Disallowable Expenses Under Section 39 1

If the traveler chooses to pay with his her credit card the earliest reimbursement is via the travel.

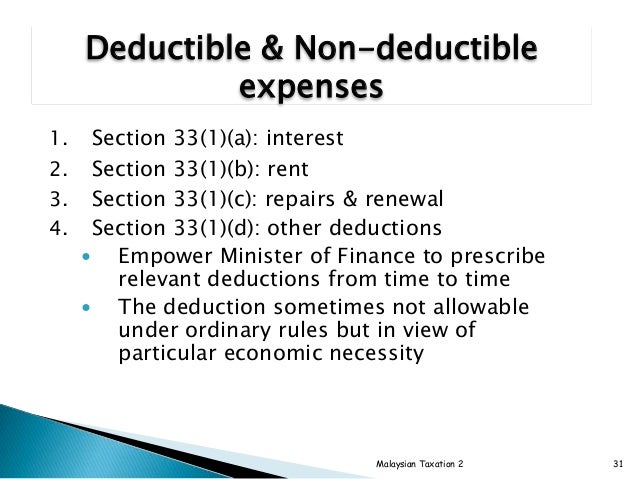

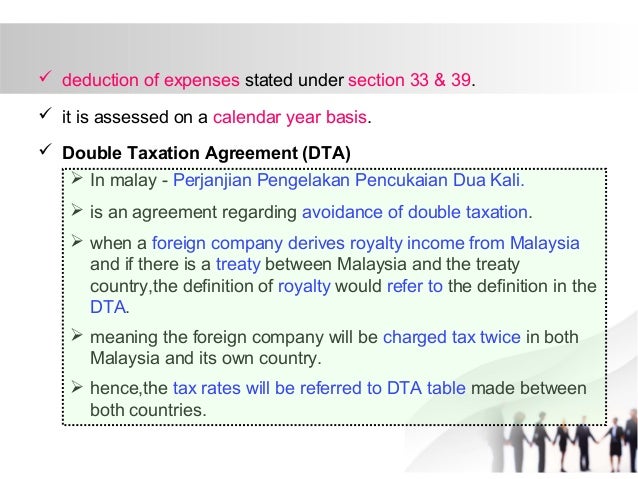

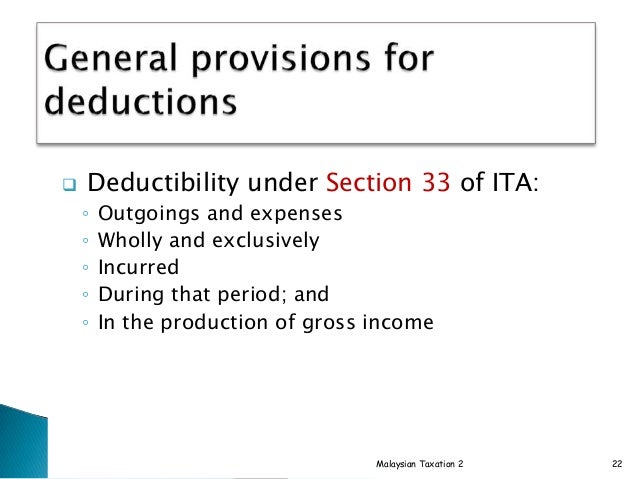

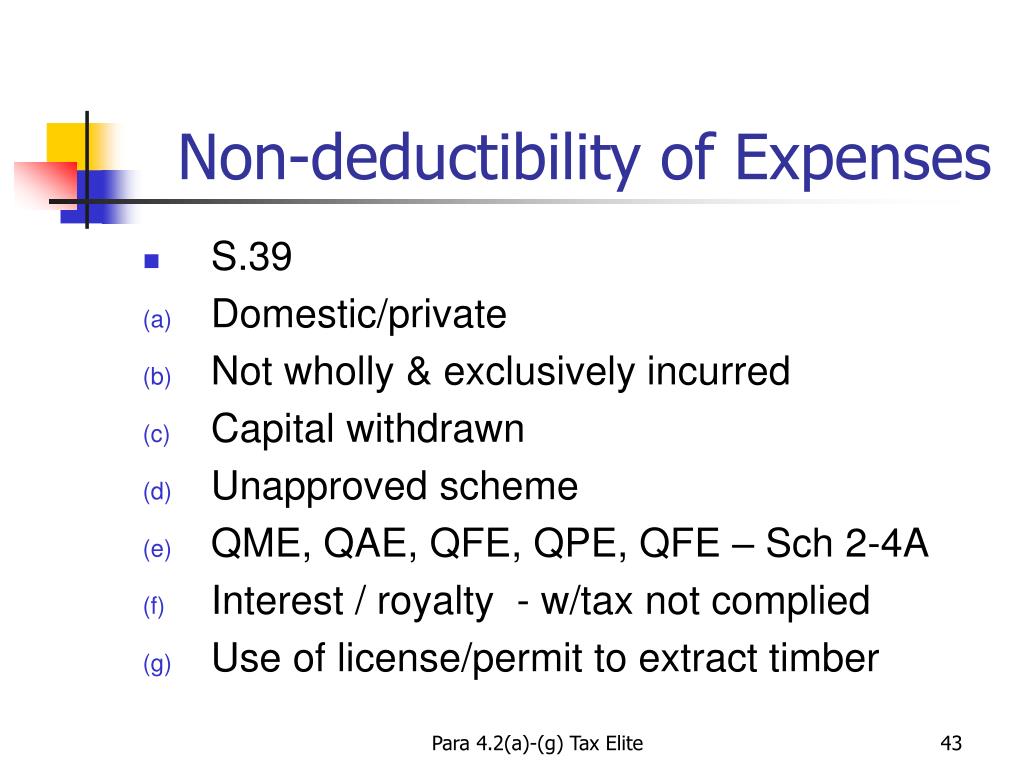

Disallowable expenses under section 39 1. 2 2 the provisions of the income tax act 1967 ita related to this pr are section 18 subsection 33 1 and paragraph 39 1 l. 2 1 this pr takes into account laws which are in force as at the date this pr is published. X most economical and direct route. You must make your claim during the accounting period that matches the date shown in the tax invoice or import permit.

Expenses incurred solely for business purposes are generally allowable. To claim section 14q deduction include the amount to be claimed under allowable business expenses in your 4 line statement in form b self employed or form p partnership starting from the ya relating to the basis period in which the r r costs are first incurred. For more details you can check out this helpful article. Paragraph 39 1 h formerly reads.

An easier way to remember what is allowable is to use the tax return itself. Interpretation the words used in this pr have the following meanings. Expenses disallowed under paragraph 39 1 l of the act entertainment expenses which are wholly and exclusively incurred in the production of income under subsection 33 1 of the act and which do not fall into any of the categories of expenses enumerated in the proviso to paragraph 39 1 l of the act. About sa103f categories.

However disallowable expenses are transactions that can t be deducted from your business income. Expenses disallowed under paragraph 39 1 l of the ita 1967 entertainment expenses which are wholly and exclusively incurred in the production of income under subsection 33 1 of the ita 1967 and which do not fall into any of the categories of expenses enumerated in the proviso to paragraph 39 1 l of the ita 1967 would only qualify for 50 deduction. When purchasing from gst registered suppliers or importing goods into singapore you may have incurred gst input tax. On the tax.

To properly categorize your hall hire washing machine usage and storage unit rental i d suggest consulting your accountant. F interest or royalty derived from malaysia from which tax is deductible under section 109 if tax has not been deducted therefrom and paid to the directorgeneral in accordance with subsection 1 of that section. May be purchased via normal procurement procedures e g. This expenditure is usually referred to as wholly exclusively.

Uh purchasing card purchase order or via the traveler s personal credit card. Airfare including discount coupons etickets itinerary. You can claim input tax incurred when you satisfy all of the conditions for making such a claim.