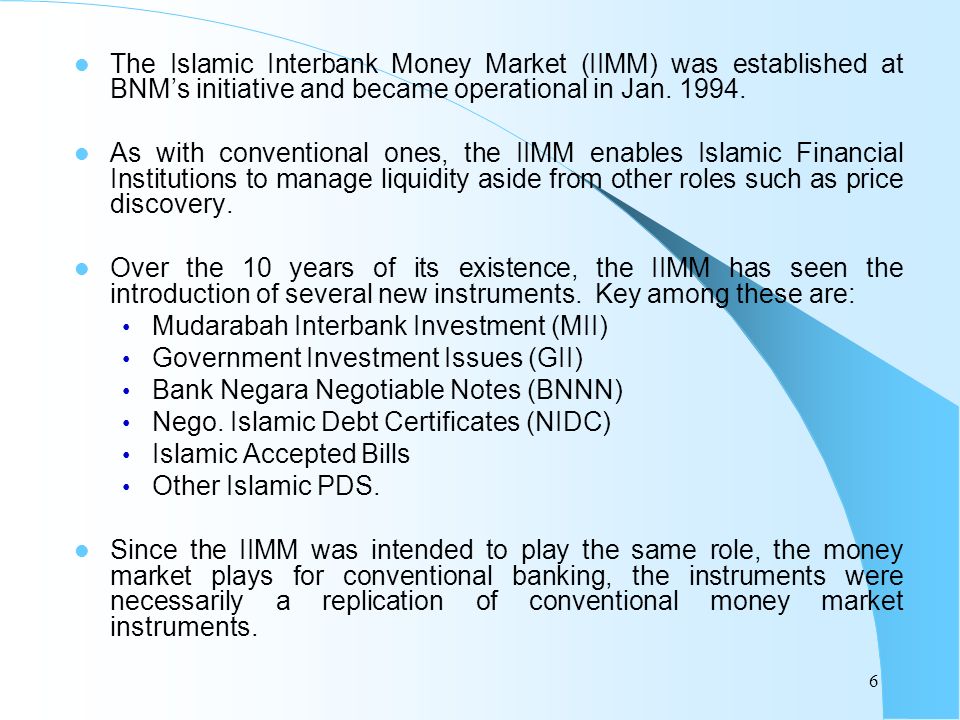

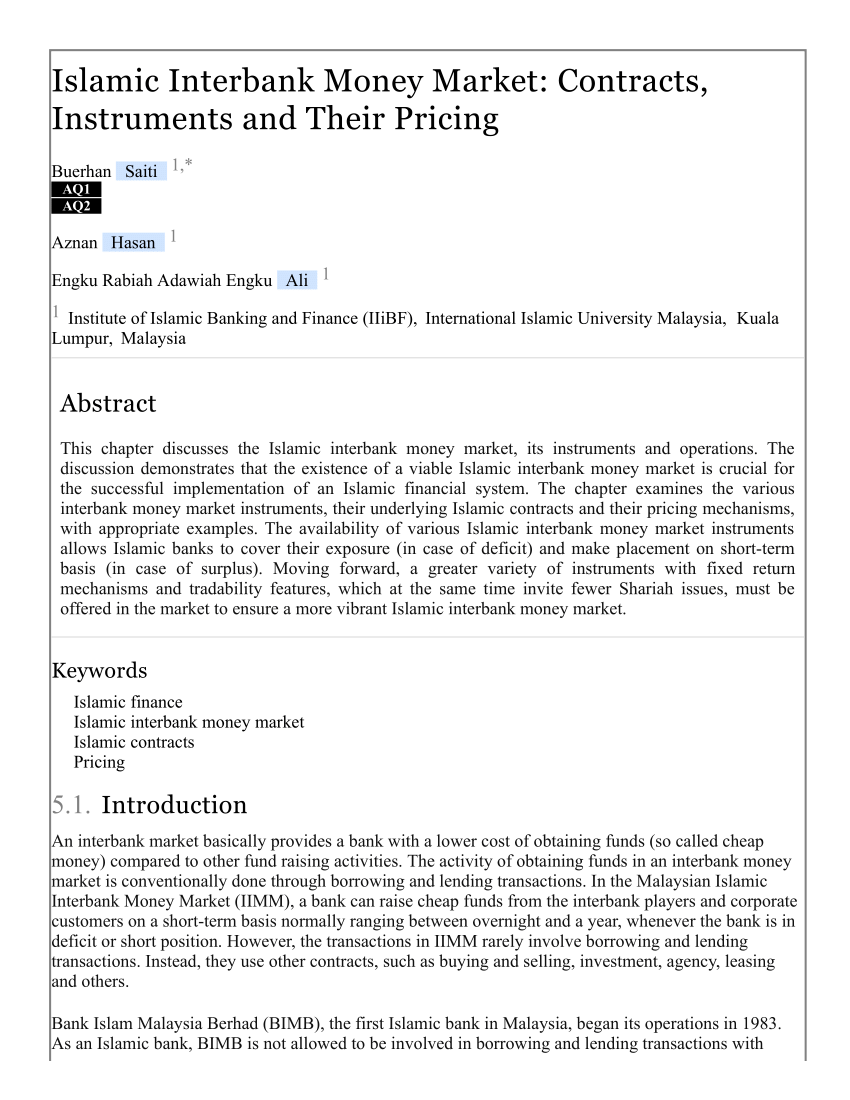

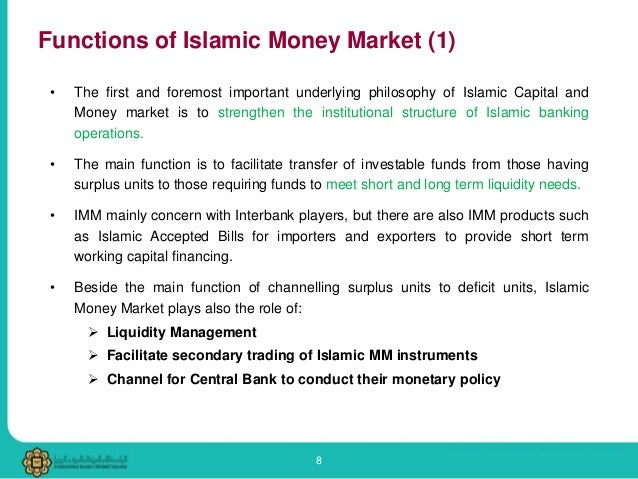

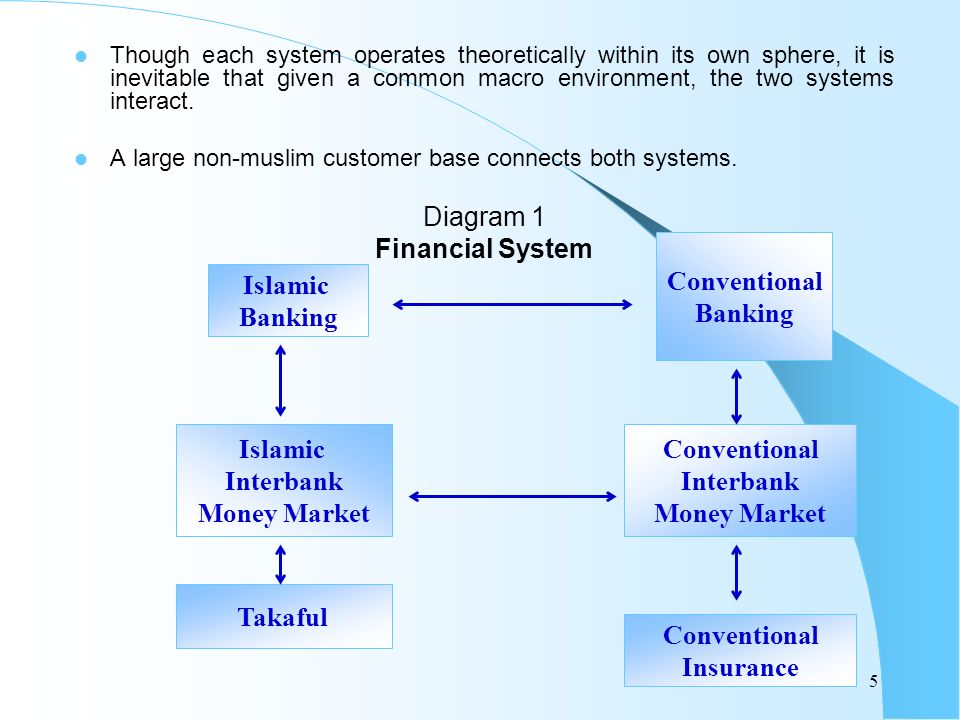

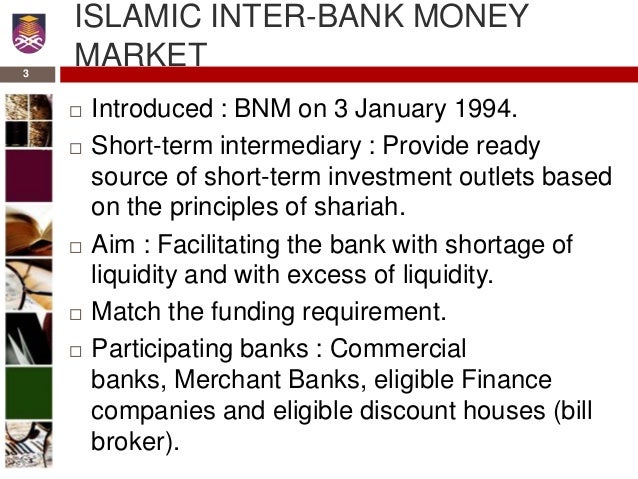

Islamic interbank money market rate. Of an islamic interbank money market. This chapter discusses the islamic interbank money market its instruments and operations. Outstanding bank s sale price less ibra if any. Interbank wakalah is a wholesale money market transaction designed as liquidity management instruments in the islamic money market.

