Double Deduction For Promotion Of Export

Overlapping period 3 5.

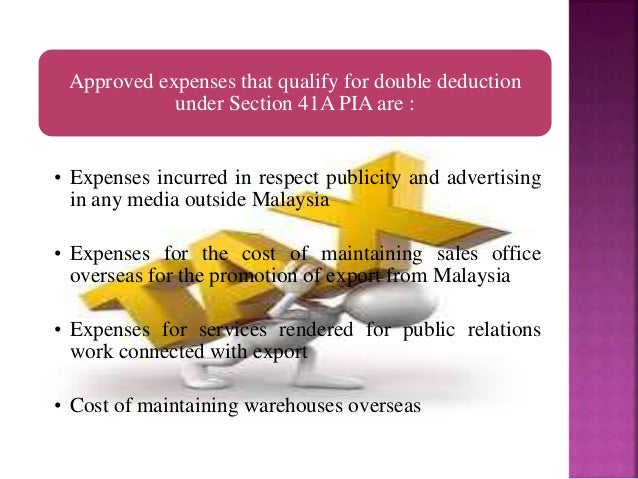

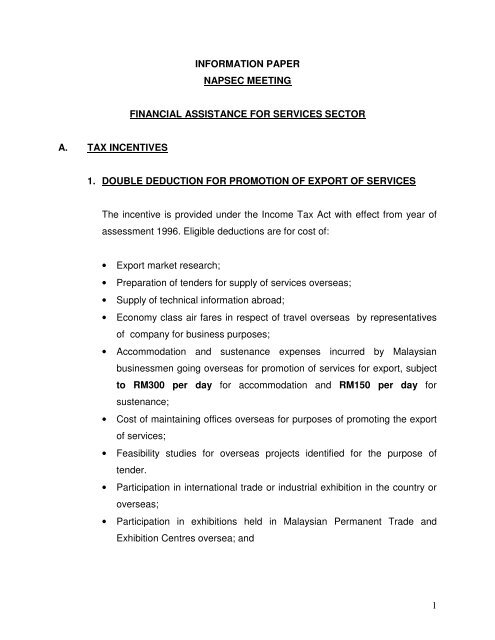

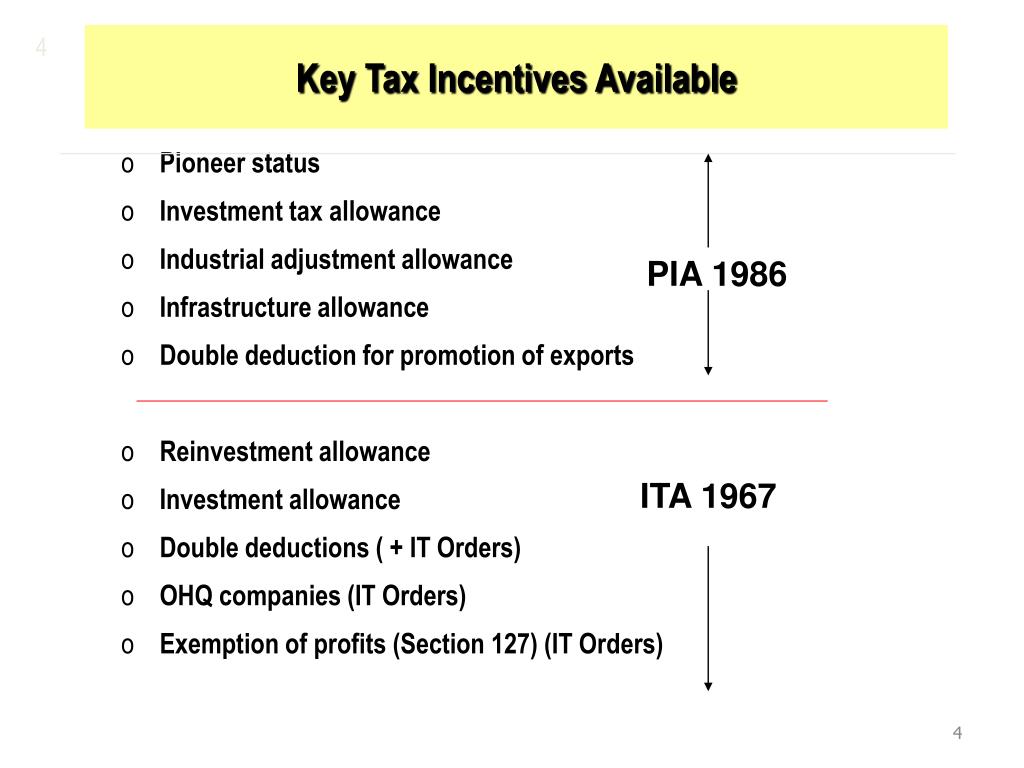

Double deduction for promotion of export. For details refer to paragraph 4. 4 february 2013 contents page 1. Income tax deduction for promotion of export of higher education amendment rules 2003 p u. Qualifying company and qualifying product activity 2 4.

