Company Tax Rate 2016 Malaysia

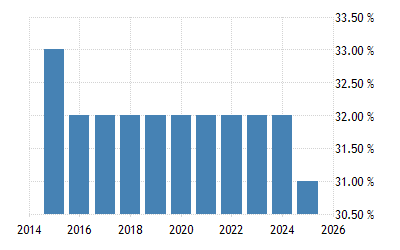

Corporate tax rates in malaysia the corporate tax rate is 25.

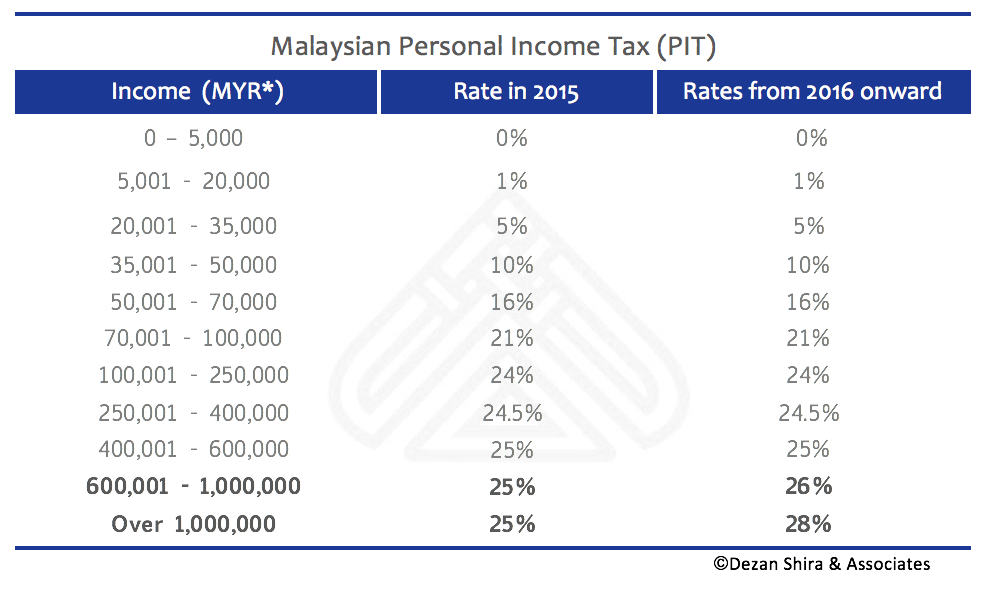

Company tax rate 2016 malaysia. Resident companies with a paid up capital of myr 2 5 million and below as defined at the beginning of the basis period for a year of assessment ya are subject to a corporate income tax rate of 20 on the first myr 500 000 of chargeable income. Business activities trading finance management and human resources. Malaysia brands top player 2016 2017. W e f ya 2016 tax rates for resident individuals whose chargeable income from rm600 001 to rm1 000 000 be increased by 1 and chargeable income exceeding rm1 000 000 increased by 3.

A qualified person defined who is a knowledge worker residing in iskandar malaysia is taxed at the rate of 15 on income from an. Malaysia corporate income tax rate for a company whether resident or not is assessable on income accrued in or derived from malaysia. Company with paid up capital not more than rm2 5 million. A firm registered with the malaysian institute of accountants.

Inland revenue board of malaysia shall not be liable for any loss or damage caused by the usage of any information obtained from this website.