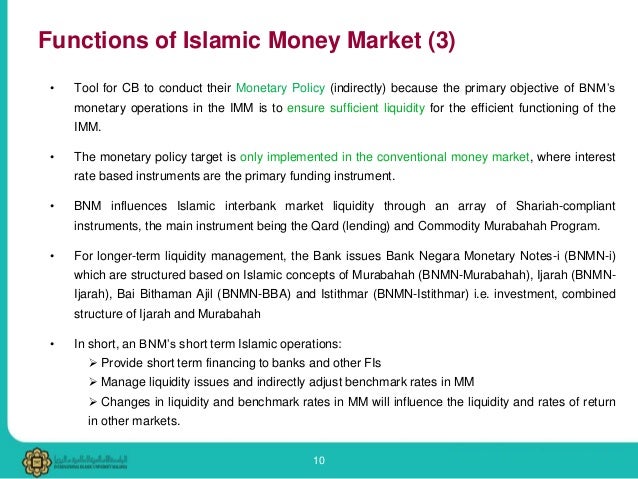

Malaysians to bring islamic banking to germany posted date. Banking islamic banking insurance takaful development financial institution money services business intermediaries digital currencies payment systems. A number of islāmic banks quote rates for interbank liquidity placements for overnight one week one month to a year or longer terms. Key islamic money market instruments.

Click here to view daily weighted average of islamic interbank deposit rates for various tenures oct 1998 june 2015. Pricing the mudarabah interbank investment funds. Trading performance on iimm. Money market is based on pro t sharing and loss gift and.

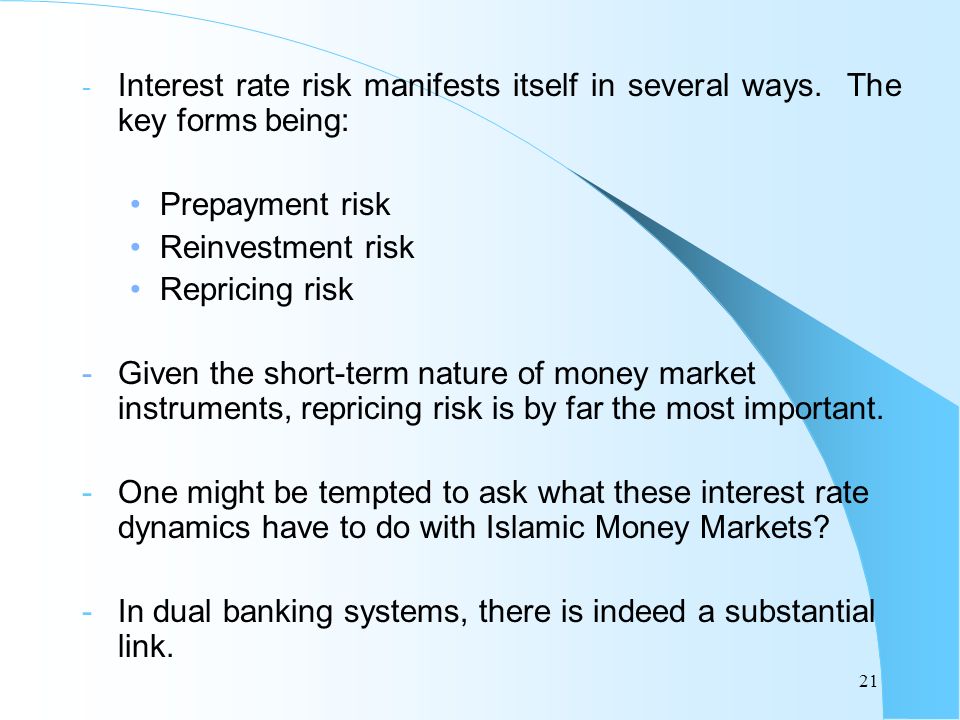

10 05 2012 tnb s rm5b sukuk bags ram award posted date. In the islamic money market interest rates are impermissible. Pricing of islamic money market instruments. Iimm and issues of risk.

However it is not permissible to price a money placement transaction due to being. The actual return is known only on the maturity date. Based on a contract of wakalah agency with the objective of making a profit its features are all but not limited to the following. The discussion demonstrates that the existence of a viable islamic interbank money market is crucial for.

The islamic interbank cheque clearing system. Utilising the contributed rates of atleast major 18. Islamic money market instruments. The kuala lumpur islamic reference rate.

Islamic interbank rate is the daily weighted average rate of the mudharabah interbank investment at the iimm in kuala lumpur where the individual rates being weighted accordingly by the volume transactions at those rates. Muashshir al ribh bayn al masarif al islamiyah provides a reliable and objective indicator of the average expected return shariah compliant short term interbank market funding for the islamic finance industry. It is a money market rate just like libor eibor or any other conventional rate that the investor banks offer to one another7. A sum equivalent to the prevailing daily overnight bnm s islamic interbank money market rate on outstanding balance i e.