Depreciation Rate In Malaysia 2017

Now the maximum rate of depreciation is 40.

Depreciation rate in malaysia 2017. Initial allowance is fixed at the rate of 20 based on the original cost of the asset at the time when the capital expenditure is incurred. The budget for 2017 was presented on 21 october 2016. During the computation of gains and profits from profession or business taxpayers are allowed to claim depreciation on assets that were acquired and used in their profession or business. Reduction in corporate income tax between 1 and 4 based on percentage of chargeable income increased compared with the previous year of assessment ya.

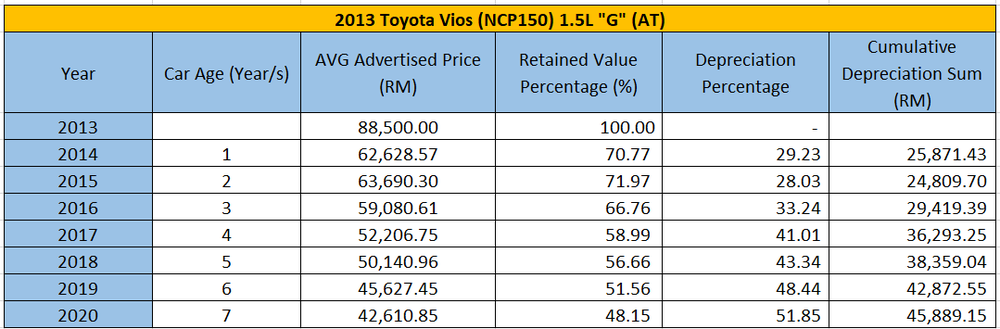

Capital allowances consist of an initial allowance and annual allowance. Block of assets. Depreciation value per year. Depreciation allowance as percentage of written down value.

A company purchases 40 units of storage tanks worth 1 00 000 per unit. Inland revenue board of malaysia income tax treatment of goods and services tax part ii qualifying expenditure for purposes of claiming allowances public ruling no. Average lending rate bank negara malaysia schedule section 140b. A ruling is issued for the purpose of providing guidance for the public and officers of the inland revenue board of malaysia.

The main measures regarding corporate taxation which are effective from 1 january 2017 are summarized below. The income tax act 1962 has made it mandatory to calculate depreciation. Ay 2006 07 to ay 2017 18. Ays 2003 04 to 2005 06.

Following are the depreciation rates for different classes of assets. Average lending rate bank negara malaysia schedule section 140b restriction on deductibility of interest section 140c income tax act 1967 study group on asian tax administration and research sgatar. 50706 kuala lumpur malaysia tel. Objective relevant provisions of the law 1 1 3.

03 21731288 printed in malaysia by sp muda printing services sdn bhd 906732 m 82 83 jalan kip 9 taman perindustrian kip kepong 52200 kuala lumpur tel. While annual allowance is a flat rate given every year based on the original cost of the asset. 8 june 2017 contents page 1. Restriction on deductibility of interest section 140c.

Example 8 amended on 12 07 2017. 2 2017 date of publication.