Epf Contribution Table 2018

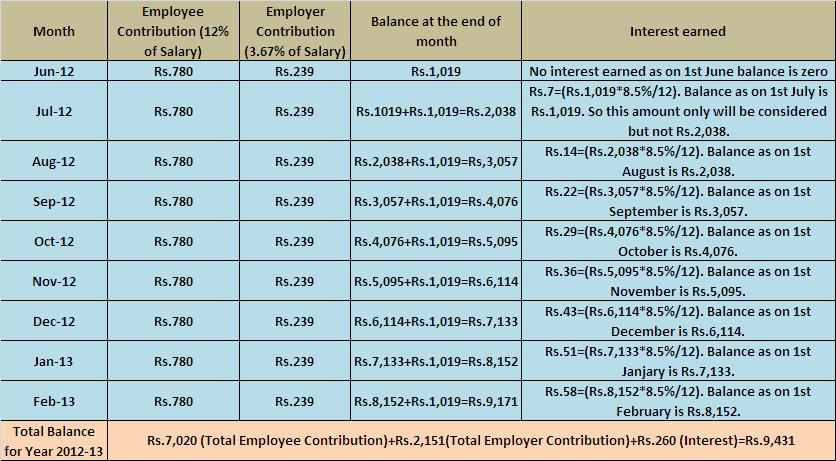

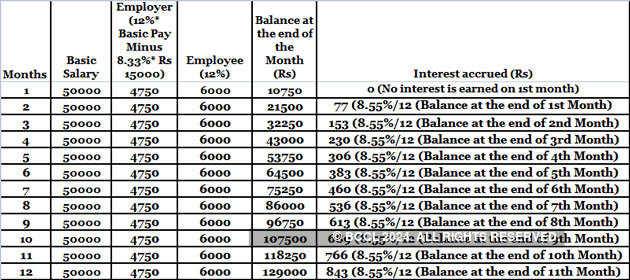

During the online epf challan submission by the employer the pension fund contributed by the bye employer 8 33 goes into this account.

Epf contribution table 2018. Salary for january 2018 therefore the contribution month is february 2018 and it has to be paid either before or on 15 february 2018. This post first appeared on moneygyaan a personal finance please read the originial post. Minimum administrative charges payable per month per establishment is rs. Total contribution paid by the employee is 12 and 12 1 13 is contributed by the employer.

01 06 2018 onwards 0 50 on total pay on which contributions are payable. Employers are required to remit epf contributions based on this schedule. Epf inspection charges payable by the employers of exempted establishments period rate reckoned on. For the exact contribution amount refer to the contribution schedule jadual or head over to the epf contribution website.

Epfo account 10 er a c 10. This will be effective from the january 2018 salary for february 2018 contribution. Kuala lumpur dec 21. The latest contribution rate for employees and employers effective january 2019 salary wage can be referred in the third schedule epf act 1991 click to download.

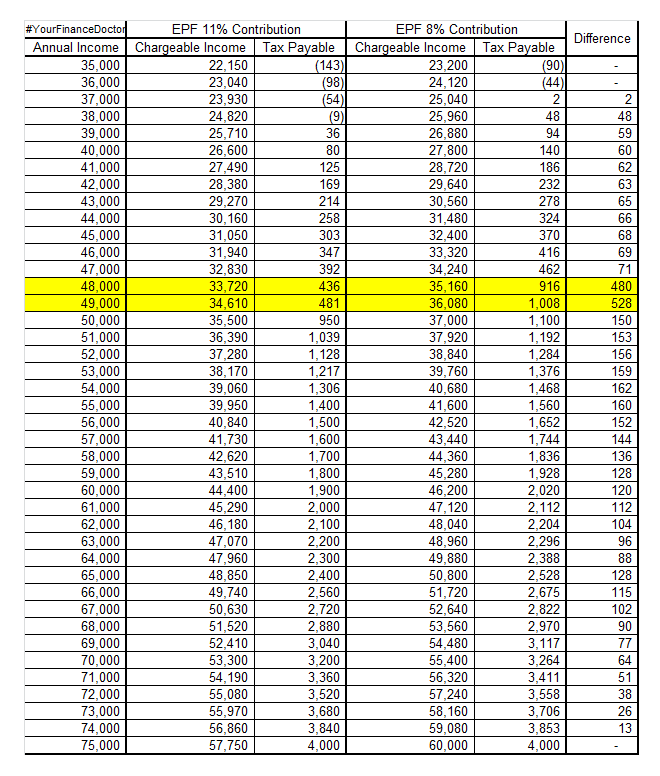

Effective from january 2018 the employees monthly statutory contribution rates will be reverted from the current 8 to the original 11 for employees below the age of 60 and from 4 to 5 5 for those aged 60 and above. Online withdrawal application via i akaun has now been extended to age 50 years 55 years 60 years and withdrawal for savings more than rm 1 million. Beginning january 2018 employees will no longer have the option of contributing 8 of their income to the employees provident fund epf. Invest in companies before they launch their ipos.

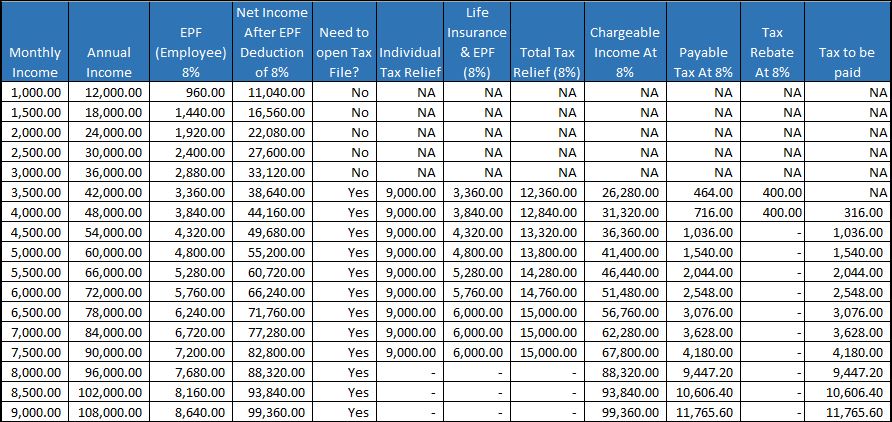

Contribution to epf approved scheme restricted to rm4 000 7 000 restricted 19. Life insurance and epf including not through salary deduction. Total deposit in year 2018 minus total withdrawal in year 2018. Employers may deduct the employee s share from their salary.

Next year the employees provident fund epf contribution rate by employees will revert to the original 11 percent for members aged below 60 and 5 5 percent for those 60 and above. Administration charges go into this account. Deferred annuity and private retirement scheme prs with effect from year assessment 2012 until year.