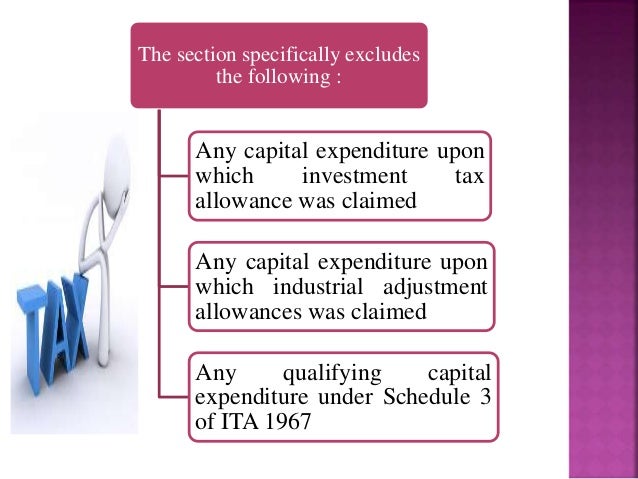

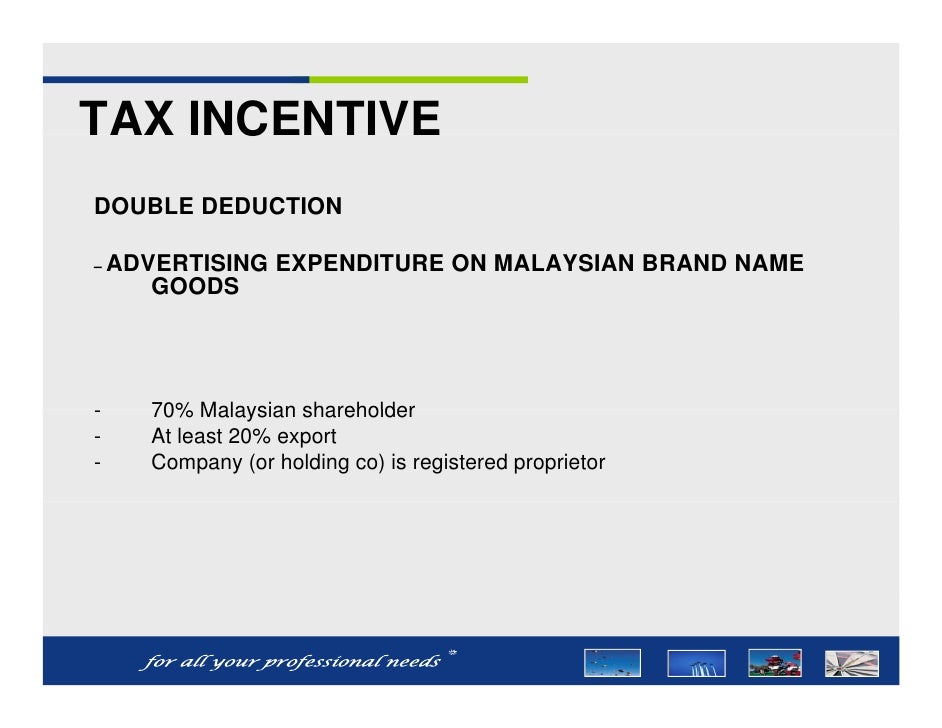

The conditions that qualify a company to claim a deduction for promotion of exports are. 31a of the promotion of investments act 1986 pia 1986 b expenses must be incurred within 10 years from the date of approval for a ii above an application for double deduction of expenses is to be submitted directly to the irb within 6 months before the financial year end of the business. These guidelines serves to explain the procedure and criterias for claiming the qualifying expenditure for the purposes of promotion of export of. Politeknik kota bharu norhazirah binti zuki 04dat17f2049nur azmina binti azmi 04dat17f2039siti rosayu binti mohd kusuhairi 04dat17f2007double deduction for promotion of exportfor promotion of exports double deduction export incentives there are 5 among expenses double deduction for promotion of exports advertisementspublicity provision of samples without charge market reseacrh carrying out.

Research approved by minister expenses incurred within 10y from date of approval incurred on r d activities undertaken overseas research institutes or companies. The following is a summary of the types of deduction available with legislative authority. Single deduction for promotion of export. A 261 which is effective from the year of assessment 2002.

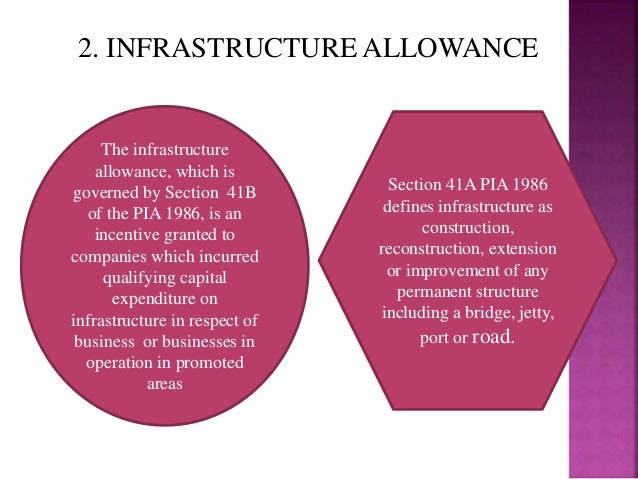

All resident companies engaged in promotions exports outside malaysia will qualify for the deduction 6. Double deductions for promotion of export the promotion of exports is a double deduction of revenue expenses incurred. Cash contribution to approved research inst. Types of deduction 4 6.

Types of qualifying expenditure for promotion of export 5 7. Deductions for promotion of exports public ruling no. The irb will only give approval for a. Previous year paper ssc chsl tier 1 part 5 reasoning complete free course gradeup gradeup.

Ssc एव अन य सरक र. Double deduction remuneration of disabled employees premium paid on export credit insurance taken with a company approved by mof research expenditure. Types of expenditure qualifying for further deduction for promotion of export. This video is unavailable.

Emcc tvettunes pnp econvergence.